You know what is the one thing stopping you from finding truly actionable insights from your web data?

You know what is the one thing stopping you from finding truly actionable insights from your web data?

Web analytics gems lie deep in the data and we spend our lives looking at the top ten rows of data.

It does not matter which report you look at. Affiliates. Products sold. Referring URL's. Pages viewed. Search keywords. Promotions. Geographies. Really pick any report with any dimension you want to look at, we spend our time (and valuable space on our dashboards) looking at the top ten.

We look at the top ten rows of data because:

1. Too much data from our web analytics tools.

2. Lack of clarity from our business leaders about what the site is solving for.

3. Not enough hours in the day to overcome challenge #1 and #2.

But if you just look at the top ten rows of anything here are the two corrosive problems:

1. The top ten of anything rarely changes (with the exception of hourly changing content – news – sites).

2. The top ten only focuses on the head, while the magic is in the long tail of anything. Magic related to finding challenges in your business. Magic related to finding opportunities. Magic that will help identify things you can actually action.

Allow me to make the case for you to look beyond the top ten rows in your reports by sharing three short stories. In each case I request you to look beyond the specific request and tool, rather focus on the analysis and how you could possibly apply it. I hope is to inspire, not to prescribe.

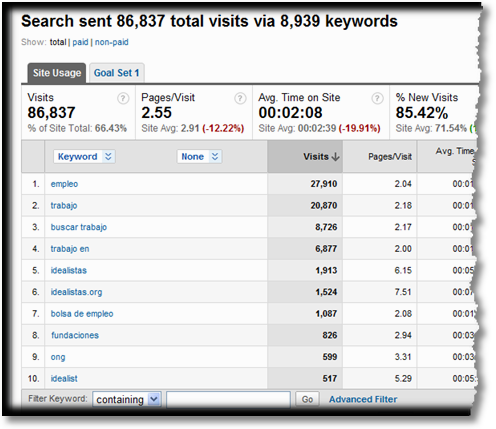

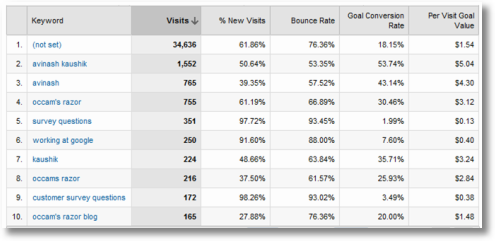

For example take a look at this report. . . .

I am sure when you look at it now it appears all mysterious, full of potential. You can't wait to take it out for a first date and then another and by the third date if you do the same old thing it gets boring. You are done looking at the bounce rates and time on site and conversions of these keywords. In the best case scenario you have even optimized landing pages. Good.

The first week's over, now want? Why keep reporting the top ten keywords on you Executive Management Global KPI Dashboard?

Look at the top of that table. For this website 86,837 visits came from 8,939 keywords!

What's going on with the other 8,929 keywords?

We never bother with them both because it is really hard to look at more than 10 rows of data. Harder still to look at 30 or 50 or 70 rows of data. Not only do we have a hard time interpreting insights from lots of data, we can't actually physically look at that much data and find insights.

Last month this blog received 40,662 Visits from 26,137 key words. The top 12 keywords accounted for 5k visits. The other 26,125 keywords accounted for 35k visits! By analyzing just the top ten see how many visitors I would be ignoring?

Here are three techniques I use to overcome the trap of the top ten rows. . . .

1. Advanced Table Filtering.

In the past we all used the standard reports that our web analytics tools churned out.

I don't do that any more. If you show me a report and it is not a custom report that you have created to better pull relevant kpi's into one place then please know that I will think less of you.

A sign of non-laziness is that you bother to atleast create custom reports. A best practice is to pull atleast some input metrics (Visits) with some attribute metrics (% New Visits), have something that denotes customer behavior (bounce rate) and it is criminal not to have atleast a couple outcome metrics (goal conversion rate, per visit goal value).

That best practice gives me this report for my search keywords. . . .

[Click on the image for a higher resolution version.]

It is a useful report that helps me understand performance much better than the standard reports from Omniture, Google Analytics, WebTrends etc etc.

But remember I have twenty six thousand keywords referring traffic to this blog.

I want to very efficiently look through them to find something useful.

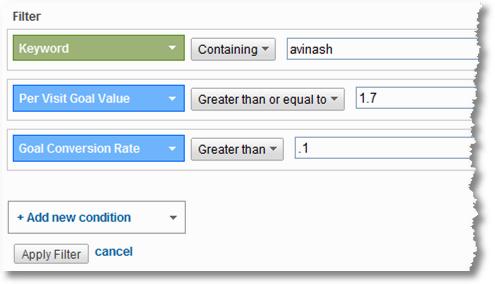

I want to locate my most important brand terms that perform magnificently for me. To accomplish that I click the link called Advanced Filter under that table and do this. . . .

