OK, I'm winding up for the day. Thanks for joining us and here are the main happenings of the day:

• US unemployment has fallen to its lowest since Feb 09, as 200,000 jobs wered added in December.

• Italian PM Mario Monti has met French president Nicolas Sarkozy to discuss the debt crisis

• Rating agency Fitch downgraded Hungary to BB+ with a negative outlook, just after the nation's PM asked for an IMF bailout "as soon as possible"

• German factory orders have plunged to an almost-three year low

• David Cameron warned that 2012 will be a 'tough year'

• ECB overnight deposits hit new €455.3bn record

The London market closed about 15 minutes ago and the FTSE 100 was up 25 points or 0.45% at 5649.68, while Germany's Dax was down 0.7% and the Cac in Paris down 0.3%. The FTSE MIB in Italy, where Unicredit has lost 37% of its value this week, fell 0.8%.

The US jobs data hasn't done much for market sentiment with the FTSE100 currently up just 19 points and heading in a southerly direction, while the Dow Jones has already, as it were, gone below the equator at 32 points down. More on the markets when London closes shortly.

John Hooper, our correspondent in Rome, has been deconstructing Monti's visit to Paris which is part of a round of meetings across the continent that will take him to Berlin next Wednesday and then to London, we're told, on January 18 for talks with David Cameron. He has this insight into Monti's grand tour.

Nobody in Rome is being so crass as to say so, but Monti's aim is to drive a wedge into the 'Merkozy' alliance. That's partly because, now that the much-derided Silvio Berlusconi has left office, he wants the euro zone's third-biggest economy to have a real say in how the crisis is managed. But it's also because Monti needs to soften the terms of the so-called 'fiscal compact', the treaty on harmonising the euro zone's public finances agreed in principle last month. It's the one Cameron refused to sign up for.

Officials began discussing a revised draft today and Monti made an unscheduled visit to see Italy's representatives in Brussels yesterday to discuss with them their negotiating strategy. Italy and the other countries with public debts of more than the EU's limit of 60% of GDP have a problem: a provision, beloved of the Germans, that says they must pay off 5% of the excess every year.

Monti is not alone in thinking that could be ruinous for the euro zone's growth prospects. He'll also, no doubt, be pressing Sarkozy to back Italy's case for euro bonds and a bigger rescue fund.

But how tempt-able is the French president? With France's debt at risk of an imminent downgrade, its interests are increasingly aligned with those of countries like Italy.

On the other hand, siding with Berlin's disciplinarian approach has kept Sarkozy at a top table laid only for two, and he may be reluctant to step away from that table – or shift over to give Monti a place.

Back to the US jobs story and Caterpillar story I was talking about a short time ago.

Such ferocious competition for jobs will no doubt bring good headlines for President Obama in election year but surely continues the depressing trend of wage deflation for the majority of workers throughout the developed world. According to the Professor Laurence Kotlikoff of Boston University who appeared on this Robert Peston documentary (start looking at around the 20 minute mark), real average wage growth since the mid 1960s has been zero.

Also worth looking at is this document produced by the Congressional budget Office last year and passed on to me by my colleague Heather Stewart. It shows how income among the top 1% of households grew so much more than that of the middle earners.

And just in case you need any more proof of squeezed living standards for the middle and lower income households, what about this shocker from our very own Institute of Fiscal Studies last year.

Italian prime minister Mario Monti is in Paris where he has pleaded with fellow European leaders to ensure that the single currency doesn't fall apart, Reuters reports. Rather like an under pressure football manager always likes to say, he is basically urging the squad to 'stick together'.

I think that the main danger is the birth and development of a basic failure of understanding between populations and member states and the return of prejudices between the north and south of Europe, old and new member states, with the potential for very, very great divisions.

Good afternoon. Martin Farrer here taking over from Rupert Neate on the blog. An interesting insight into how the US economy might be creating new jobs comes from a report here about how Caterpillar has told locked-out workers at a factory in Ontario, Canada, that they can take a pay cut or the jobs will go to cheaper sites.....in the US.

Wage and benefit costs at a Caterpillar rail-equipment plant in LaGrange, Illinois, are less than half of those at the company's locomotive-assembly plant in London, Ontario, Caterpillar is quoted as saying in the Wall Street Journal report. Not surprisingly, the unions at the Canadian plant have reacted angrily to suggestions that they might want to see wages halved.

Time for a round up of today's big news before I hand over to Martin Farrer, who'll guide you through this afternoon's developments:

• US unemployment has fallen to its lowest since Feb 09, as 200,000 jobs wered added in December.

