-

This is cross-posted from the Let's Move! blog.

We're excited to announce that on Friday, April 13th at 1:00 p.m. EST, White House Executive Chef Cris Comerford and culinary expert, food writer and TV personality Gail Simmons are hosting a Google+ hangout live from the White House. We're inviting Americans across the country to join the conversation and ask our experts about making healthy choices while juggling multiple schedules, and making smart choices whether you are cooking family meals or eating away from home.

Just over two-years ago, the First Lady launched Let's Move!, a comprehensive initiative dedicated to solving the challenge of childhood obesity within a generation, so that children born today will grow up healthier and able to pursue their dreams. Parents play a key role in both making healthy choices for children now and teaching children to make healthy choices for themselves. But in today's busy world, this isn't always easy. So Let's Move! offers parents the tools, support and information they need to make healthier choices while helping develop healthy eating habits in children that will last a lifetime.

What are your questions for Cris and Gail? Here's how you can get involved:

- Starting now, you can ask questions on the White House Google+ page, and you just might be invited to join the live Hangout.

- Ask questions in advance and during the Hangout on the Let's Move! facebook page or on Twitter with #AskLetsMove

- Watch live at 1:00 p.m. EST on Friday, April 13th on WhiteHouse.gov/live, YouTube.com/whitehouse or the White House Google+ page.

For upcoming White House Hangouts and more chances to engage, follow the White House on Google+. We hope you'll join us!

-

April 12, 2012

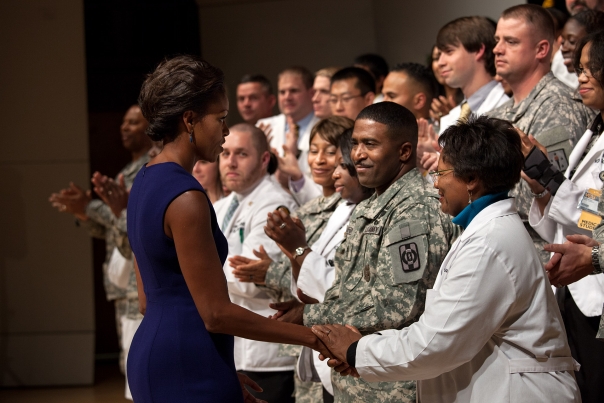

03:38 PM EDTOver the past 12 months First Lady Michelle Obama and Dr. Jill Biden have encouraged an entire nation to commit to honoring and serving military families as they have served us. As Dr. Biden has said: “while troops serving our nation may be only 1 percent of the population, we want to make sure that 100 percent of Americans are supporting them.”

While the primary focus of the first year has been to increase employment opportunities and to promote improved care for service members, veterans, and their families, we've also had a lot of fun meeting with the families of our brave troops and been inspired by the courage and sacrifice of so many proud Americans.

To celebrate the one year anniversary of Joining Forces, we've put together a slideshow that chronicles the journey -- check it out:

-

For half a century, the average tax rate paid by the richest people in America has been trending down -- while tax rates for the middle class have essentially stayed the same.

The trend is so unbalanced that, today, thousands of the wealthiest individuals in the United States are paying a lower tax rate than middle class families.

And that's not fair.

Warren Buffett realized the problem when he sat down and compared his tax rate with those of the 20 people in his office. That's what it took for him to learn that he pays a lower rate than his secretary -- and everyone else he works with. That's when he decided to speak out, and it's why President Obama's proposal to fix this problem is called the Buffett Rule.

Now we've created a new tool to show exactly how millionaires paid a lower effective tax rate than you -- think of it as your own personal Buffett number. Try it out below.

For more information:

-

Sidewinder, the Missouri Air National Guard rock band, was at the White House Wednesday to help First Lady Michelle Obama and Dr. Jill Biden celebrate the one-year anniversary of Joining Forces.

While the band was deployed in the Middle East, a video taken by an audience member went viral on YouTube, garnering national attention. If you weren't one of the millions of people that watched Sidewinder's version of Adele's "Rolling in the Deep" on YouTube, you may have seen them perform recently on "The Ellen DeGeneres Show" or watched Staff Sgt. Angie Johnson on "The Voice." And if you haven't heard of Sidewinder before, be sure to check out their performance at the White House.

Go backstage with the band at the White House and check out video of their performances, including their covers of Adele's "Rolling in the Deep", KT Tunstall's "Black Horse and the Cherry Tree" and Journey's "Don't Stop Believing."

Learn more:

-

Today at 4:00 p.m. EST, the WHite House is hosting a Hangout on Google+ to discuss the Buffett Rule and tax fairness with Americans across the country. Jason Furman, Principal Deputy Director of the National Economic Council, will join the multi-person video chat live from the White House.