I move beyond the limitation of the top ten rows by creating a simple inline filter.

Find keywords:

containing "avinash"

where the "per visit goal value" is greater than $1.7 (a higher bar since the average is 1.3) and

the Goal Conversion Rate is greater than 10% (again another high bar compared to the site average)

Notice that I can only run a smarter query because I had created a custom report, without it I would have to use the "lame" metrics that I might get in the standard report (or immediately proceed to extracting all the data, all metrics and spending next four hours in excel doing what I can in two seconds in Analytics).

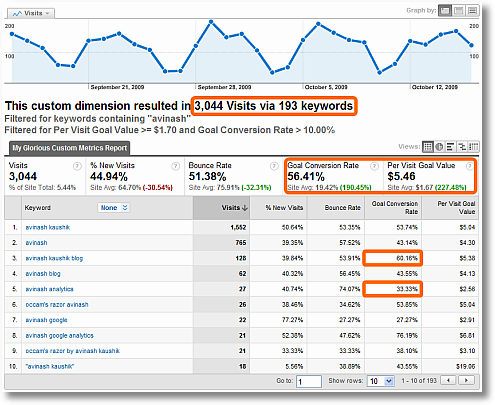

In a second the table transforms into. . . .

[Click on the image for a higher resolution version.]

You know what's in the table?

Keywords we should make love to because regardless of if they bring a lot of traffic or little, they hugely deliver to the bottom line. Making love might be too small a emotion when you realize compared to a site average of $1.3 the per visit goal value is $5.5. And look at that conversion rate!

Also notice up top. . . I quickly went from tens of thousands of keywords to just 193 I should focus on. I need to analyze these keywords, search engines, landing pages, products sold, leads received, and so much more to figure out:

1. what is going on here that is so right that it works like magic and

2. how much can I replicate the lessons learned

Far too often we focus on our losers. Here I start by focusing on winners and see if I can do more of what I know already works.

I could just as well have mined my data to look for

-

people on non-branded terms

people who come on every variation of the names of my two books

people who come from China

people who use a cluster of terms I consider most competitive or. . .

The limit to the data I can mine (and I use that word loosely here) is the imagination I have (or better put: the intelligence I possess about important business questions).

So do this. Use inline advanced table filters to go from tens of thousands of rows to just a few that you need to focus on.

Yes you can absolutely do this in Excel. But it will take you five times the amount of time and effort required because. . . please pay attention. . . in this case you are querying the entire dataset of your website and in Excel you'll keep going back and forth to get more data or dump it or write more complicated queried or. . . you catch my drift.

Advanced Table Filters can be used in any report in Google Analytics (Yahoo! Web Analytics also has a very similar feature, actually YWA had it before GA! :)).

The one limitation of the approach is that you'll more optimally analyze your known knowns. You'll even get to understanding your known unknowns. But not your unknown unknowns.

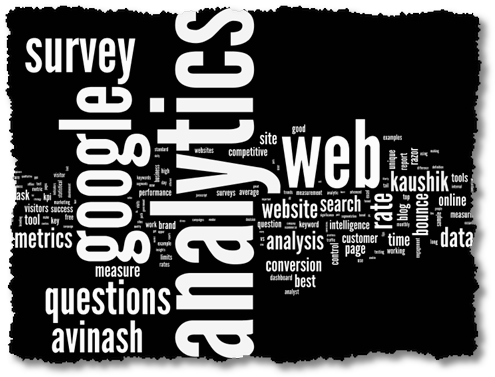

For pulling lots of data from lots of rows all together into one place I do so love tag clouds.

Download all your keywords into a text file (twenty six thousand or so in my case) and upload them into Wordle and bam!

[Click on the image for a higher resolution version.]

O M G!

Did you think that by doing something so simple you could get such a quickly glance-able view of so much data?

I love search keyword tag clouds because they can tell you about the health of the company when it comes to search.

In my case, above, for example I LOVE the fact that above and beyond everything the word Analytics dominates it all, and what makes me happier is that the word Survey is so prominent (you all know I love qualitative data, now here is proof that my blog attracts so much of that traffic).