• Rating agency Fitch downgraded Hungary to BB+ with a negative outlook, just after the nation's PM asked for an IMF bailout "as soon as possible"

• German factory orders have plunged to an almost-three year low

• David Cameron warned that 2012 will be a 'tough year'

• ECB overnight deposits hit new €455.3bn record

• Christine Lagarde, the boss of the IMF, and Christian Noyer, governor of the Bank of France, are both certain the euro will ride out the crisis.

Our Wall Street dude Dominic Rushe has filed this reaction from the Big Apple

The jobs figures will be a big boost for Obama as employment, or the lack of it, emerges as the big debate of the 2012 election cycle. But the US stock markets seem to be non-plussed. Dow Jones futures are up about 55 points ahead of the stock market opening, hardly a big vote of confidence. Investors didn't get too carried away by yesterday's better than expected private sector figures from ADP either. Maybe they think the Euro woes may yet dampen the US's recovery.

Marcus Bullus, trading director at MB Capital, on the US job figures:

That's one hell of a number. Such an impressive fall in both the number of jobless Americans and the unemployment rate will cheer everyone bar Republican spin doctors.

The Obama administration could be forgiven for showboating over this convincing evidence that America's economy is pulling away from Europe's. This will certainly put a swagger in Tim Geithner's step in his next get-together with Merkozy.

From a market perspective, strong US data like this will add to optimism but nobody doubts the considerable downward pressure the Eurozone will continue to place on the global marketplace during 2012.

The surprisingly good US job data has helped the dollar gain against the euro and the yen. The euro is now trading at $1.2757 down from $1.2781 before the report. Against the yen the dollar is trading at 77.27 compared to 77.15 before the figures.

US non-farm payroll jobs increased by 200,000 in December, significantly ahead of estimates of 150,000. It's the biggest rise in three months.

The US unemployment rate dropped from 8.7% to 8.5% - the lowest since Feb 2009.

All the job gains came from the private sector, where payrolls rose 212,000 - the most in three months. Government employment contracted 12,000.

There were job gains in construction, where unseasonably mild weather has boosted groundbreaking for new homes. Construction payrolls increased 17,000 after falling 12,000 in November. Transportation and warehousing also got a boost from the mild temperatures, with employment jumping 50,200.

Average hourly pay rose a fraction from $23.20 to $23.24 an hour.

Fitch has downgraded Hungary to BB+ with a negative outlook. Press release.

The downgrade of Hungary's ratings reflects further deterioration in the country's fiscal and external financing environment and growth outlook, caused in part by further unorthodox economic policies which are undermining investor confidence and complicating the agreement of a new IMF/EU deal.

When Fitch put Hungary's ratings on Negative Outlook on 11 November 2011, it cited negative rating drivers as a worse than anticipated economic slowdown, and a rise in the risk premium and fiscal financing pressure. In the agency's view these risks have materialised.

The Hungarian growth outlook is continuing to deteriorate. In December, Fitch halved its forecast for 2012 eurozone GDP growth to 0.4%. Given Hungary's high degree of trade openness and strong economic and financial linkages to the eurozone, as well as tightening domestic financial conditions, the agency in January cut its forecast for Hungary's GDP growth to -0.5% from 0.5% previously.

Fiscal and external financing risks have increased significantly since early November, owing to a deterioration in investor sentiment. Hungary's high stock of government, external and private sector foreign currency debt and large associated financing requirements leave it vulnerable to adverse swings in investor confidence. The government faces external debt repayments of EUR4.6bn in 2012 (and larger ones in 2013-14), as well as large non-resident holdings of domestic debt to roll-over.

As the countdown to US job figures due out at 13:30 approaches, the Twittersphere's finance nerds have started putting forward their predictions.

@Alea is one of the most optimistic reckoning that 319,000 non-farm jobs were added in December. While @10_cents predicts just 69K (but he could just be being childish...).

Make your own guess using the #payrollssweepstake hashtag and in the comments below or @RupertNeate. The closest entry before 13:29 gets a shout out at the top of the blog.

An interesting analysis by Zerohedge shows the world's three biggest central banks - the Fed, the ECB and the Bank of Japan - have grown their balance sheets to a combined $8 trillion - more than 25% of the world's GDP.

This is more than double the combined total notional in 2007. More importantly, these banks assets (and by implication liabilities, as virtually none of them have any notable capital or equity) combined represent a whopping 25% of their host GDP, which just so happen are virtually all the countries that form the Developed world (with the exception of the UK). Which allows us to conclude several things. First, the rapid expansion in balance sheets was conducted primarily to monetize various assets, in the process lifting stock markets, but just as importantly, to find a natural buyer of sovereign paper (in the case of the Fed) and/or guarantee and backstop the existence of banks which could then in turn purchase sovereign debt on their own balance sheet (monetization once removed coupled with outright sterilized asset purchases as is the case of the ECB). And in this day and age of failed economic experiments when a dollar of debt buys just less than a dollar of GDP (there is a reason why the 100% debt/GDP barrier is so informative), it also means that central banks now implicitly account for up to 25% of developed world GDP!