President Obama believes we should build an economy where everyone does their fair share and everyone plays by the same set of rules. That’s why he proposed the Buffett Rule. It’s simple: if you make more than $1 million a year, you should pay at least the same percentage of your income in taxes as middle class families do. On the other hand, if you make under $250,000 a year – like 98 percent of American families do – your taxes shouldn’t go up.

We hope you’ll Hangout with us today at 4:00 p.m. EST. Here’s how you can get involved:

- What’s your question about the Buffett Rule? You can still ask questions for Jason on the White House Google+ page.

- Watch the Hangout live at 4:00 p.m. EST today on WhiteHouse.gov/live, YouTube.com/whitehouse or the White House Google+ page.

Visit WhiteHouse.gov/Buffett-Rule to learn more about the Buffett Rule and to calculate out how many millionaires pay a lower effective tax rate than you.

For upcoming White House Hangouts and more chances to engage, follow the White House on Google+

-

Note: This live session of Office Hours has concluded. Check out the full question and answer session below or at Storify.com

Tomorrow, the White House, in partnership with the U.S. Department of Commerce and the Council of the Americas, will host the White House Conference on Connecting the Americas leading up to the President's participation in the 6th Summit of the Americas in Cartagena, Colombia this weekend. Building off the Summit's theme – “Connecting the Americas: Partners in Prosperity,” Obama Administration officials will join Hispanic community and business leaders from across the country who have cultural and economic ties to the rest of the Americas to further identify ways in which they can partner up with the Administration to promote economic growth and prosperity.

Join us tomorrow, Thursday, April 12th at 11:30 a.m. EDT, for a special session of Office Hours on Twitter with Dan Restrepo, Special Assistant to the President and Senior Director for Western Hemisphere Affairs. He'll be taking your questions about the upcoming Summit, and the work the Administration has carried out over the past three years to embark on a new era of regional cooperation based on equal partnership and shared responsibility with our neighbors in the Americas. Ask your questions now using the hashtag #WHChat.

-

In too many communities across America, residents do not have easy access to a primary health care provider. As a medical student in Baltimore, Maryland, Christin Donnelly has seen the impact that has on families and communities:

“My experiences working in inner city Baltimore and rural western Maryland have shown me how fulfilling it is to provide healthcare for those who need it the most. I enjoy the challenge and believe that I can maximize the wonderful education I have been given by working with these underserved populations.”

Thanks to the Affordable Care Act, more Americans will have access to health care from a compassionate doctor or nurse like Christin – receiving part of $9.1 million in National Health Service Corps funding being distributed to medical students at schools in 30 states and the District of Columbia – who will serve as primary care doctors and help strengthen the health care workforce.

-

April 11, 2012

04:07 PM EDTThe President believes we should build an economy where everyone does their fair share and everyone plays by the same set of rules. That’s why he proposed the Buffett Rule. It’s simple: if you make more than $1 million a year, you should pay at least the same percentage of your income in taxes as middle class families do. On the other hand, if you make under $250,000 a year – like 98 percent of American families do – your taxes shouldn’t go up.

Today at the White House the President met with millionaires and their assistants who support the Buffett Rule. The fact is, a majority of the American people agree with this idea. Surveys have found that most millionaires and nearly half of Republicans also agree. There’s another Republican who also agreed with this principle: President Ronald Reagan.

The President originally introduced the Buffett Rule as a principle of a broader tax reform plan – just like Ronald Reagan – that would simplify the tax code and lower tax rates – just like Ronald Reagan – including getting rid of subsidies for millionaires that they do not need – just like Ronald Reagan. And yet, Congressional Republicans managed to denounce President Obama’s proposal even before he had even introduced it. Congressional Republicans have another shot at supporting Buffett Rule next week. We’ll see where they stand.

Let’s take a look at what the President said today:

I’m not the first President to call for this idea that everybody has got to do their fair share. Some years ago, one of my predecessors traveled across the country pushing for the same concept. He gave a speech where he talked about a letter he had received from a wealthy executive who paid lower tax rates than his secretary, and wanted to come to Washington and tell Congress why that was wrong. So this President gave another speech where he said it was “crazy” -- that's a quote -- that certain tax loopholes make it possible for multimillionaires to pay nothing, while a bus driver was paying 10 percent of his salary. That wild-eyed, socialist, tax-hiking class warrior was Ronald Reagan.

He thought that, in America, the wealthiest should pay their fair share, and he said so. I know that position might disqualify him from the Republican primaries these days, but what Ronald Reagan was calling for then is the same thing that we’re calling for now: a return to basic fairness and responsibility; everybody doing their part. And if it will help convince folks in Congress to make the right choice, we could call it the Reagan Rule instead of the Buffett Rule.

-

April 11, 2012

03:45 PM EDTWhen I served as an Army officer in Baghdad, Iraq in 2003, it became a ritual that our soldiers would reposition fuel trucks on our compound just as the sun went down. Soon after moving these trucks, insurgent mortar fire would target the area where they had previously been sitting. These were the moments when my soldiers and I began to realize the importance of energy to our warfighters on the battlefield. The issue also surfaced as the roads in Baghdad became more dangerous during our 15 month deployment, but we still needed to send daily logistical convoys into those streets to go pick up the new fuel supply.

