Council of Economic Advisers Blog

The Employment Situation in April

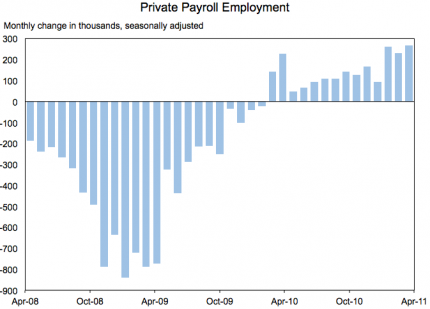

Posted by on May 6, 2011 at 9:52 AM EDTToday’s employment report shows that private sector payrolls increased by 268,000 in April, the strongest monthly growth in five years. The economy has added 2.1 million private sector jobs over 14 consecutive months, including more than 800,000 jobs since the beginning of the year. The unemployment rate rose to 9.0 percent, but remains 0.8 percentage point below its November level.

Despite headwinds from high energy prices and disruptions from the disaster in Japan, the last three months of private job gains have been the strongest in five years.While the solid pace of employment growth in recent months is encouraging, faster growth is needed to replace the jobs lost in the downturn. We are seeing signs that the initiatives put in place by this Administration – such as the payroll tax cut and business incentives for investment – are creating the conditions for companies to add new jobs and foster the industries of the future. We will continue to work with Congress to find ways to reduce spending, so that we can live within our means without neglecting the investments in education, infrastructure, and clean energy that will strengthen our economy.

In addition to the increases last month, payroll survey estimates of private sector job growth for February (now +261,000) and March (now +231,000) were revised up. Overall payroll employment rose by 244,000 in April, well above market expectations. Payroll employment grew in almost every sector. Solid employment increases occurred in retail trade (+57,100), professional and business services (+51,000), education and health services (+49,000), leisure and hospitality (+46,000), and manufacturing (+29,000). Manufacturing has added 244,000 jobs in the last 14 months, the best period of manufacturing job growth in 13 years. State and local government experienced a decline of 22,000; this sector has shed 289,000 jobs in the past 14 months, mostly in local government.

The unemployment reading in April showed a partial reversal of the 1.0 percentage point decline over the previous four months. Employment measured in the household survey dipped in April and the labor force participation rate was unchanged. The unemployment rate data derive from a separate household survey. The payroll and household surveys can differ on a monthly basis; the household survey is more volatile, but the two surveys typically show similar long-run trends in employment.

The overall trajectory of the economy has improved dramatically over the past two years, but there will surely be bumps in the road ahead. The monthly employment and unemployment numbers are volatile and employment estimates are subject to substantial revision. Therefore, as the Administration always stresses, it is important not to read too much into any one monthly report.

Austan Goolsbee is Chairman of the Council of Economic Advisers

Learn more about EconomyAdvance Estimate of GDP for the First Quarter of 2011

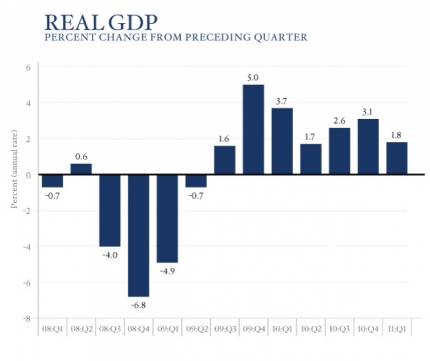

Posted by on April 28, 2011 at 9:12 AM EDTToday’s report shows that the economy posted the seventh straight quarter of positive growth, as real GDP, the total amount of goods and services produced in the country, grew at a 1.8 percent annual rate in the first quarter of this year. While the continued expansion is encouraging, clearly, faster growth is needed to replace the jobs lost in the downturn.

Some key components of GDP continued to expand in the first quarter. Consumer spending rose 2.7 percent at an annual rate, boosted by a 2.9 percent increase in real disposable income that was due in part to the cut in payroll taxes. Equipment and software investment increased 11.6 percent. Spending components that subtracted from GDP included construction of nonresidential structures (-21.7 percent), federal spending (-7.9 percent), and state and local government spending (-3.3 percent). On the production side, goods production rose at a 9.3 percent, roughly consistent with the previously-reported 9.1 percent increase in manufacturing industrial production.