Reuters have just put a good feature on banks and currency traders plans for the dissolution of the euro. Apparently, some of the industry's biggest players have been war-gaming the break up of the euro bloc since mid 2010.

Many of the industry's big FX banks, clearing houses and trading platforms say they are looking at ways to ensure their systems can quickly deal with any change in the composition in the euro, the world's most traded currency after the dollar.

Some institutions say they have been preparing for a possible break-up since mid-2010, when Greek default fears flared.

In a recent interview, HSBC said it had analysed its ability to trade new currencies as soon as possible after they were announced, but added it was not yet in full contingency mode.

"It's not that we are expecting a break-up of the euro, but we need a plan to deal with adding new currencies and how to settle them," said Vincent Craignou, global head of FX and precious metals derivatives at the bank, ranked No. 6 by market share in Euromoney's closely watched FX survey.

Banks had years - and more money - to prepare for the euro's launch, but the 2007-2008 credit crisis has left many in a weaker position to deal with a break-up, which could happen suddenly to minimise damage to the value of assets issued by an exiting country.

"It took many years for the euro to come together," David Rutter, chief executive of ICAP, which operates the electronic trading platform EBS, recently told Reuters.

"A large number of people in the industry believes that, if the euro comes apart, it will come apart more quickly."

FX participants acknowledge the difficulty of preparing for an event which could be kept secret until the last minute.

Industry experts say smaller institutions are underequipped to deal with the initial disruptions to trade that could result should a country leave the euro, while adding that most big banks' FX desks are expected to weather the transition.

If Greece, for example, left the euro, banks would need to update dealing systems to trade a "new drachma" against other currencies - from the dollar to the Swiss franc - on a spot and forward basis.

The process may be more complicated than reviving dormant trading pairs, such as drachma/dollar, as the old trading software might be incompatible with modern systems.

Hungary's PM Viktor Orban said he wants an IMF loan "as soon as possible".

Talks for Hungary's second bailout in four years broke down last month as Orban, who shunned the IMF since taking office in 2010, refused to abandon a central bank law that the EU said threatens the monetary authority's independence. The Cabinet must prove that's not the case before talks can restart, the European Commission said yesterday.

"It's our joint position that the government and the central bank must cooperate in the closest possible way for the sake of confidence in the forint," Orban said after the meeting. The government will support the central bank "in everything" it does to ensure the forint's stability, Orban said according to a Bloomberg report.

Jill Treanor has been taking a look at Unicredit's crisis.

Things are going from bad to worse for the Italian bank Unicredit, which is trying to raise €7.5bn from its shareholders to plug a capital shortfall identified by the European Banking Authority (the new EU regulator for banks). Unicredit's website carries a helpful chart of share prices. It does not make pretty reading. As this one shows, the cash call was priced on Monday night - the shares have tanked. The rights issue was priced at a 69% discount to Tuesday's close of €6.3. The shares were trading at €4.1 at noon. Bad news. As it was, Unicredit was trying to raise half its existing stock market value (€12bn) as it priced the cash call. That market value has now fallen by a third - and looks likely to keep falling.

Neil Mellor, currency strategist at Bank of New York Mellon, reckons the euro will fall further against Sterling.

I think euro/sterling will continue to go lower. All the problems that have caused eurozone bond markets to sell off in the fourth quarter have not only not been resolved, they look set to intensify.

It comes back to the issue of ugly currencies. In terms of dollar, sterling and euro, sterling comes second best.

Worrying news from Germany, where factory orders dropped the most in almost three years in November. Bloomberg has the skinny.

Orders, adjusted for seasonal swings and inflation, slipped 4.8% from October, when they surged a revised 5%, the economy ministry in Berlin said in a statement today. That's the biggest drop since January 2009. Economists forecast a decline of 1.8%, according to the median of 25 estimates in a Bloomberg News survey.

While Europe's sovereign debt crisis has clouded the growth outlook and cooling global growth is hurting export orders, the region's biggest economy may still avert a recession. Unemployment at a two-decade low is helping to bolster consumer sentiment and business confidence unexpectedly rose for a second month in December.

Orders had "a strong showing in the previous month," said Johannes Mayr, an economist at Bayerische Landesbank in Munich. "The euro debt crisis is an issue for manufacturers as it damps foreign orders, but we expect the domestic economy to be strong enough to avoid a severe weakness overall."

