Bank CEOs to answer for financial crisis

By Jennifer Liberto, senior writerJanuary 12, 2010: 11:34 PM ET

WASHINGTON (CNNMoney.com) -- As lawmakers start trickling back to Washington, a panel tasked with investigating the financial crisis is set to make its first big splash.

The Financial Crisis Inquiry Commission, a 10-member panel appointed last summer by Congress, will hold public hearings on Wednesday and Thursday.

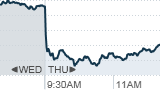

First up are four chiefs of some of the best-known and largest banks: Goldman Sachs (GS, Fortune 500), Morgan Stanley (MS, Fortune 500), J.P. Morgan Chase (JPM, Fortune 500) and Bank of America (BAC, Fortune 500).

The panel's chairman, Philip Angelides, said he's interested in hearing about the banks' role in creating the crisis as well as finding out how they became "too big to fail." The federal government stepped in to prop up the banks in fall 2008, creating the Troubled Asset Relief Program to help provide them with liquidity.

"We think it made sense to start by bringing up the four biggest investment banks that were involved in so many aspects of the crisis," said Angelides, former California State Treasurer, who warned about financial sector abuses back in 2002. "Many of them had arms that were involved in originating mortgages, some were packaging mortgage securities and some of them were betting against these mortgage securities."

Lawmakers say the commission was modeled after the Pecora Commission, a panel that was convened after the 1929 Wall Street crash and other events leading to the Great Depression.

The Pecora panel's findings led to an overhaul of federal banking laws, including the creation of the Glass-Steagall Act of 1933. Glass-Steagall divided investment banking from government-insured commercial banking; ending that separation in the 1990s was seen by some critics as contributing to the current crisis.

Slow start

The Financial Crisis Inquiry Commission has taken a while to get up on its feet.

The panel was appointed last July and held its first meeting in September. It has only started getting staffed up over the past few months.

It has new offices in downtown Washington, a few blocks northeast of the White House. Funded to the tune of $8 million, it aims to employ between 40 and 50 investigators and other staffers.

The crisis panel's one big goal is to complete a final report, sort of like the final 9/11 Commission report that found federal agencies missed signs of the impending terrorist attacks in 2001. The financial crisis report is due Dec. 15.

Critics have noted the panel's impact may be blunted by timing, as the House has already passed a bill to overhaul regulations and the Senate is deep in negotiations on similar proposals.

But panel members have consistently pledged their work will serve as more than window dressing for politicians worried about the appearance that they allowed the financial crisis to happen.

The panel, which has subpoena power, plans to issue interim reports as it collects data, Angelides has said.

The panel's second-in-command is Bill Thomas, a retired California Republican congressman described as strong-willed during his tenure running the powerful Ways and Means Committee.

Other key panel members include: Keith Hennessey, an economic adviser under President George W. Bush; former Sen. Bob Graham, a Florida Democrat; and Brooksley Born, a past chairwoman of the Commodities Futures Trading Commission, who called for stronger regulation of complex financial products such as derivatives in the 1990s.

On Wednesday, the panel will swear in bank chiefs Lloyd Blankfein of Goldman Sachs, Jamie Dimon of JPMorgan Chase, John Mack of Morgan Stanley and Brian Moynihan of Bank of America.

The panel didn't invite Citigroup (C, Fortune 500) CEO Vikram Pandit this go round, said panel spokesman Tucker Warren. "That doesn't mean we won't be talking with Citigroup, either publicly or privately, in the course of our investigation," he added.

The chief executives are no strangers to Washington hearings. Blankfein, Dimon and Mack were seated together last February when a House Financial Services pelted them with questions about the TARP program.

This time around, Angelides said he expects the tone to be "professional" but also "tough, thorough and fair."

"There's a real hunger among the people of this country to know what happened," Angelides said. "We're not out to get anyone. We're out to get to the bottom of what happened as best we can."

First Published: January 9, 2010: 8:13 AM ET