These data indicate that the measures put in place by this Administration – such as the payroll tax cut and business incentives for investment – are helping to foster growth. We will continue to work with Congress to find ways to reduce spending, so that we can live within our means and focus on the investments that are most likely to help grow our economy and create jobs – investments in education, infrastructure, and clean energy.

Austan Goolsbee is Chairman of the Council of Economic Advisers

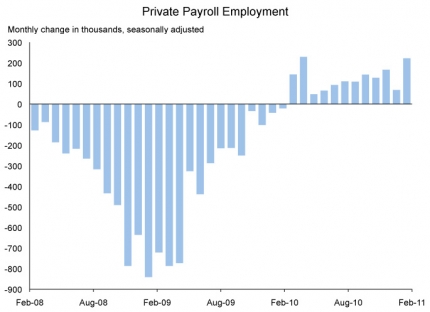

Learn more about EconomyThe Employment Situation in March

Posted by on April 1, 2011 at 9:43 AM EDTToday’s employment report shows that private sector payrolls increased by 230,000 in March, marking 13 consecutive months of private employment growth. Private sector employers added 1.8 million jobs over that period, including more than half a million jobs in the last three months. The unemployment rate fell for the fourth straight month to 8.8 percent. The full percentage point drop in the unemployment rate over the past four months is the largest such decline since 1984, and, importantly, it has been driven primarily by increased employment, rather than people leaving the labor force.

As long as millions of people are looking for jobs, there is still considerable work to do to replace the jobs lost in the downturn. Nonetheless, the steep decline in the jobless rate and the solid employment growth in recent months are encouraging. The last two months of private job gains have been the strongest in five years. We are seeing signs that the initiatives put in place by this Administration – such as the payroll tax cut and business incentives for investment – are creating the conditions for sustained growth and job creation. We will continue to work with Congress to find ways to reduce spending, so that we can live within our means and focus on the investments that are most likely to help grow our economy and create jobs - investments in education, infrastructure, and clean energy.

Learn more about Economy, Startup AmericaThe Employment Situation in February

Posted by on March 4, 2011 at 11:15 AM EDTToday’s employment report shows that private sector payrolls increased by 222,000 in February, marking 12 consecutive months of growth that has added 1.5 million jobs at private firms. The unemployment rate fell for the third straight month to 8.9 percent. The 0.9 percentage point drop in the unemployment rate over the past three months is the largest such decline since 1983, and it has been driven primarily by increased employment, rather than falling labor force participation.

Though unemployment remains elevated, we are seeing signs that the initiatives put in place by this Administration – such as the payroll tax cut and business tax incentives for investment – are creating the conditions for sustained growth and job creation. The steep decline in the unemployment rate and the overall trend of economic data in recent months has been encouraging, but there is still considerable work to do to replace the jobs lost in the downturn. We will continue to work with Congress to find ways to reduce spending, but not at the expense of derailing progress in the job market, making the investments we need to educate our workers, investing in science, and building the infrastructure our companies need to succeed.

In addition to the increases last month, the estimates of private sector job growth for December (now +167,000) and January (now +68,000) were revised up. Overall payroll employment rose by 192,000 last month. The sectors with the largest payroll employment growth were professional and business services (+47,000), education and health services (+40,000), manufacturing (+33,000), and construction (+33,000). State and local government experienced a large decline (-30,000), and has shed jobs in 14 of the past 16 months.

The overall trajectory of the economy has improved dramatically over the past two years, but there will surely be bumps in the road ahead. The monthly employment and unemployment numbers are volatile and employment estimates are subject to substantial revision. Therefore, as the Administration always stresses, it is important not to read too much into any one monthly report.

Austan Goolsbee is Chairman of the Council of Economic Advisers

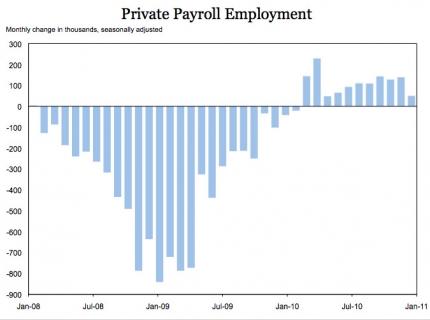

Learn more about EconomyThe Employment Situation in January

Posted by on February 4, 2011 at 10:42 AM EDTToday’s employment report shows that the unemployment rate fell sharply to 9.0 percent and private sector payrolls increased by 50,000 in January. Revisions to private sector payroll data show that 1.1 million jobs were added during 2010, the strongest private sector job growth since 2006. The 0.8 percentage point decline in the unemployment rate over the past two months is a welcome development; however, the rate remains unacceptably high.

