The boss of Switzerland's central bank quit on Monday after he failed to dispel accusations that his wife profited from insider dealing.

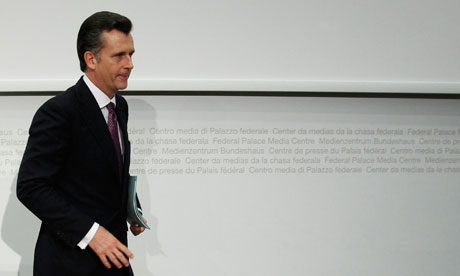

Philipp Hildebrand, pictured below, stepped down as chairman of the Swiss National Bank with immediate effect, saying he wanted to protect the bank's reputation, which has come under sustained attack since leaks implicated his wife in currency trades only weeks before he pegged the value of the Swiss franc (SFr).

His resignation after two years in the job is another blow to the image of the Swiss banking industry. The country's two major publicly listed banks have suffered huge losses and record fines from regulators in recent years, leading to an exodus of business to other low-tax havens. The sale of private client information to the German government, which revealed widespread tax avoidance by wealthy customers, also proved highly embarrassing.

Hildebrand, whose salary of SFr861,900 (£587,000) made him the world's best-paid central banker, has maintained that he and his wife are innocent of collusion. He said his wife had conducted the trades without his knowledge and was cleared of any wrongdoing by a team from accountants PricewaterhouseCoopers before Christmas.

But he conceded that he could not prove that he was unaware his wife had traded in dollars while he was making key decisions as central bank chief.

"In view of the continued public debate centred on these financial transactions and following detailed examination of all documentation and reflection since the news conference, I have come to the conclusion it is not possible to provide conclusive and final evidence that my wife did initiate the transaction without my knowledge," he said.

He said the pressure might compromise his ability to take tough decisions to address what he called "probably the most threatening economic and financial situation since the second world war".

"I am sad to take this step, I loved this job, I fought like a lion for it," he said.

In a press conference before a scheduled grilling by parliamentarians, he denied allegations made in a local Swiss newspaper that he alone arranged the transactions. He maintained that the dealing was by his wife, Kashya, a former hedge fund trader who now runs a Zurich art gallery. "The fact is, my word is my bond, I had no knowledge of my wife's transaction on that day."

Hildebrand added that he hoped his resignation would "allow the SNB to retain its credibility, which is its greatest asset".

Following his efforts to bring down the value of the Swiss franc against the dollar and the euro, Hildebrand had been under sustained attack from the far-right Swiss People's party (SVP).

The SNB shocked foreign exchange markets last September when it imposed a cap on the value of the franc against the euro to stop the currency soaring and thereby hurting Swiss exporters' earnings.

SVP vice-president Christoph Blocher attacked the intervention in currency markets as a waste of precious Swiss francs.

A weekly newspaper close to the SVP, Die Weltwoche, claimed to have access to banking documents showing that in March alone Hildebrand bought US dollars worth SFr1.1m.

Bank Sarasin, which allegedly handled the transactions, said an employee had leaked client information by transmitting banking details to a lawyer close to the SVP. It said the member of staff had left the bank and could face prosecution.

Die Weltwoche said the same employee had lodged a complaint against Hildebrand for alleged insider trading.

Christoph Mörgeli, a politician from the SVP, welcomed Hildebrand's resignation. "There was nothing left for him to do," he told Reuters.

The SNB's supervisory council said in a statement that its vice chairman, Thomas Jordan, who joined the central bank in 1997, would take over as chairman for the time being and the vacancy on the three-person governing board would be filled as soon as possible.

The board, previously made up of Hildebrand, Jordan and Jean-Pierre Danthine, reiterated that the cap on the Swiss franc at 1.20 to the euro, which was imposed on 6 September, would be retained "with utmost determination".

Hildebrand had been due to appear before the parliamentary economics committee alongside the head of the SNB's supervisory council, Hansueli Raggenbass, who is also under pressure over the affair.

"As we suggested last week, Hildebrand's position was almost untenable, and so it has proved," said Tony Nyman of Informa Global Markets. "The Swiss franc has actually gained on the news, possibly due to hopes of increased integrity ahead, but also market positioning too."

The Swiss franc, which Hildebrand has fought to stop soaring on safe-haven buying driven by the eurozone debt crisis, rose on the announcement, trading up 0.1% at 1.2138 per euro.

"From a policy point of view there will be no change and the Swiss franc will revert to where it was before the knee-jerk reaction," said Gavin Friend, an analyst at National Australia Bank.