Howard Archer, European economist at IHS Global Insight, warns that the Eurostat data shows the eurozone "suffered clear GDP contraction" in the last three months of 2011 and is in "serious danger" of enduring another drop in the first quarter of 2012.

A further decline in overall business and consumer confidence to a 25-month low in December, a 0.8% drop in retail sales in November and a further 45,000 rise in the number of jobless keeping the unemployment rate up at a record 10.3% comprises a worrying set of data that fuel belief that the eurozone suffered clear GDP contraction in the fourth quarter of 2011 and is in serious danger of enduring a further drop in the first quarter of 2012. Tighter fiscal policy, squeezed consumers, the seemingly never-ending eurozone sovereign debt crisis, weakened global growth and financial market turmoil are taking a serious toll on economic activity across the eurozone.

And eurozone unemployment has still risen by a total of 727,000 over the past seven months. Furthermore, further marked increases in unemployment look highly likely given that the European commission's business and consumer confidence survey revealed a further deterioration in employment expectations among manufacturers, services companies, and retailers.

We expect the ECB to respond to likely eurozone GDP contraction in the fourth quarter of 2011 and the early months of 2012 by cutting interest rates further. And mounting evidence of retreating inflationary pressures gives scope to the ECB to act. The falling back in eurozone consumer price inflation to 2.8% in December from a three-year high of 3.0% over the three months to November should be only the start of an appreciable retreat in inflation over the coming months. We expect eurozone consumer price inflation to be back below 2.0% before mid-2012 as weakened economic activity and high and rising unemployment reduce underlying price pressures and base effects become increasingly favourable due to the waning impact of the sharp increases in oil and commodity prices in late-2010/early-2011.

Specifically, we forecast the ECB to trim interest rates by a further 25 basis points from 1.00% to 0.75% in the first quarter although we do not expect another cut as soon as the 12 January policy meeting. The fact that the decision to cut interest rates in December was only taken as a result of a majority decision indicates that the ECB will probably be reluctant to trim interest rates again as soon as in January and they will also not be pleased to see that the European commission's business and consumer confidence survey showed that consumers' inflation expectations rose in December.

We also believe that interest rates could very well come down as low as 0.50% in the second quarter of 2012.

Italian and Spanish governments bond yields are continuing to rise ahead of a big Italian and Spanish debt auctions next week.

Yields on Italian benchmark 10-year bonds rose beyond the key 7% figure to 7.144% this morning, according to Bloomberg. Spanish borrowing costs on 10-year debt rose as high as 5.703%.

Spain is expected to raise about €5bn by selling shorter-dated bonds next week, while Italy is thought to be aiming to raise around €7.5bn from 3,4 and 15-year bonds.

The UK is due to hold three auctions of short-term debt within the hour.

Portugual's prime minister Pedro Passos Coelho has said the debt-laden country will meet the targets of its €78bn EU/IMF bailout this year and will create conditions for economic growth even as the economy is still expected to contract sharply.

This is going to be a year of great challenges, but it also will be a turning point for the country. A year of a turnaround in which we will show that we meet our obligations. Our sacrifices will bring about stabilisation of investor confidence and create healthy conditions for future growth.

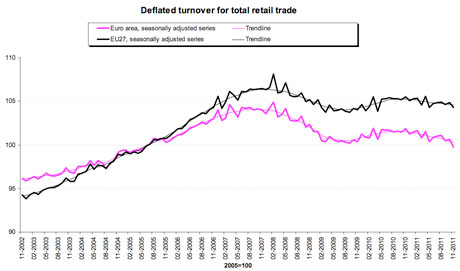

Retail sales across Europe also dropped by a worse-than-expected 0.8% in November. Economists had forecast a 0.2% fall. See the graph below that appears to show the beginnings of the second part of a double dip.

Eurozone and EU retail trade since 2002. Source: Eurostat

Eurozone and EU retail trade since 2002. Source: Eurostat

Martin van Vliet, a eurozone economist at ING, warned that the data has "recession written all over it". "It is all but guaranteed that we are going to see a contraction in the eurozone in the fourth quarter."

In addition Eurostat said its overall reading of economic sentiment in the eurozone fell 0.5 points to 93.3.

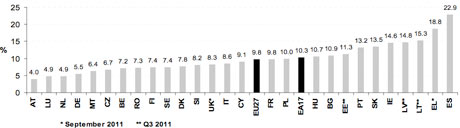

Eurozone unemployment has reached a record 16.4m in November, according to the latest stat dump from Eurostat. The figure rises to 23.7m in the EU27, or 10% of the population.

