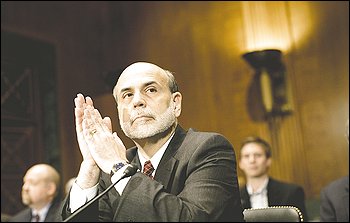

Government regulators slow to act on triggers of crisis, Bernanke says

|

Discussion Policy

Comments that include profanity or personal attacks or other inappropriate comments or material will be removed from the site. Additionally, entries that are unsigned or contain "signatures" by someone other than the actual author will be removed. Finally, we will take steps to block users who violate any of our posting standards, terms of use or privacy policies or any other policies governing this site. Please review the full rules governing commentaries and discussions. You are fully responsible for the content that you post.

|

Friday, September 3, 2010

Regulators fell short in using their powers "forcefully or effectively" to stop risky practices by banks and were slow to identify and address abuses in the U.S. financial system that led to global economic crisis, Federal Reserve Chairman Ben S. Bernanke told a panel investigating the financial crisis on Thursday.

In a lengthy analysis delivered before the congressionally appointed committee, Bernanke said government regulators did not do enough to protect consumers in the marketplace and to force large financial institutions to curtail risky practices.

"Regulators had recognized these problems in some cases but did not press firms vigorously enough to fix them," he said.

Bernanke said the single most important lesson from the crisis was that the problem of financial institutions that are "too big to fail" must be solved.

He said that the U.S. government should be prepared to close down even the nation's largest firms if they pose a broader threat to the financial system. The financial overhaul signed into law earlier this summer gives regulators that power.

Bernanke's remarks were delivered on the second day of hearings by the Financial Crisis Inquiry Commission, which is charged with writing the official account of the causes of the financial crisis and the subsequent response by U.S. regulators. The government, invoking emergency powers, has issued more than $2 trillion in loans and other assistance since 2008 to help support the financial sector.

On Wednesday, former Lehman Brothers chief executive Richard S. Fuld said that U.S. regulators had acted on "flawed information" in making their decision to deny Lehman Brothers aid and force it into bankruptcy proceedings.

Thursday's event on Capitol Hill marked the final public hearing of the commission before the panel issues its report in December.

The commission's 10 members have been critical of Wall Street's role in the crisis since beginning their inquiry in January. They continued their attack on financial firms this week but also began shifting their attention to the government's responsibilities.

After Bernanke's remarks, members of the commission repeatedly pressed the central bank chairman on two of the most vexing questions about the financial crisis. They want to know why Lehman did not receive a government bailout and what role the Fed played in the housing market bubble.

Philip Angelides, chairman of the commission and a former California state treasurer, asked Bernanke to explain the Federal Reserve's decision-making on whether Lehman was considered too big to fail.

Bernanke said he recognized that if Lehman failed, the consequences would be catastrophic but that the Fed could not extend a lifeline without a reasonable expectation that it could get repaid.

Commission Vice Chairman Bill Thomas, a former Republican chairman of the House Ways and Means Committee who is now a visiting fellow at the American Enterprise Institute, asked Bernanke to explain the difference between Lehman and insurer American International Group, which received a $182 billion rescue package from the government.

Bernanke said there was a "very big difference" in whether the government was reasonably likely to be paid back. While Lehman's entire value was in financial instruments, he explained, AIG was "the largest insurance company in America, and the financial products division was just one outpost of this very large and very valuable insurance company."

After 2 1/2 hours of answering questions, Bernanke made a frank admission: Even as the Fed scrambled to save Lehman the weekend before it declared bankruptcy, the Fed had already concluded the bank would fail because customers and investors had declared it dead.

On the Fed's role in the housing market's run-up, Bernanke said it would have been "questionable" for the Fed to raise interest rates before the real estate market became overheated.

Bernanke, who in 2007 told lawmakers that he thought the subprime mortgage issue was "manageable," said he did not recognize the weaknesses that would turn the housing problem into a much bigger crisis.

Much of Bernanke's prepared testimony focused on reviewing the immediate triggers of the crisis and the longer-term structural weaknesses in the financial system. The hearing's second witness, Sheila C. Bair, chairman of the Federal Deposit Insurance Corp., focused on the collapse of two large banks - Washington Mutual and Wachovia. She said the two cases illustrate that under the rules in place in 2008 there could be "disparate treatment for investors and counterparties in different institutions" but that the sweeping financial regulation bill passed by Congress should make the process more equitable.

He blamed "shadow banks" (financial entities that are not regulated depositories that help channel savings into investments); poor risk management by insurers and investors; and the permissive standards of lenders that allowed many households, businesses and financial firms to take on more debt than they could handle, among other factors.