A drop in the unemployment rate and a jump in job creation must count as good news, but this is no time for celebration.

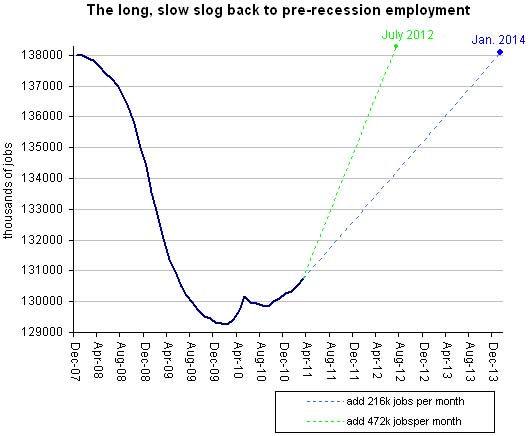

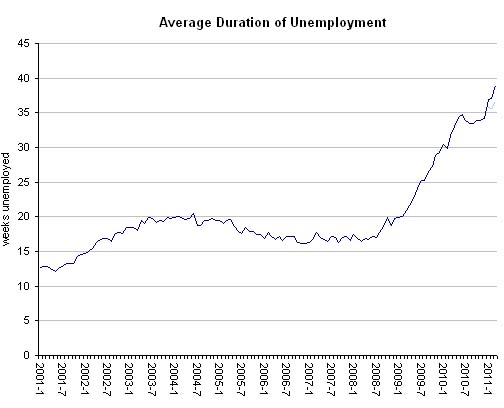

After all, at 8.8 percent, unemployment is still very high,even if the current rate is down slightly from 8.9 percent a month ago, and at the current pace of growth in jobs, a painfully large number of people will be out of work for years to come.

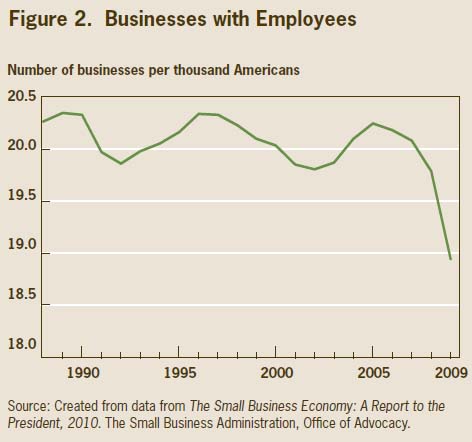

Still, as Michael Powell says on the new Weekend Business podcast and writes in The Times, there are some very positive signs embedded in the Labor Department’s monthly report. Manufacturing, for example, a downtrodden sector that has been in decline in the United States for decades, has been reviving in the economic recovery. Most sectors reported net job gains in March, and they occurred despite several global crises — the turmoil in the Middle East, the disasters in Japan and the debt problems in Europe.

In the United States, it’s tough enough to get a job in the current environment. It’s even tougher to get one that pays a living wage, as Motoko Rich observes in another discussion on the podcast. She talks about a new study, which she covered for The Times, indicating that many working people are unable to make ends meet.

Read more…

Apture allows readers to dig deeper into a subject without ever leaving the blog post. When you click on any link marked by the icons

Apture allows readers to dig deeper into a subject without ever leaving the blog post. When you click on any link marked by the icons