I worry a smidgen that people will think this blog is about Google Analytics, it is not, so I am happy that the word Google appears atleast as much as the word Web (and variations like website and online etc). I can't drill down in wordle so easily, but I use technique #1 (above) and it turns out 30% of the time the word Google appears in search queries in the spirit of "working for google", and another 30% for queries like "google insights for search", "google ad planner" etc (tools I have blog posts on). My mind is relieved.

See how I can understand about a strategic concern, at least a bit, using a technique as simple as a tag cloud?

Another thing I am rather ecstatic about is the sheer diversity of the keywords in search queries. It is not my brand that dominates (boo hoo! cry cry!) but rather "category" terms (which bring the "impression virgins"). Metrics and Conversion and Data and Questions (look at that!) and Analysis and Customer and Intelligence and Bounce and Best. . . .

That sweet spread validates some my Search Engine Optimization strategy (something I spend a lot of time on) – go for diversity and attract new people to my "franchisee".

Or in your case it may not. It may tell you different things. The main point is it would be hard to understand some of these macro factors in your data by looking just at a table in your web metrics tool of the top ten keywords!

Here is a tag cloud for a small company you might have heard of, Gatorade. The data does not come from them (obviously), it is from Compete. . . .

[Click on the image for a higher resolution version.]

I am not a SEO expert, can't underscore that enough, but everything that could possibly be sub optimal about seo/ppc is wrong with Gatorade.

The one brand term dominates their referring search keywords. This in of itself is not a bad thing, Gatorade is a huge brand. But what it indicates clearly that their site attracts people who already know Gatorade and are "pre converted", when perhaps a greater use of the website would be to attract the impression virgins and blow them away with the greatness of Gatorade so they'll never consider Powerade or any other brand.

Look at the diversity of keywords.

Find any?

People use tens and thousands of different ways to find even a web analytics blog. Look at how much different types of content there is on Gatorade.com and MissionG.com and Gssiweb.com and it is quite clear that Gatorade's tag cloud is telling a sad story.

Finally for all the money that Gatorade is handing out to premier current athletes (and the really expensive content Gatorade has on its website related to those top athletes) only two show up in the tag cloud. One that used to be important (though he is still a big brand) and the other that sadly ran over a fire hydrant a couple weeks back. That shows how exposed the Gatorade brand (atleast online) is should something unfavorable happen to these two guys.

I would humbly dramatically change Gatorade's SEO and PPC strategies tomorrow morning.

It is amazing how when you have so much data in one place, using such a simple technique, that you can find some very intriguing patterns in your data, stories that might validate what you are doing right or expose everything that is wrong with your digital strategy.

Simple but effective. Try it for your site. What do you find?

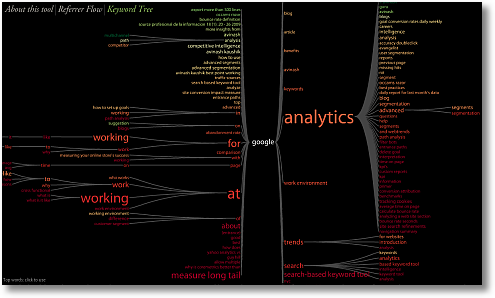

This is my latest love. I mean it.

I was so happy when I first saw it because of this constant quest I am on to take lots of data and show it on a page.

Zach and the team at Juice Analytics have created two powerful visualizations: Referrer Flow and Keyword Tree.

I adore that last one.

You simply go to http://analyticsvisualizations.appspot.com click on Keyword Tree and you are on your way!

The visualization uses the free, open and multifaceted Google Analytics API. In a few seconds you'll get something pretty and intelligent (how often have you seen those two together :)). . . .

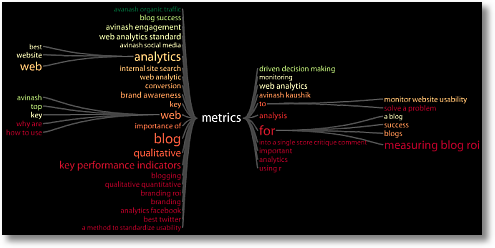

[Click on the image for a higher resolution version.]

It's a tree. With branches. :)

While in the case of tag clouds it is difficult to understand the relationships between different words that exist in your search queries, that is not the case with keyword trees.

I was looking up the relationships for the word "avinash", image above, click for a higher resolution version. I am looking at hundreds upon hundreds of rows of data visualized all in one page.

I can easily see long tail queries like "top 10 key metrics web analytics avinash" or head ones like "kaushik blog" or even "kaushik web analytics 2.0 pdf" (my book is not available in pdf form but now I know lots of people are looking for it and so maybe we should get it out fast!).