The overall trend of economic data in recent months has been encouraging, as initiatives put in place by this Administration are taking hold, but there is still considerable work to do. Today, the Administration puts forward our comprehensive innovation agenda, which details our efforts to accelerate American leadership in educating our workers, investing in science, and building the infrastructure our companies need to succeed. Innovation will be a key driver of the economy as we strengthen America’s position as home to the world’s best new businesses and industries, and the best jobs.

In addition to the increases last month, the estimates of private sector job growth for November (now +128,000) and December (now +139,000) were revised up. These revisions, along with the annual payroll survey revisions, show that private sector employment has now grown for eleven consecutive months.

Overall payroll employment rose by 36,000 last month. Among the sectors with the largest payroll employment growth were manufacturing (+49,000), retail and wholesale trade (+36,700), and professional and business services (+31,000). Transportation and warehousing (-38,000), construction (-32,000), finance (-10,000), and local government (-10,000) were among the sectors that subtracted from the total. Severe weather in some parts of the country may have impacted employment and hours in some industries.

The 0.4 percentage point decline in the unemployment rate to 9.0 percent in January was accounted for by a large increase in employment as measured by the household survey (which is separate from the payroll survey). The labor force participation rate was unchanged.

The overall trajectory of the economy has improved dramatically over the past two years, but there will surely be bumps in the road ahead. The monthly employment and unemployment numbers are volatile and employment estimates are subject to substantial revision. Therefore, as the Administration always stresses, it is important not to read too much into any one monthly report.

Austan Goolsbee is Chairman of the Council of Economic Advisers

Learn more about EconomyAdvance Estimate of GDP for the Fourth Quarter of 2010

Posted by on January 28, 2011 at 12:06 PM EDTToday’s report shows that the growth rate of the economy continued to increase in the final quarter of 2010, a further sign that the economy continues to gain momentum as it recovers from the worst recession since the Great Depression. Real GDP, the total amount of goods and services produced in the country, grew at a 3.2 percent annual rate in the fourth quarter of last year, the sixth straight quarter of positive growth. For 2010 as a whole, GDP rose 2.9 percent, the fastest since 2005 and a dramatic reversal compared with the -2.6 percent rate in 2009. Private forecasters have predicted that the tax cut package signed by the President in December will have a significant impact on economic growth this year. We are on the right path, but have a lot more work to do to accelerate growth so that we are creating the jobs we need.

Some key components of GDP continued to expand in the fourth quarter, including exports (8.5 percent), consumer spending (4.4 percent), equipment and software investment (5.8 percent), and residential spending (3.4 percent). Government spending fell 0.6 percent. Consumption and net exports made the largest positive contributions to growth this quarter, while the decline in inventory investment subtracted substantially from GDP growth.

The overall trend of economic data over the past several months has been encouraging. The measures we worked with Congress to pass last month that continue tax cuts for the middle class and extend unemployment insurance are important for strengthening the recovery in 2011 and putting more money in the pockets of American families. The incentives for business investment will further boost the economy. The Administration will continue to focus on actions that the President has recommended to increase growth and job creation, such as providing incentives to encourage businesses to invest and hire here at home, investing in education and infrastructure, and promoting exports abroad.

Learn more about Economy

Learn more about Economy

- &lsaquo previous

- …

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- …

- next &rsaquo

White House Blogs

- The White House Blog

- Middle Class Task Force

- Council of Economic Advisers

- Council on Environmental Quality

- Council on Women and Girls

- Office of Intergovernmental Affairs

- Office of Management and Budget

- Office of Public Engagement

- Office of Science & Tech Policy

- Office of Urban Affairs

- Open Government

- Faith and Neighborhood Partnerships

- Social Innovation and Civic Participation

- US Trade Representative

- Office National Drug Control Policy

categories

- Blueprint for an America Built to Last

- Equal Pay

- White House Internships

- Civil Rights

- Defense

- Disabilities

- Economy

- Education

- Energy and Environment

- Ethics

- Family

- Fiscal Responsibility

- Foreign Policy

- Health Care

- Homeland Security

- Immigration

- Inside the White House

- Poverty

- Rural

- Seniors and Social Security

- Service

- Taxes

- Technology

- Urban Policy

- Veterans

- Women

- Additional Issues