Flood of foreclosures: It's worse than you think

Banks are moving slowly to list repossessed homes for sale, which could mean that housing inventory is even more bloated than current statistics indicate.

NEW YORK (CNNMoney.com) -- Housing might be in worse shape than we think.

There is probably even more excess housing inventory gumming up the market than current statistics indicate, thanks to a wave of foreclosures that has yet to hit the market.

The problem: Many foreclosed homes and other distressed properties that are now owned by banks have yet to be listed for sale. The volume of this so-called 'ghost inventory' could be substantial enough to depress already steeply falling prices when it does go on the market.

"That's not good news," said Pat Newport, an analyst with IHS Global Insight. "[Excess] inventory is the biggest problem in housing these days, and it leads to lower housing prices, which leads to more foreclosures."

RealtyTrac, the online marketer of foreclosed properties, recently discovered that it has far more foreclosed properties listed in its database, which the company compiles using courthouse records, than there are listed in the multiple listing services (MLS) maintained by real estate agents.

RealtyTrac looked at listings in four states, California, Maryland, Florida and Wisconsin, and found that they contained only a third of the foreclosures it has in its database.

The scope of the problem isn't clear, but it could be huge considering that RealtyTrac has a total of 1.5 million bank-owned properties on its site.

"Many properties that should be listed on the MLS are not listed on the MLS," said Lawrence Yun, chief economist for the National Association of Realtors (NAR).

The National Association of Realtors calculates official housing inventory statistics using data from the multiple listing services. By that measure, there were 4.2 million existing homes for sale in November, an 11.2-month supply at the current sales pace, up from a 10.3-month supply in October.

But now it seems quite possible that these figures, which are already at record highs, are underestimating the situation. And if that's the case, it could take much longer for the housing market recovery than analysts currently expect.

Until supply can be brought down to a more normalized level of six to seven months, home prices will continue to come under pressure, according to Yun.

"It could be a worse problem than we think," he said.

L.J. Jennings, a real estate broker with Pyramid Real Estate and Investments in Oakland, Calif., sees plenty of evidence that it is.

"There are a number of properties in my area that have actually been taken back by the banks, but have not hit the market yet," he said. "Once a bank repossesses a property, in some cases, it can take more than six months to hit the market."

He cites a handful of examples offhand, including a single-family home in Richmond seized in early October, a condo in San Ramon taken back the same month and a four-family building in Oakland that was repossessed in July.

"Either lenders are overwhelmed and can't get these properties back on sale quickly" said RealtyTrac spokesman Rick Sharga, "or they're deliberately slowing down."

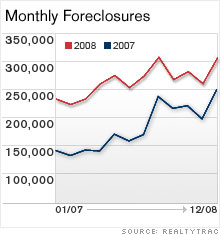

The chief problem is probably system overload: Lenders are just not prepared to handle the sheer numbers of foreclosures that they have on their books. Banks took back about 860,000 in 2008 - more than twice the number in 2007 - according to RealtyTrac. Before the housing crisis hit, it took only about a month to get a bank-owned foreclosure on the market.

Lenders still insist they try to act as swiftly as possible. According to Tom Kelly, a spokesman for Chase (JPM, Fortune 500) Mortgage, their goal is to cut their losses on these homes, which are expensive to maintain, as fast as possible.

But banks might hold back listings in areas where they already have lots of homes for sale in order to avoid flooding the market, according to Michael Youngblood, a financial analyst and founder of Five Bridges Capital, an asset management company.

"If lenders have a significant number of properties in a limited area, they may want to stagger putting them back on the market," he said.

Eve Alexander, a real estate broker with Buyers Broker of Florida in Orlando, attributes the delays to the general malaise that's overtaken the lending industry as it's imploded.

"I think banks are dragging their rears about doing just about everything," she said. "They have so much going on, and there's so much red tape and the people don't care, nothing gets done."

There are also batches of bank-owned homes that don't appear on the multiple listing services because lenders are trying to sell them via bulk and auction sales to investors as well as individuals, according to John Mechem, public affairs director for the Mortgage Bankers Association.

He adds that it's also taking much longer to get many foreclosed homes in decent enough shape to put on the market. (see This home for sale stinks.)

Bank-owned properties are in worse condition than ever because the foreclosure process is taking longer than ever. As much as a year can pass between the time a borrower first misses a payment and the final auction sale, according to Youngblood. During that time, houses often deteriorate because owners have neither the money nor the incentive to maintain them. Some disgruntled homeowners may even deliberately damage homes before they leave.

"According to our servicing folks, it's taking more time for lenders to get properties in saleable condition," said Mechem.

The phenomenon of a growing ghost inventory doesn't promise to get better anytime soon, as long as the rate of foreclosures continues to ravage the market. There were more than 3.1 million foreclosure filings in 2008, according to RealtyTrac.

Said Sharga: "I don't see how we can avoid another 3 million in 2009." ![]()

-

Small businesses are finally trying to increase prices - some for the first time in years. More

-

Save time, money and sanity with these tech devices designed for entrepreneurs. More

-

Mark Twain may have said "golf is a good walk spoiled," but many corporate CEOs disagree. More

-

Colorado's medical pot retailers are finding the industry isn't the shortcut to riches they'd hoped. More

-

Tax audits surged last year for those making more than $10 million. More

-

Feel like you're working long hours just to fork over your hard-earned dollars to the IRS? More

-

A-list director Tom Shadyac has a new documentary on anti-materialism. Play