EU unemployment rates in November 2011, seasonally adjusted. Source: Eurostat

EU unemployment rates in November 2011, seasonally adjusted. Source: Eurostat

Unemployment is highest in Spain (22.9%), Greece (18.8%) and Lithuania (15.3%). While just 4% of people are unemployed in Austria, and 4.9% in Luxembourg and the Netherlands.

Heather Stewart has the full story here

UBS's Paul Donovan says the ECB's efforts to solve the euro crisis have been "more water pistol than big bazooka".

"Sarkozy meets Monti today, and Merkel on Monday. The Tobin tax idea is likely to be revived once again (the French presidential election is dictating the schedule). Markets do not seem impressed by the endless round of bilateral meetings," he said in his daily audio economics briefing.

He also contrasts the US's "reasonable" jobs report - "If you have a job in the US, life is good. Jobs are safe, incomes are rising (a bit)" - with the "very different picture" in Europe.

"If you have a job and are German, life may be good. If you don't meet both those criteria, you are likely to feel unsafe. Insecure people do not spend, they do not support growth, and so euro recession becomes inevitable."

Photograph: Olivier Hoslet/EPA

Photograph: Olivier Hoslet/EPA

IMF chief Christine Lagarde has warned that the euro is unlikely to "vanish" this year.

Will 2012 be the end of the euro? My answer is, I don't think so. The currency itself is not likely to vanish or disappear in 2012.

Will Greece quit the eurozone in 2012? The euro partners have affirmed, reaffirmed their determination. We can only support that.

We should be prepared for a 2012 that will not be an easy journey, but one of effort and focus (regarding) the European crisis and its resolution.

Speaking at a press conference in South Africa, she warned that the IMF will cut its global growth forecasts later this month. The report is due out on January 25 or 26, she said.

A quick look at today's agenda:

• Eurozone retail, unemployment & economic confidence (10am)

• US non-farm payroll data (1.30pm)

• Italian prime minister Mario Monti meets French president Nicolas Sarkozy in Paris

Photograph: Roslan Rahman/EPA

Photograph: Roslan Rahman/EPA

Christian Noyer, the governor of the Bank of France, has said the euro remains "very strong", and sought to reassure his countrymen that if it does fall further it'll be good for exports.

The euro remains a highly rated currency. It is a bit less strong, but that's not a bad thing; it helps exports.

Everyone must stop fantasies about the end of the euro. The crisis in the euro zone isn't about the single currency itself, but about problems with management of the debt.

Noyer also said the European Central Bank can continue to refinance banks "without risk" and that the ECB expects the inflation rate will decline.

Fresh data from the ECB shows that overnight deposits at the central bank last night were up to €455.3bn - another new high.

They hit a previous record of €453bn on Tuesday night.

Photograph: Matt Cardy/Getty Images

Photograph: Matt Cardy/Getty Images

UK house prices fell by 1.3% in 2011 after a monthly decline of 0.9% between November and December, according to Halifax.

With prices having "held up" well during the year, the bank added that it was hopeful of a similar performance in 2012 if the UK can avoid recession.

Halifax housing economist Martin Ellis said:

There is, however, considerable uncertainty regarding the prospects for the UK economy which will, to a large extent, depend on how events in the eurozone unfold.

In addition, the extent to which households choose to reduce their debts will also affect growth. As a result, the outlook for house prices is also uncertain.

The average house price at the end of 2011 stood at £160,063. with prices down 0.1% in the final quarter after falls in November and December offset a 1.2% rise in October.

Whilst there was a modest fall overall in prices during 2011 with an annual decline of 1.3% in December, house prices held up well last year in the face of the difficult and deteriorating economic climate and substantial pressure on households' finances.

Evan Davis asks Cameron who he would choose to play himself in a move a la Meryl Streep and Lady Thatcher? Flashman actor Malcolm McDowell perhaps?

"I'm sure the movie will never be made," says Cam.

Speaking about the veto on the European Union treaty, Cameron says "Britain would've been in a much worse position" if he hadn't pulled out of the deal.

He says the use of the veto means the members of the new treaty can't discuss the single market without a full European Union meeting (therefore including the UK).

Cameron's speaking out against excessive executive pay, again.

I think the whole bonus culture has got completely out of whackThere's been a massive reduction in bonuses over the last few years. And we want to see that continue

He says shareholders will be given "much greater power" over executive pay.

David Cameron is talking about the economy on the Today programme now.

He said the "rebalancing" of the economy "is not going as far as I would want it to".

"It's undoubtedly, a difficult tough year," but he hopes inflation will fall in 2012.

Inflation has been stubbornly high and that had an effect on household income last year and so consumers felt particularly squeezed. Looking into 2012 one of the trends I hope to see happen is a fall in the level of inflation and so therefore households feeling under less pressure than they did in 2011.

