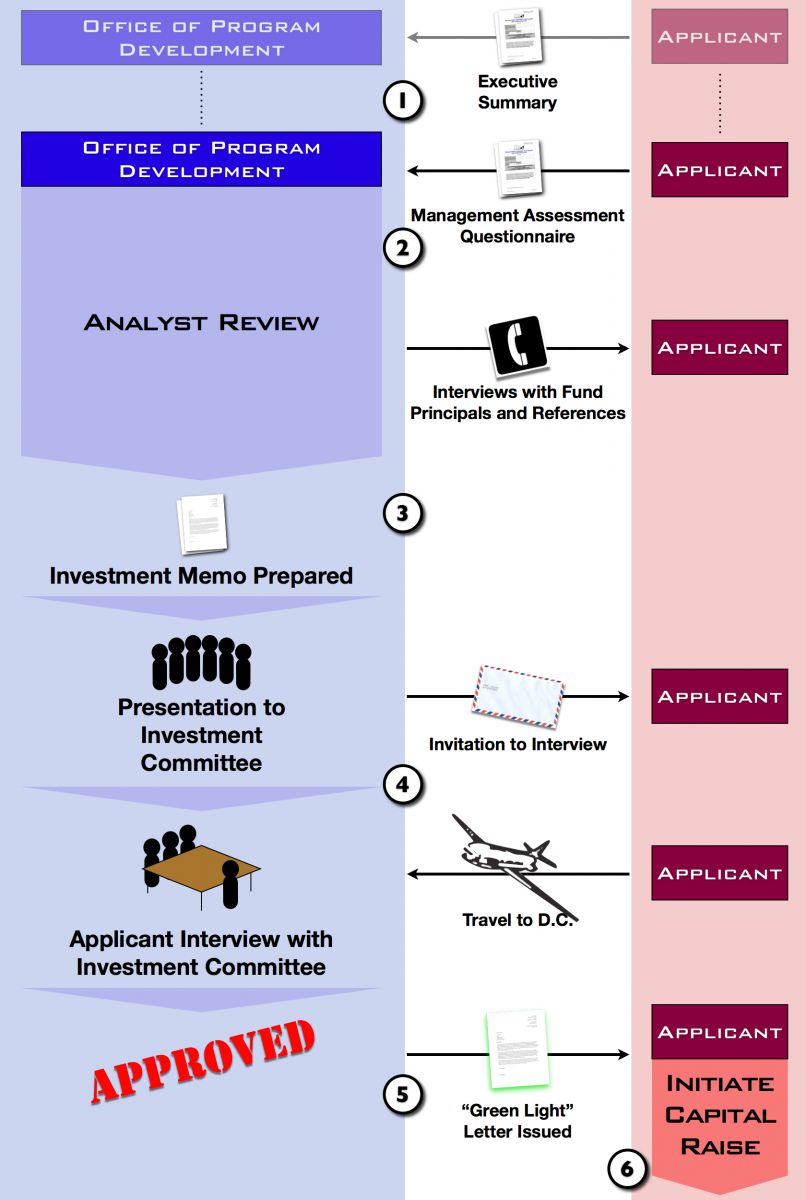

Phase I: Program Development Review

The Management Assessment Questionnaire and the Office of Program Development:

(Click the adjacent image for a visual representation of Phase I)

1. EXECUTIVE SUMMARY REVIEW (See Pre-Screening Process)

The first step in the process of becoming a licensed Small Business Investment Company is optional. As a courtesy, the Office of Program Development (“Program Development”) will provide non-binding preliminary feedback on a potential applicant’s Executive Summary. Program Development will assess your fund’s eligibility and identify potential deficiencies in the Executive Summary.

2. PREPARATION OF THE MANAGEMENT ASSESSMENT QUESTIONNAIRE (“MAQ”)

Applying for an SBIC license begins with the completion of the Management Assessment Questionnaire or (“MAQ”). The MAQ consists of two forms that cover qualitative and quantitative information on the management team, the proposed strategy for the SBIC and the principals’ investment track record. Most applicants engage counsel to assist with the preparation of the MAQ.

FAQ: What forms are included in the MAQ?The MAQ consists of SBA Form 2181 and the exhibits in SBA Form 2183. To obtain a copy of the most recent versions of these forms, please send an e-mail to maqrequest@sba.gov FAQ: What if we have questions about the MAQ?Please take time to read the instructions included with each form. The instructions address most of the frequently asked questions. Second, please consult with your attorney. If you do not have an attorney familiar with the SBIC program, please consider retaining one. Please contact sbic@sba.gov to request a list of firms with active SBIC practices from the SBA's Investment Division. Please only call the Investment Division at (202)-205-6510 after have reviewed the instructions and consulted with your attorney. FAQ: How long does it take to complete the MAQ?Depending on the size of the fund and the track record, it is estimated to take around 100 hours to complete the MAQ. FAQ: Where do we send the completed MAQ?Email the completed MAQ to sbic@sba.gov. Please compress large files using WinZip or another compatible program. Also, please submit two (2) hardcopies of the MAQ to: Chief Investment Officer & Director of Program Development Investment Division U.S. Small Business Administration 409 3rd St., SW, Suite #6300 Washington, DC 20416 |

3. PROGRAM DEVELOPMENT REVIEW

Program Development will analyze the MAQ in detail, assess your proposal in light of the minimum requirements and management qualifications, perform full scale due diligence and track record review, and prepare a written recommendation to the Investment Committee of SBA’s Investment Division (composed of senior members of the Division).

FAQ: How long will it take before we get a decision?Processing time is a function of demand for the program, but historically the Investment Committee has rendered decisions within 8-10 weeks from the MAQ submission date. |

4. INVESTMENT COMMITTEE INTERVIEW

If, after a thorough review of the MAQ and Program Development’s evaluation, the Investment Committee concludes, by majority vote, that the management team may be qualified for a license, the entire team is invited to SBA Headquarters in Washington for an interview.

FAQ: What should we expect during the interview?The interview is a discussion based meeting intended to provide the Investment Committee an opportunity to learn more about your proposed fund and team. If you are invited to interview, Program Development will provide you with guidance regarding content, presentation and meeting logistics. |

5. GREEN LIGHT LETTER

If, following the interview, the Investment Committee votes to proceed, your team will be granted a “Green Light” letter, formally inviting your fund to advance to the second part of the process by filing a license application. You can expect to receive the Green Light letter via email within a few days of the Investment Committee’s decision. Note that the Green Light letter is not a determination that you are qualified to receive an SBIC license, but an invitation to proceed to the next step in the process.

6. FUNDRAISING

Once the “green light” letter is received, the applicant can begin fundraising and preparing its license application.