Financial crisis panel seeks bankers' testimony

Friday, January 8, 2010

The commission appointed by Congress to examine the causes of the financial crisis is to hear testimony Wednesday from the heads of four of the nation's largest banks, as the panel begins a year-long investigation that its chairman described as an effort to figure out "what the heck happened."

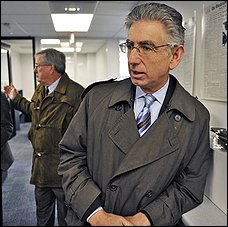

Philip Angelides, chairman of the Financial Crisis Inquiry Commission, said he planned to hold a series of public hearings, conduct hundreds of interviews and request or subpoena information from companies and government agencies.

"This is a proxy for the American people, giving them the chance to ask what led this country to the economic precipice," said Angelides, a Democrat who served as California's state treasurer until 2007.

The commission has until Dec. 15 to produce a report. Although legislation to reform financial regulation already is moving through Congress, Angelides said the commission's work remains relevant because more bills are likely to follow and a better understanding of what happened could inform the way laws are enforced.

The commission's vice chairman, William Thomas, a retired Republican congressman from California who once headed the House's tax-writing committee, said the commission would also benefit from its instructions to focus on understanding the crisis rather than providing policy recommendations.

Thomas said commissions that focus on recommendations often bog down in political debates and accomplish little. During a meeting Thursday with Washington Post reporters and editors, both men pointed to the success of the 9/11 Commission as a model for their own work.

"They were looking to say what happened and not what should happen next," Thomas said.

Still, the Financial Crisis Inquiry Commission faces a number of challenges.

House and Senate leaders, who appointed six Democrats and four Republicans to the commission, allocated $8 million for its work, enough to hire about 50 investigators but "probably less than any of the investment banks will spend dealing with this investigation," Angelides said.

The tight timetable also makes it impossible to produce a comprehensive account of the crisis, both men said. Instead, the commission will focus its work on particular topics, perhaps producing a series of case studies, Angelides said.

Four bank executives are to appear at the first hearing: Jamie Dimon of J.P. Morgan Chase; Lloyd C. Blankfein of Goldman Sachs; Brian Moynihan, the new chief executive at Bank of America; and John Mack, who retired at the end of December as chief executive of Morgan Stanley but remains the company's chairman. The commission did not invite anyone from Citigroup, the other U.S. company with a large investment banking operation.

The next day, the commission is to hear from local and state regulators about ongoing investigations related to the financial crisis.

President Obama detailed his financial reform agenda in June, and the House has already passed its version. Democrats and Republicans on the Senate banking committee continue to negotiate their differences, but Democratic leaders say they are confident that a bill will pass before the midterm elections in November -- at least a month before the commission is required to publish its findings.

In addition to shaping future legislative efforts, Angelides said, an authoritative account of the crisis could have an impact beyond Washington, affecting public debate on issues such as executive compensation.

Both Angelides and Thomas acknowledged that the commission is off to a slow start, having waited more than a year since the peak of the crisis to hold its first hearing. Thomas said that a lot of work already was happening behind the scenes and that the hearing next week could be compared to a rocket lifting off after a lengthy construction process.

Even as books and speeches about the crisis pile up, Thomas expressed confidence that the committee's work could still make a difference.

"There are a lot of people who still haven't learned the lessons," he said.

![[slate.com logo]](https://cybercemetery.unt.edu/archive/fcic/20110310195838im_/http://media.washingtonpost.com/wp-dyn/content/graphic/2007/09/27/GR2007092701096.GIF)