The FTSE 100 has opened up 0.2%. Germany's DAX is up 0.3%, France's CAC up 0.6%, Spain's IBEX up 0.6% and Italy's FTSE MIB up 0.2%

Michael Hewson, market analyst at CMC Markets, reckons the euro could fall to the lowest point of 2010.

The 2010 lows at 0.8065 remain some way off but are by no means out of the question at this stage.

Pullbacks are likely to find resistance around the 0.8305/10 area and old December lows, while above here re-targets 0.8370.

The key resistance remains around the highs for the last three weeks at 0.8425, and only a move beyond here would target a move back towards 0.8450 and even the 200 week MA at 0.8567.

Oh dear. The euro has fallen to another fresh low against sterling. The euro is now worth 82.39p - the lowest level since (earlier in) September 2010.

It could be worth buying your summer holiday cash now (scroll down).

Good morning, and welcome to another day of our rolling coverage of the eurozone crisis.

Yesterday the euro dropped to 82.5p - its lowest against the pound since September 2010 - and it could slide even further today as fears about the health of the contintent's banks continue to mount.

The key test will come next week when Spain and Italy issue new bonds. And the spectre of an S&P credit rating downgrade continues to hang over France.

All eyes in the City will be on US non-farm payroll numbers due out at 13:30, with trading in Europe expected to be light in anticipation. The number of people in work is expected to have risen by 150,000 in December, which will increase investor confidence in the US economy.

"With the much anticipated core European bond auctions behind us until next week, the market's sole attention now turns to the US payrolls report," says Chris Weston, a dealer at IG Markets. "It has to be said that expectations are elevated given all traditional leading indicators have shown improvement from last month, so we will need to see not only an above-expectation print, but at least an inline unemployment rate and a not-so-dramatic revision to last month."

Comments

6 January 2012 8:14AM

Projections suggest the USA has to create circa 450,000 jobs per month in order to expand so an NFP number of 120-150k is nothing to celebrate, particularly given so much of the number would be seasonally related..

6 January 2012 8:17AM

Quote

"It could be worth buying your summer holiday cash now "

Yup, change your pounds into a currency which may be gone soon !!!!!!

6 January 2012 8:19AM

Eurozone crisis live: Euro at 16-month low against pound

Proclaims the headline. Why not say "pound at 16-month high against euro"? surely not because that goes against the doom'n'gloom message that keeps getting pushed?

6 January 2012 8:21AM

Here comes the Eurozone' final act...

And where is that fella who kept on guffing on about the strength of the Euro all the time?

Any comment from him today?

6 January 2012 8:33AM

It's a lot less weak than the pound.

6 January 2012 8:37AM

Interesting article about the situation.

http://www.spiegel.de/international/world/0,1518,806772,00.html

As for my holiday money, I think I will keep sterling thanks for now.

6 January 2012 8:37AM

http://www.spiegel.de/international/world/0,1518,806772,00.html

6 January 2012 8:39AM

And ? A spot of today. And 150.000 jobs from what level?

Why all this exaggerating report?

6 January 2012 8:39AM

Oh my God we're all going to die.

6 January 2012 8:41AM

bradfudbantam

Why not say "pound at 16-month high against euro"?

From an exporters point of view that would be doom and gloom, their goods would now be the most expensive they've been for 16 months in their biggest market.

6 January 2012 8:42AM

Why should 150,000 people helping out with the Xmas rush stateside be a cause for optimism in the Eurozone?

Smoke and mirrors!

6 January 2012 8:47AM

150,000 Santas now returned to dealing pot

6 January 2012 8:48AM

Roddy McDowall in full Planet of the Apes costume would be better...

YOU MANIACS! YOU BLEW IT UP! OH, DAMN YOU! GODDAMN YOU ALL TO HELL!

6 January 2012 8:49AM

Given that we are constantly told that the one great advantage of having the pound is that we can devalue it and that devaluation is the key to happiness, the euro getting to a 16 month low against the pound is not good news.

Except of course in this debate there's no room for logic. If the euro goes up we're told that's disastrous for the euro. If the euro goes down that's disastrous for the euro. Give it a rest.

6 January 2012 8:55AM

nice to see someone has thought this out! If you keep talking the euro down, it will go down! So UK exports get more expensive, and EZ imports cheaper. This is not exactly helpful to UK plc...

6 January 2012 8:55AM

Does this mean that the trick the ECB learnt from President Mugabe of printing money has ended up with the same result .The paper can now be used in the SHIT HOUSE:

6 January 2012 8:56AM

"The name is Bond. [insert Euro country] Bond. Licensed to kill (at a price)."

