Bear Stearns Execs To Face Financial Crisis Panel

Planet Money

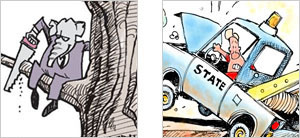

The federal commission tracing the causes of the financial meltdown begins a fresh round of hearings Wednesday. First to take the hot seat: top executives from Bear Stearns, the failed investment bank that helped set the meltdown in motion. Michele Norris talks to Phil Angelides, the commission's chairman, about the hearings this week in Washington.

Copyright © 2010 National Public Radio®. For personal, noncommercial use only. See Terms of Use. For other uses, prior permission required.

MICHELE NORRIS, host:

The federal commission tracing the causes of the financial meltdown begins a fresh round of hearings tomorrow, and we're guaranteed to hear one phrase over and over again: the shadow banking system.

It refers to the rise of nondeposit banks, namely investment banks and hedge funds, that operate outside the control of federal regulators.

First to take the hot seat on Wednesday, top executives from Bear Stearns, the failed investment bank that helped set the meltdown in motion.

We're joined now by the chairman of the Financial Crisis Inquiry Commission, or FCIC, Phil Angelides, welcome back to the program.

Mr. PHIL ANGELIDES (Chairman, Financial Crisis Inquiry Commission): It's great to be with you.

NORRIS: First, let's go to that phrase, shadow banking system, what exactly are we talking about? What can these banks do and what can't they do?

Mr. ANGELIDES: Over the last two decades, what we've seen is the emergence of a whole set of companies that are bank-like but weren't subject to the same kind of regulation, didn't fund themselves with insured deposits, so they were subject to a run.

They were the investment banks, the money market funds, the hedge funds. And that system, that shadow banking system, kind of the opaque, darker part of our banking system, grew to be as big as our regular banking system.

In 2008, when the financial system came under stress, we began to see kind of like old-fashioned bank runs. We saw it at Bear Stearns. We saw it at Lehman Brothers. We saw people who had the money with those institutions pulling them out and a financial panic under way.

NORRIS: Without the insurance that might protect the consumer in that case or the bank from collapse.

Mr. ANGELIDES: Well, in fact, the whole notion of deposit insurance was yes, you would protect the depositor, but it also would prevent bank runs because even if you thought your bank was in trouble, there wouldn't be the run because you knew the federal government was standing behind it.

So you take an institution like Bear Stearns. Here is an institution with about $400 billion in assets. It was the baby of the investment banks. But it only had about $11 billion in equity. Plus, much of their funding was in what was called overnight repo. About $50 to $60 billion each day they had to roll over, and their lenders had to agree to lend them for the next day.

And when confidence was shaken, when the mortgage market in which they had a lot of mortgage securities start to come apart, there was a run.

NORRIS: Were they leveraged up that high because they were allowed to do that outside of the regular regulatory structure, or did they receive some sort of special dispensation so they could actually run their leverage above 25, 30 percent?

Mr. ANGELIDES: Most of these shadow banking institutions were very lightly regulated. As it turns out in 2004 though, the SEC, the Securities and Exchange Commission, took responsibility for overseeing a certain number of investment banks, and the fact is they did it because they could, and no one stopped them.

NORRIS: There are two parallel conversations going on in Washington when it comes to the debate over financial regulations. On one hand, lawmakers are talking about fixing the problem so this country never gets into this position again, where the government has to hand out huge bailouts and where we're dealing with systems that are deemed to be too big to fail.

On the other hand, there's the FCIC that is casting a very strong spotlight on a problem that sounds like it's not fully addressed in that other conversation going on in Capitol Hill. That seems not to make sense.

Mr. ANGELIDES: Well, the first view I take is we have our job to do, they have their job to do. You know, the Congress and the president were elected. They don't feel like they can sit on their hands and let the system just stay as it is.

So what I really believe is going to happen here is as we learn more and more about what brought down our financial system, and we learn more every day about practices of investment banks like Goldman Sachs and others, as we learn more, the reforms and the reform debate will continue.

In the 1930s, in the wake of the Great Crash of '29, that reform debate took a decade, and I believe we're just starting.

NORRIS: But is it possible that we could wind up with a banking bill that doesn't address some of the problems that you're wrestling with at the FCIC? I mean, when you look at the list of so-called carve-outs, the things that aren't presently in the bill, private equity firms, hedge funds, they're not currently within the regulatory structure that they're starting to create on Capitol Hill.

Mr. ANGELIDES: There will be many unaddressed issues. Credit rating agencies really haven't been addressed yet. The fate of Fannie Mae and Freddie Mac that will have about $190 billion of losses haven't been addressed yet. We have miles to go.

NORRIS: Phil Angelides, always good to talk to you. Thanks for coming in.

Mr. ANGELIDES: Nice to be with you.

NORRIS: Phil Angelides is the chairman of the Financial Crisis Inquiry Commission or FCIC.

Copyright © 2010 National Public Radio®. All rights reserved. No quotes from the materials contained herein may be used in any media without attribution to National Public Radio. This transcript is provided for personal, noncommercial use only, pursuant to our Terms of Use. Any other use requires NPR's prior permission. Visit our permissions page for further information.

NPR transcripts are created on a rush deadline by a contractor for NPR, and accuracy and availability may vary. This text may not be in its final form and may be updated or revised in the future. Please be aware that the authoritative record of NPR's programming is the audio.

More Economy

Economy

U.S. Trade Gap Widens Amid Oil Price Surge

U.S. imports jumped at the fastest pace in 18 years. And China reported a surprise trade deficit.

Economy

New Jobless Claims Up 26,000 Last Week

The increase may have been affected by the prior week's Presidents' Day holiday.

Politics

Rising Gas Prices Spur Calls For U.S. Oil Production

But the White House notes domestic production last year rose to its highest level since 2003.

Comments

Please Note: Community managers review some user comments prior to posting them to the site. Read our editorial statement to find out more.

Discussions for this story are now closed. Please see the Community FAQ for more information.