By easing the terms of its $150 billion rescue package for the American International Group, the government is trying to buy time for the financial conglomerate to slim down and reinvent itself as a simple property and casualty insurer, with a new name, new faces in the boardroom and perhaps an initial public offering in its future.

The government will meanwhile take a preferred stake in the company’s crown assets in its fourth attempt to stanch the flow of problems from the insurance giant. The worldwide life insurance division and the Asian insurance operations are being taken off the block, because they are too hard to sell for a reasonable price in the current market and are essentially being used to repay expensive government loans.

The company said Monday that it would create a new holding company, called A.I.U. Holdings, and install its domestic and foreign property and casualty insurance businesses there — with more than 44,000 employees and customers in 130 countries.

That company will be run by senior A.I.G. insurance executives, and its name comes from an existing A.I.G. business, American International Underwriters.

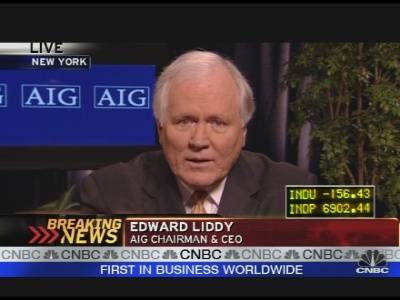

But the goal is to break this new property insurer free of A.I.G. and its many complications. “A.I.G.’s conglomerate structure is too complicated, unwieldy and opaque,” said Edward Liddy, who was brought in as chief executive by the government last fall when the conglomerate nearly collapsed. While announcing the details of the latest government package and the company’s fourth-quarter loss of $61 billion, he emphasized that the company does not need cash.

But to satisfy the government loans, he has been trying to sell divisions, a fact made harder because of A.I.G.’s opaque structure.

Mr. Liddy also took a jab at A.I.G.’s former chief executive, Maurice R. Greenberg, saying he was the one who oversaw A.I.G.’s foray into derivatives. That business “has literally brought us to our knees,” he said on Bloomberg television.

Mr. Greenberg, known as Hank, fired back with a lawsuit against A.I.G., which he accused of securities fraud.

Mr. Liddy predicted the sales would go more smoothly and profitably once A.I.G. was carved up into comprehensible parts, and said there might be a public offering for the reorganized property and casualty business in nine months to a year.

Joe Paduda, a former A.I.G. employee who is now principal in the insurance consulting firm of Health Strategy Associates, agreed that the “black box” aspect of A.I.G. was putting off prospective buyers. “They don’t want to buy anything they don’t think they really understand thoroughly,” he said.

Within its web, different operating companies could affect one another’s performance in unpredictable ways, he said.

A.I.G.’s other divisions have an even cloudier future. Its global life insurance division and its Asian insurance operations are being shifted into two special-purpose entities, where they will help satisfy debts to the Federal Reserve Bank of New York. They may eventually be sold, too, but no one at the company was predicting when.

Moody’s Investor Service reacted to these developments by holding A.I.G.’s credit rating steady, as well as the ratings of its property and casualty units. But it downgraded the debt of certain divisions, including its life insurers.

“This is not a good option, but it’s the least worse of a lot of bad options,” Mr. Paduda said.

In a conference call with securities analysts Monday, Mr. Liddy said A.I.G. had been trying without success to sell the Asian insurer, the American International Assurance Company or A.I.A., and the worldwide life insurer, called Alico. Other insurance companies have made offers, but with the life insurance industry in a major downturn, Mr. Liddy said prospective buyers could not reach far into their pockets.

Some observers speculated that competitors had been trying to buy its businesses on the cheap.

“A.I.G. is down, and they’re kicking them as hard as they can,” Mr. Paduda said. “A.I.G. is not very well liked in the insurance business.” He said that back in its glory days the company had a reputation for aggressively poaching its rivals’ customers.

By putting the stock of Asian and worldwide life insurance units into the new special-purpose entities, the company said it was accomplishing two things: taking them off the auction block until the industry recovered and better offers came forward, and paying back a portion of the roughly $38 billion drawn down from its total $60 billion lending commitment from the Fed.

- 1

- 2