6 January 2012 8:57AM

Because this isn't a live blog about the relative appreciation of sterling, it's a live blog about the Eurozone debt crisis, one symptom/consequence of which is the fall of the Euro against many currencies, one of which is sterling.

Why do you people even read the Guardian website if all you're going to do is call shenanigans?

6 January 2012 8:57AM

Maybe because the pound is not higher against other currencies and its the Euro thats falling, not the pound rising? Anyway, is a higher pound good news for the UK, or a lower Euro bad for Europe-maybe not.

6 January 2012 8:58AM

One could also say the same thing about the £. But then, you probably wont like me saying that! In the end, the "my willy is stronger than your willy" type of discussion doesn't help anyone.

6 January 2012 8:59AM

Hahaha.. All those Biily Bob Thornton Bad Santas.. Actually this NFP jobs report in the USA only goes up to November so there is a seasonal element but not the bad Santa quota.. ;-)

In answer to "why the fuss?" NFP (non farm pay roll day) day is (was) a big day to speculate on currency or index movements. Many day traders take a punt on whether tne USD will fall or rise versus: yen, eur, Swissy, and our Great British pound..IMHO it's a mugs game and the fireworks haven't been there for a while, best to 'view' it from the safety of a daily candle..

6 January 2012 8:59AM

That's more than a bit rich given the antics of the Fed and BoE.

6 January 2012 9:02AM

A strong pound is bad for UK business. Helps you buy oil .

6 January 2012 9:04AM

Ikonoclast

wow..we agree.

the problem is that even if you knew the NFP data before the release, it often would't necessarily be clear what trades you should be putting on, certainly in this environment

6 January 2012 9:07AM

I still shudder at the level of ignorance in the UK wrt to the Eurozone issue. Our nearest neighbour catches cold we get the flu. I can only put the 'wanting to dance on the euro grave' phenomena down to the right wing xenophobic press telling our poor attention span nation that "one in the eye for Jonny Foreigner is to be rejoiced.."

Here's just one outcome; Euro disappears overnight> UK FTSE collapses to 3000> pensions disappear as FTSE takes perhaps a decade to recover..investments trashed and house prices do an Ireland, collapse back to 2000 levels..

Methinks the journos, with their jumbo mortgages in the leafy part of Islington, might want to talk the Euro up..

6 January 2012 9:15AM

Why wouldn't you "agree"? ;-)

Long time since I traded NFP, I only trade 'off the dailys' HA candles..Had my fill off the double spikes taking out stops either way..Nope, the safety glasses of the dailys is like watching a nuclear explosion on Christmas island from the South Pole..

6 January 2012 9:16AM

Ikonoclast

where did you read that? my understanding was 150k+, which i have seen in a few papers

6 January 2012 9:17AM

Now that's a positive: "fresh" has something spring-like about it.

I wonder if the Guardian could provide an interactive timeline graph of the course of the vocabulary used to describe the Euro/Eurozone stories of 2011/2012 with time on the x-axis and the gravitas of the vocabulary on the y-axis (Sort of like, from "absolute end of the world" to "not quite so bad after all").

For those interested in the performance of the Euro/Pound since the start, here is a chart (yes, I know, boring, isn't it?): Historical performance Euro/pound since start

6 January 2012 9:18AM

to be honest i think day trading technicals is a mugs game full stop, especially in a market like this.

6 January 2012 9:22AM

if the guardian is genuinely interested in euro issues, you should ditch some of these blogs and do some detailed pieces...what about a piece on the functioning, potential liabilities and imbalances if the target2 system?

6 January 2012 9:22AM

Ye gods, people, are you still buying into this "jobs" canard!

The figures have been fiddled for years and friends in the U.S testify, that, what they see on the streets is not what's being reported on the news.

Get your head out of the clouds!

6 January 2012 9:23AM

Although I agree with you, that is a very un-newsworthy statement. Can't you think of an angle? How exactly are we going to die? How much more painful will this death be? And who is to blame for all of this? Don't you have any lazy speculation to add to it? A responsible journalist would have some.

6 January 2012 9:26AM

10 years ago, when the Euro started, 1 Euro was worth about 62 pence. Today it is worth about 82 pence, an increase of about a third.

Likewise in January 2002, 1 Euro was worth about 89 US cents. Today it is worth about 1.28 Dollar, an increase of about 45%.

The two currencies that have dramtically lost in value in the last 10 years relative to the Euro are the US Dollar and the British Pound.

6 January 2012 9:33AM

Childish comment.

Suggest you get used to the pitfalls of democracy .. they are here to stay.

I consider the falling Euro big problems for the UK. I thought it was only holiday makers that wanted a strong currency?

