By MICHAEL R. CRITTENDEN

WASHINGTON -- The U.S. government's rescue of the financial system is vulnerable to fraud that could potentially cost taxpayers tens of billions of dollars, government watchdogs warned lawmakers Tuesday.

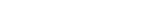

Neil Barofsky, the special inspector general for the $700 billion Troubled Asset Relief Program, told a House subcommittee that the government's experiences in the reconstruction of Iraq, hurricane-relief programs and the 1990s savings-and-loan bailout suggest the rescue program could be ripe for fraud.

He also said fewer than 5% of banks receiving government aid have responded to a request about what they have done with their bailout money.

The comments come as the Obama administration prepares to pour more money into the financial sector. Federal banking regulators begin a series of "stress tests" at the largest U.S. banks this week to determine whether they need greater infusions of government funds to survive a worse economic downturn.

"History teaches us that an outlay of so much money in such a short period of time will inevitably draw those seeking to profit criminally," Mr. Barofsky said.

Gene Dodaro, acting comptroller general of the U.S., told the subcommittee that a reliance on contractors and a lack of written policies could "increase the risk of wasted government dollars without adequate oversight of contractor performance."

The Treasury Department "has yet to develop comprehensive written policies and procedures governing TARP activities or implement a disciplined risk-assessment process," Mr. Dodaro said.

Mr. Barofsky didn't specify the scope or type of fraud he was talking about. Mr. Dodaro said the Treasury has made progress in its oversight of independent contractors, but that the department has identified "high risk issues that still need attention."

He said the Treasury's frequently changing strategy for dealing with the financial crisis has hurt efforts to restore stability.

Federal officials have already alleged TARP-related fraud. In January, the Securities and Exchange Commission charged a Nashville, Tenn.-based firm with defrauding investors of at least $6.5 million by claiming their money was invested in TARP and other securities that didn't exist. Mr. Barofsky's office is working with the SEC in investigating the case.

A Treasury spokesman said the agency has acted "to implement all of [the Government Accountability Office's] recommendations, and we look forward to continuing to work closely with the oversight bodies to ensure taxpayer dollars are spent wisely. The administration has already imposed new rules to enhance transparency and accountability and restrict lobbyists' influence to make sure that investments are based solely on the merits."

Write to Michael R. Crittenden at michael.crittenden@dowjones.com

Printed in The Wall Street Journal, page A2

![[gascover1]](https://cybercemetery.unt.edu/archive/cop/20110402234100im_/http://si.wsj.net/public/resources/images/OB-NI994_gascov_C_20110401184323.jpg)

![[Car1]](https://cybercemetery.unt.edu/archive/cop/20110402234100im_/http://si.wsj.net/public/resources/images/OD-AF476_Car1_C_20110401011028.jpg)

![[OB-NJ130_gomez1_C_20110402143726.jpg]](https://cybercemetery.unt.edu/archive/cop/20110402234100im_/http://si.wsj.net/public/resources/images/OB-NJ130_gomez1_C_20110402143726.jpg)

![[COBRA]](https://cybercemetery.unt.edu/archive/cop/20110402234100im_/http://si.wsj.net/public/resources/images/NY-AW294_COBRA_C_20110401222208.jpg)

![[jumpropes1]](https://cybercemetery.unt.edu/archive/cop/20110402234100im_/http://si.wsj.net/public/resources/images/OB-NI754_jumpro_C_20110401123242.jpg)

![[NYSCENE6]](https://cybercemetery.unt.edu/archive/cop/20110402234100im_/http://si.wsj.net/public/resources/images/NY-AW330_NYSCEN_C_20110401181946.jpg)

Most Recommended

“"[Working class whites]...;”

“The plan of the left, as so...;”

“One congressman bucking the...;”

“A model for the failure of...;”

“Exactly like the Mafia, unions...;”