The U.S. Small Business Administration (SBA) announced that the National Center for American Indian Enterprise Development (NCAIED) is one of eleven awardees in a Small Business Teaming Pilot Program designed to help small businesses work together to compete for federal contracts, grow, and create jobs.

On September 27, 2010, President Obama signed into law the Small Business Jobs Act, the most significant piece of small business legislation in over a decade designed to provide critical resources to help small businesses continue to drive economic recover and create jobs. The Small Business Teaming Pilot Program, one of many beneficial programs made possible by the Small Business Jobs Act, awards grants to organizations for training, counseling, and mentoring to help small businesses enter into teaming relationships and compete for larger federal contracts. Teaming may take the form of joint venture and mentor-protégé relationships.

As one of eleven grantees selected from hundreds efforts to of applications submitted, the National Center was awarded $500,000 that will go toward creating jobs, businesses, and cooperative efforts between businesses and tribes nationally and within Indian Country. The organizations in the pilot program will help small businesses find other firms interested in teaming, form teaming arrangements, and find and bid on larger contracts. Grantees will leverage their existing resources and collaborate with SBA District Offices, resource partners, and other federal, state, local and tribal government small business development programs.

Exporting matters! It matters to firms that profit from exporting and it also matters to the national economy as a whole. Federal, state and local governments devote billions of dollars each year to encourage exporting among firms of all sizes and in all sectors. here's how RTM, hosted by USTDA can help you grow your business and strengthen the American economy.

Exporting matters! It matters to firms that profit from exporting and it also matters to the national economy as a whole. Federal, state and local governments devote billions of dollars each year to encourage exporting among firms of all sizes and in all sectors. here's how RTM, hosted by USTDA can help you grow your business and strengthen the American economy. Employer Identification Number (EIN)

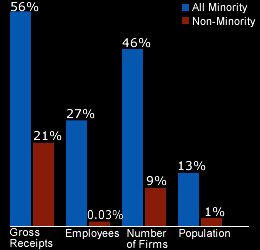

Employer Identification Number (EIN) In support of the President’s call to increase collaboration among federal agencies and with private and public sector entities, there has been an abundance of interagency initiatives geared to increase job creation and entrepreneurship. Among these, MBDA has partnered with other federal agencies in support of the

In support of the President’s call to increase collaboration among federal agencies and with private and public sector entities, there has been an abundance of interagency initiatives geared to increase job creation and entrepreneurship. Among these, MBDA has partnered with other federal agencies in support of the