6 January 2012 9:34AM

I think the whole bonus culture has got completely out of whack

There's been a massive reduction in bonuses over the last few years. And we want to see that continue"

Where and when has ther been a massive reduction?

6 January 2012 9:35AM

Can't comment on the Fed as I don't have the data, but the QE programme followed by the BoE hasn't led to hyperinflaton - sure inflation is at historically high levels, but that's as much to do with continuing high energy prices and VAT increases as any increase in money supply.

Let's see what happens to the UK inflation figures in January, once the Jan 2011 VAT increase falls out of the calculation.

6 January 2012 9:41AM

A bit of a Freudian slip happened there:

So she "warned" that the euro will NOT vanish?

In other news: Cameron's warns that the UK will exist next year.

6 January 2012 9:46AM

Oh come Dave, don't be so modest. You are about to do more damage to the British economy than even Maggie Thatcher could have ever dreamed.

Hollywood LOVES disaster films. Give it a few years, the Americans will make a film about the end of the UK as we know it...

6 January 2012 9:47AM

The euro will be here long after we are dead in our cold, cold graves. It may be a different format, but it WILL survive.

6 January 2012 9:52AM

One of the problems with this country is the growth of the blame culture! But since you ask 1)starvation 2)very 3)them

6 January 2012 9:53AM

How many times does it need to be said on this blog: The ancient history of the euro exhange rate has no relevance in the context of the current crisis. The only signifant period that should be under review is what has been going on since the sovereign debt crisis became problematic, particularly since the July 2011 summit that was supposed to resolve the crisis. In this context the euro has been steadily weakening against both sterling and the greenback and will likely continue to do so.

6 January 2012 9:56AM

One thing which is never reported in the MSM about US unemployment stats, is that after 12 months of no job, the unemployed person falls off the stats.

If you do a little research, you will find the REAL unemployment rate in the USA exceeds 22%. But no government in their right mind is going to allow for those figures to be widely broadcast.

There are NO jobs in America. In fact, you have college grads coming out of university with good degrees, only able to find a job flipping burgers for minimum wage.

6 January 2012 9:57AM

I agree. Just been reading about the huge success of Nissan in Sunderland, mainly due to the advantage it gets through international sales ---- because of the weakness of the pound.

6 January 2012 9:59AM

HarryRogers

How is suggesting a piece on target2 childish? do you know what it is? do you know why it is potentially so important in the possible event of a full or partial break up?

6 January 2012 10:02AM

That's what Anglo-American "markets" would like us to believe, I know. Doesn't mean it's true. The USA and Great Britain are more likely than relatively well-managed and more equitable economies such as Finland, Germany, or the Netherlands to collapse under their debt, crumbling infrastructure and pent-up social unrest. The so-called "debt crisis" has been manufactured and continues to be stoked by the Anglo-American financial industry and its political puppets. It is a crisis entirely manufactured for political ends (ie. the undermining of the European Union vis a vis a USA that knows it is declining fast). In this game, Britain plays the predictable role of hand puppet to its American masters.

6 January 2012 10:05AM

@beanfield:

"I agree. Just been reading about the huge success of Nissan in Sunderland, mainly due to the advantage it gets through international sales ---- because of the weakness of the pound"

Well exactly. Most countries actually want a weak currency generally speaking.

That's why all this America/UK trying to talk down the Euro is such rubbish. If America wanted a strong currency, why do they keep berating the chinese for manipulating the Remninbi exchange rate and printing money!

The Euro has been weakening against the pound and the dollar for 6 months and will continue to do so until this crisis is resolved.

If Greece and weaker members leave the Euro, it will initially crash (due to the shock) and then strengthen due to the makeup of the remaining members, such as Germany etc.

6 January 2012 10:05AM

Discouraged Workers: There's an ongoing debate as to whether these people should be included in the Unemployment rate.... d'uh... Yeah?

http://en.wikipedia.org/wiki/Discouraged_worker#United_States

6 January 2012 10:07AM

"The euro will be here long after we are dead in our cold, cold graves. It may be a different format, but it WILL survive."

So much so that Gloria Gaynor sang a song about it.

6 January 2012 10:07AM

The ship is listing badly... I hope it doesn't sink.

6 January 2012 10:09AM

It would be a great movie.

The rags-to-riches tale of a young boy who, despite all the odds, overcame the disadvantage of an Eton/Oxford education to become a Tory MP.

His courageous style - going along with the Iraq war and failing to see the flaws in Gordon Brown's mad economic plans - helped our hero rise to the top of the Tory Party.

And, after over-coming a terrible wisteria problem in his chimney, he led his party to... ok, it wasn't quite a victory, but he became Prime Minister...

This has 'blockbuster' written all over it!