I can simply walk through the various branches of the tree and it helps me understand in a very powerful way the relationships that exist in my data. It always throws up surprises (partly because of my top ten rows table driven existence I have never actually looked at so much data in such a easy to understand way).

The fun though does not stop here. I can actually look at keyword trees using different metrics.

In this view I am looking at the data for the keyword "tracking", the colors shown highlight the bounce rate metric for each relationship. . . .

[Click on the image for a higher resolution version to be truly impressed!]

Now I know the queries that stink like a skunk, the deep reds, and find some sweet ones, "event tracking" is one such word (lots of visits with very little bounce).

But I can switch and say. . . . well our bounce rates stink so we'll not use that as a success metric :), let's use the % of New Visitors as a success metric. Ok no problem, press the button on the control panel on the right and. . . .

[Click on the image for a higher resolution version to be truly impressed!]

Notice the relationships change, the queries you would have paid attention to will change, what you will action will change. Just with the press of a button.

You can also flip the size of the words. I am using Visits in both cases above, but you can just as easily go for quality (in this case) and use New Visits. I would love to see some kind of Outcome metric there, given my passionate and sustained obsession with measuring end success.

You can do lots of true analysis, for free, with your data and get the kind of insights tables from Google Analytics and Yahoo! Web Analytics and WebTrends and CoreMetrics simply can't provide.

Let me share two snapshots to make that point.

I was genuinely shocked at the complexity of the tree and branches associated with the word "google". . . .

[Click on the image for a higher resolution version to absorb the whole thing!]

The darn thing did not even fit my laptop monitor (1440×900), and there was so much going on that it took me a while to absorb all the lessons.

Meanwhile for the "analytics" branch I can see, at a glance, the 70 or so queries that cause the "main flare" and it gives me a peek into the the head of my visitors unlike anything else. Talk about collecting VOC (and actually understanding it!!).

On the other hand I was quite saddened to see the report for the word "metrics". . . .

[Click on the image for a higher resolution version.]

Remember this blog is all about data and metrics. Yet the tree is so "shallow". Or better put it is less a tree and more a bush. Or maybe just a shrub.

For all of the reasons I was less than thrilled with the gatorade data in #2, I am less than thrilled here. From competitive intelligence analysis I know that there is a ton of volume on Google for queries related to "web metrics", and variations, yet I have not done a good job of attracting that traffic.

The above picture does not simply tell me that I need to do a better job of doing SEO for "web metrics", the real lesson is that I need to put in a ton of effort to attract the long tail for "web metrics" because that is where most of the volume is.

You will probably find other lessons from this exercise on your data. Hopefully there is no doubt by now that valuable lessons do await you if you put in the effort to start switching from using tables and excel and shift to using other data analysis / visualization techniques.

Each effort above uses something very simple and while none of them are a panacea, your understanding of web metrics data will not be the same boring self.

Have fun.

[Bonus Item: #4: One strategy to escape the top x rows is listed in the second half of this post, jump to just after the picture of Tiger Woods (!!): Focus On “What’s Changed”.]

Ok… your turn now.

What do you think of these strategies? Have you used them before? Worked for you? Have you used other data visualization techniques that liberate you from the trap of top ten rows? What tools do you use? Got models / approaches / strategies you want to share?

We would all love to learn form you. Please share. Thank you.

PS:

Couple other related posts you might find interesting:

- “Dear Avinash”: Be Awesome At Comparing KPI Trends Over Time

- Consultants, Analysts: Present Impactful Analysis, Insightful Reports

- How Thick is Your Head and How Long is Your Tail?

- Make Web Analytics Actionable: Focus On “What’s Changed”

- Web Data Quality: A 6 Step Process To Evolve Your Mental Model

It is rare for me to work with a organization where the root cause for their faith based decision making (rather than data driven) was not the org structure.

It is rare for me to work with a organization where the root cause for their faith based decision making (rather than data driven) was not the org structure. Are there standard tools deployed? Or is it all cowboy country with "Analysts", if any, running with as much freedom as free range chickens (which by the way I highly recommend!).

Are there standard tools deployed? Or is it all cowboy country with "Analysts", if any, running with as much freedom as free range chickens (which by the way I highly recommend!). When I consult with large companies when they are in this (messy) state my deliverable is a 90 day plan (that relies on the aforementioned accelerators) and a 180 day plan and a 365 day plan.

When I consult with large companies when they are in this (messy) state my deliverable is a 90 day plan (that relies on the aforementioned accelerators) and a 180 day plan and a 365 day plan. It matters who your boss is and how much power she has to make stuff happen.

It matters who your boss is and how much power she has to make stuff happen.