The government may view Bank of America and Citigroup as too big to fail, and dozens of smaller banks may soon find that size matters for them as well.

Fifth Third Bancorp reported a $2.2 billion quarterly loss.

Multimedia

Capital One Financial, Fifth Third Bancorp, KeyCorp, Huntington Bancshares and SunTrust Banks announced sharp fourth-quarter losses on Thursday, the start of a trickle of red ink at the nation’s small and midsize lenders that could result in a flood of mergers in an industry that is already consolidating.

Most of these banks were never big players in credit cards, subprime mortgages or credit-default swaps. But they were major lenders to commercial real estate developers, home builders and small corporations. As the recession tightens, losses have started to surge.

“There will not be the shock and awe factor” of the big bank losses, said Nancy A. Bush, a longtime banking analyst. But “small and midsize banks are up to their eyeballs in commercial real estate related to residential development and business loans. We are going to see a reckoning with how bad that got” in 2009.

Most small and regional banks will probably be able to slog through several more quarters of dismal results. But as their losses swell, pressure from investors and regulators could lead dozens of banks to start cutting deals.

Gerard Cassidy, a veteran banking analyst, projected that 200 to 300 small banks might fail or be forced into mergers over the next year or so. While that is still a fraction of the industry’s 8,400 banks, it is up sharply from the 25 bank failures in 2008. “It is really going to be a combination of the depth of the recession and how long the regulators allow these things to stay open,” Mr. Cassidy added. Federal officials have been giving bailout money from the $700 billion Troubled Asset Relief Program to selected weaker banks. Lawmakers want them to make more loans to consumers and small businesses. Regulators, nervous about the banks’ fragile finances, have been making some investments conditional on a good-faith effort to find a stronger institution to merge with, according to several financial advisers.

In other cases, like PNC Financial’s takeover of National City, regulators helped facilitate the acquisition through lucrative tax breaks and additional TARP money. PNC, which received nearly $7.6 billion in government money, was given National City’s share of the bailout funds to help it complete the deal.

“If some of these guys are going to be weakened, they should be acquired,” said Bert Ely, a longtime banking industry consultant. “Regulators should really push the weak guys to do a deal.”

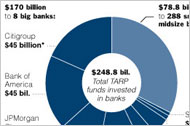

So far, 288 small and midsize banks have received $78.8 billion of government money. That is about one-third of the nearly $249 billion awarded to the industry and less than the combined $90 billion in capital injections that Bank of America and Citigroup have received since last fall.

As with larger banks, private investors are reluctant to pour capital into smaller institutions to offset their deepening losses. And because additional government support is uncertain, many small and midsize banks may be forced to take aggressive steps to survive.

On Wednesday, SunTrust cut its dividend to 10 cents, from 54 cents; Huntington Bancshares slashed its dividend to a penny a share. These moves cost investors, but analysts say dozens of banks may follow suit to preserve billions of dollars’ worth of capital each year.

Still others may be forced to take more drastic action. Some are already looking to sell off stronger businesses. SunTrust, for example, sold its long-held stake in the Coca-Cola Company for $2 billion last year to help it weather the credit storm. Some investment bankers expect Fifth Third to put its credit card processing unit or asset management units on the block. On a call with analysts, Fifth Third executives declined to comment.

“It’s almost like the Bernie Madoff investors who have to pawn their family jewels,” said David Hendler, a financial analyst at CreditSights. “The banks have to sell what they can just to get by.” Other banks are ratcheting back on lending, even if it causes lawmakers to grumble. Bankers are already fearful about their exposure to troubled consumers running up big credit card balances and corporate loans tapping revolving credit lines. After enduring huge losses from doling out easy money in a boom economy, they are reluctant to lend into a global slump.

Besides, the easiest way to free up capital is to reduce the size of their balance sheets.

“The government’s rhetoric says that we want banks to lend to get the economy to expand,” Christopher Whalen, a managing partner at Institutional Risk Analytics. “The reality is the banking system is going to continue to shrink.”

With stronger balance sheets and far less exposure to complex derivatives and risky trading, small and regional banks are unlikely to suffer the big quarterly losses of their larger rivals. Still, they will contend with more quarters of escalating losses.

SunTrust, of Atlanta, swung to a $347.6 million loss in the fourth quarter amid rising real estate losses in Southeast. It has accepted more than $4.85 billion of government money and some analysts say it may need as much as $2.1 billion in additional capital to plug deepening holes. “We are under no illusions as to the severity of this credit cycle,” John M. Wells III, SunTrust’s chief executive, said.

Capital One Financial, a credit card company with a regional banking arm in northern Virginia, reported a $1.42 billion loss amid rising consumer loan losses and a big charge tied to overpaying an auto lender. It accepted $3.6 billion in government money.

Fifth Third, of Cincinnati, reported a $2.2 billion loss as consumer and commercial real estate loans soured in Florida, Michigan and Ohio. It received a $3.4 billion capital injection from the government last fall.

KeyCorp, based in Cleveland, suffered a $524 million operating loss in the fourth quarter. The loss stemmed from increasing its reserves, shedding mortgage-related assets, and taking a big charge for overpaying on several earlier deals. It has received $2.5 billion in government money.

Huntington Bancshares, another Ohio bank, which accepted $1.4 billion from the government, reported a $417.3 million loss in the fourth quarter.

Even profitable banks were not immune. BB&T, a North Carolina-based bank that accepted $3.1 billion in government money, said profit fell 26 percent to $305 million in the fourth quarter as it set aside more money to cover expected losses. Comerica, which has a big presence in Michigan and California, reported a $20 million profit, off sharply from last year. It announced plans to lay off 5 percent of its staff and freeze salaries for senior managers as it braced for more losses in 2009. Comerica accepted a $2.25 billion government infusion this fall.

M&T Bank, which took about $600 million in government money, has been among a handful of smaller banks where profits have remained strong. Net income at the Buffalo-based bank rose 57 percent to $102.2 million in the fourth quarter. Still, it suffered losses in its mortgage securities portfolio and expected more bad home and auto loans.