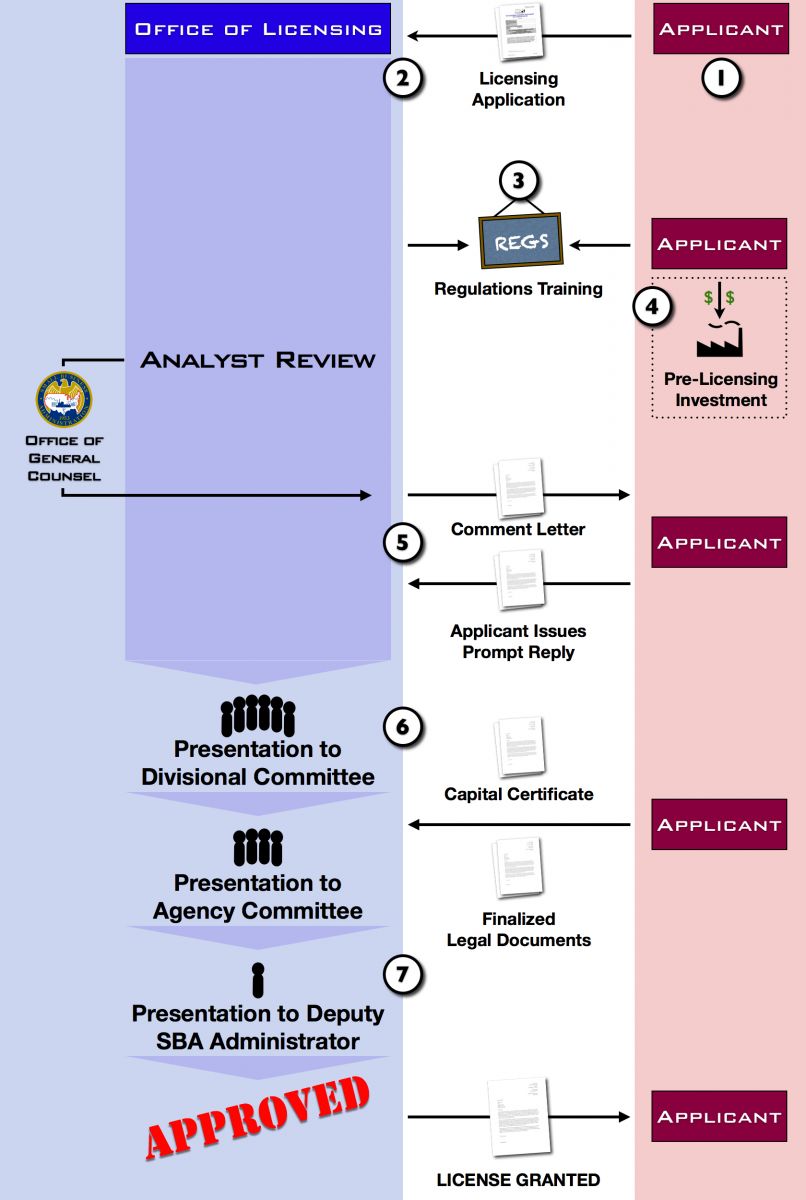

Phase II: Licensing Review

(Click on the image of the Licensing Process for an enlarged view)

(Click on the image of the Licensing Process for an enlarged view)

Once you have the Green Light letter and depending on the status of your private fundraising, you may be ready to begin preparing the license application. For your convenience, the MAQ and Licensing application have been integrated, minimizing the need to rearrange and repeat information as applicants move from the MAQ stage to the processing of the formal license application.

1. REVIEW THE REGULATIONS AND PREPARE LEGAL AGREEMENTS

Read the regulatory requirements found in Subpart C of 13 CFR Part 107— Qualifying for an SBIC License — beginning with §107.100. Download the legal documents, such as the “model partnership agreement” which can be used as a starting point. Understand that the extent to which you deviate from the SBA’s model agreement may increase the amount of time required to review, negotiate and finalize your partnership agreements.

|

FAQ: What legal entities may be licensed? An SBIC can be organized in any state, as either a corporation, a limited partnership (LP) or a limited liability company (LLC). LLCs only must be formed under Delaware law. A few SBICs are corporations with publicly traded stock. |

2. SUBMIT THE APPLICATION

When you start to complete the application, you should be highly confident that you can meet the minimum capital levels specified in §107.200 and §107.210. A minimum of $5 million of regulatory capital is required to submit an Application. You will file the Application along with a check payable to the U.S. Small Business Administration. The filing fee is nonrefundable, and the charges are:

- Base Fee $10,000

- Partnership or LLC SBIC $5,000 additional

Include an original and two copies of the Application and Exhibits, with each set in a 3-ring, tabbed binder. Zipped electronic versions should be included on cd-rom or via email as well. The entire package and filing fee check should be sent to:

Chief of Licensing

Investment Division

U.S. Small Business Administration

409 Third Street, SW, Suite #6300

Washington, DC 20416

Upon receipt of your application, we will acknowledge receipt by email. Normally, within three weeks, SBA’s licensing staff will make a determination of whether to formally accept your application based on whether or not the application is complete, and meets the minimum capital and management ownership diversity requirements. Once formally accepted, we will immediately forward the fingerprint cards and Statements of Personal History to SBA’s Office of Inspector General for processing by the FBI.

|

FAQ: What is the minimum amount of capital that must be raised before filing a License Application? As noted above, the regulations governing the SBIC program require a minimum capital raise of $5 million to remain eligible for an SBIC license. However, the regulations also provide that "in SBA's sole discretion, [the applicant] must be economically viable..." Prior to filing its license application, an SBIC applicant should carefully consider if it has raised enough capital to be "economically viable" at the time of filing. Even funds filing with $5 million of "regulatory capital" in hand may not be deemed as such. FAQ: Can an SBIC applicant continue to raise funds after its Licensing Application has been filed? Yes. SBIC applicants may continue to raise private capital during the licensing process.

FAQ: Is there a limit on the amount of state economic development or state government agency capital that can be invested in an SBIC? A maximum of 33% of regulatory capital can come from state and local government entities. FAQ: Can an SBIC have a single private partner? A leveraged SBIC must have diversity in its private partner funding base. Generally, investment by a single large LP is restricted to 70% of private capital. This restraint does not apply to non-leveraged SBICs. |

3. SBIC REGULATIONS TRAINING CLASSES

All SBIC principals must complete the SBIC Regulations training classes. This training is normally held several times per year in Washington, DC. The purpose of this class is to familiarize SBIC principals with the SBIC rules, regulations and compliance procedures. Classes are normally limited in size and a licensed SBIC may not draw down leverage until all principals have completed the training, so it is best to enroll for training early in the licensing process. Registration for this class is handled by the Small Business Investor Alliance (SBIA, formerly the National Association of Small Business Investment Companies). Certain non-principals such as significant investors or members of a board of directors may also be required to take the class. In addition, any employees or consultants whom you have assigned to handle regulatory matters or to interact with the Investment Division should attend the class.

4. PRE-LICENSING INVESTMENTS (IF APPLICABLE)

If SBA has formally accepted your license application, you may make one SBA-approved investment in a Small Business and have it included in both Regulatory Capital and Leverageable Capital (as defined in §107.50). This is known as a “pre-licensing investment.” At least 10 business days in advance of the closing of the investment, details must be submitted to Licensing using the appropriate form, which is found in the Exhibits of Form 2182.

All pre-licensing investments must be approved by SBA in order for them to be included in your Leverageable and Regulatory Capital. If at least one principal of the applicant has attended the SBIC Regulations training class, an applicant may make more than one investment, which will count towards Regulatory and Leverageable Capital.

5. FORMAL REVIEW OF THE LICENSE APPLICATION

Following a review of your application and legal documents by a licensing analyst and an attorney in SBA’s Office of General Counsel, you will be issued a “comment letter.” You will be asked to respond in writing to the comment letter, via mail, fax or email. The goal is to resolve any and all issues, as expeditiously as possible through written and oral communications. Remember that your promptness in responding is important, and long response times may result in your fund taking a lower priority for processing.

6. APPROVAL BY DIVISIONAL LICENSING COMMITTEE

Once the SBA’s licensing staff has completed its review and due diligence, your license application is presented to the Investment Division Licensing Committee which generally meets on a monthly basis. This committee is composed of the senior managers of the Division. If your application receives a favorable majority vote, it is forwarded to the Agency Licensing Committee which is comprised of certain senior managers of the SBA.

7. APPROVAL BY AGENCY LICENSING COMMITTEE AND SBA ADMINISTRATOR

At this time, you must have on deposit at least $2.5 million. (Please note that any approved pre-licensing investments, as well as approved organizational and operating expenses, can be counted toward this $2.5 million cash deposit requirement.) A certification by the applicant’s selected bank that the funds are in the account and unencumbered is required prior to being presented at the Agency Licensing Committee. The Capital Certificate must be signed and all legal documents must be in “final form,” meaning they are fully agreed and ready to be executed) prior to consideration by the Agency Licensing Committee. If the Agency Licensing Committee votes affirmatively on your license application, as soon as you submit fully executed copies of all legal documents, your application will be forwarded to the SBA Administrator for final action. (Please note that the executed documents must be identical to the “final form” of the documents approved by us.) If the Administrator of the SBA approves your application, your SBIC license is issued.

|

FAQ: Does the SBA require specific legal provisions to be included in an SBIC's LPA? The SBA's Investment Division has prepared a Model Limited Partnership Agreement to help guide the drafting of SBIC LPAs. Refer to this document to more information on which provisions must be included in the LPA. |