Over the last 10 years of war, America's warfighters have gained a better understanding of the significant and inherent connection between energy independence and national security. As a result, the Department of Defense is making great strides in addressing these issues and enhancing our nation's energy security. That is why, as a veteran and in my new role as the Federal Environmental Executive, I am so proud of today's announcements by the Obama Administration, which take steps to bolster energy security for not only our brave men and women fighting on the front lines, but for all Americans.

Today, the Administration announced:

-

The Army will open a new 30,000-square-foot lab in Michigan to develop cutting edge energy technologies for the next generation of combat vehicles. This new lab will support the launch of the Army Green Warrior Convoy, which will test and demonstrate advanced vehicle technology including fuel cells, hybrid systems, battery technologies and alternative fuels.

-

The Energy Department's Advanced Research Projects Agency will launch a research competition to engage our country's brightest scientists, engineers and entrepreneurs in improving the capability of energy storage devices that can be used in the battlefield and for civilian applications.

- Building on the commitment President Obama made in his State of the Union Address, the Department of Defense (DOD) will make one of the largest commitments to clean energy in history, with a new goal to deploy three gigawatts of renewable energy – including solar, wind, biomass, and geothermal – on Army, Navy, and Air Force installations by 2025 – enough to power 750,000 homes.

-

The Army will open a new 30,000-square-foot lab in Michigan to develop cutting edge energy technologies for the next generation of combat vehicles. This new lab will support the launch of the Army Green Warrior Convoy, which will test and demonstrate advanced vehicle technology including fuel cells, hybrid systems, battery technologies and alternative fuels.

-

April 11, 2012

03:35 PM EDTNancy Clark is the owner of Glen Group, a small advertising and marketing agency in North Conway, New Hampshire, which serves people from across the state. As a small business owner, Nancy is mindful of her business’ expenses, and has had to cut back where she could. But one thing that Nancy tells us she never considered cutting was the health insurance she offers to her employees.

“My personal philosophy is health care is a right and it should be affordable,” Nancy says. “So here as a very small business owner, I will always offer the mechanism by which people can have access to health care.”

The small business tax credit provided by the Affordable Care Act was important to Nancy’s company. For 2010 and 2011, the credit helped with Glen Group’s bottom line. And now that the economy and Nancy’s business are getting stronger, she says: “My hope is that in 2012 we will … take that tax credit and I would like to use it to pay down deductibles or even to pay … one co-pay or two co-pays.”

-

First Lady Michelle Obama and Dr. Jill Biden today marked the one year anniversary of the launch of Joining Forces with an event on the South Lawn of the White House, and Mrs. Obama used the occasion to renew her call of action, and challenged all Americans to keep finding new ways to show their support for military families.

The First Lady told the crowd that over the past year, as she and Dr. Biden reached out on behalf of our military families, "not a single person that we've talked to, that we have approached, has told us that they could not help -- not a single person. We've asked; they said yes.

And the good thing is, is that once people get started, they just keep coming up with new ideas on their own. We’ll present something, and they double it. They want to do even more. They just keep raising their goals even higher. They just keep figuring out how to get more and more people involved."

And her message for all military families, is that "you do live in a grateful nation."

-

In this new White House White Board, Brian Deese, the Deputy Director of the National Economic Council, explains why the Buffett Rule is necessary to restore fairness to the American tax system -- and ensure that everyone plays by the same set of rules.

Later this morning, President Obama will discuss the Buffett Rule from the White House. Tune in at 10:15 AM ET at WhiteHouse.gov/live.

-

"Let's Go, Let's Play, Let's Move!" was the theme of this year's Easter Egg Roll. Attendees dribbled basketballs with the President, flew hand-made kites, and jumped through obstacle courses – it’s no wonder someone needed a nap!

More than 30,000 people attended the White House event from all 50 states and many of the attendees captured priceless moments from the experience. Take a look at pictures shared by #EasterEggRoll attendees below or on Storify.

-

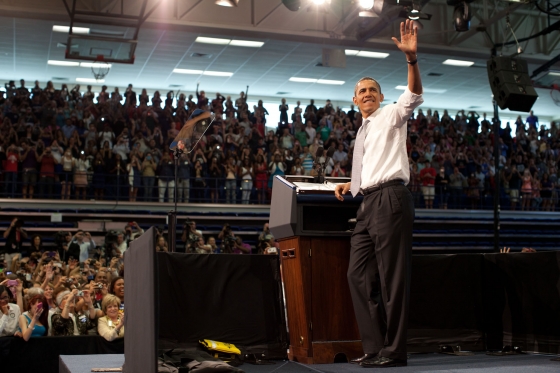

President Obama was in Florida today to talk about our economy, and what he called the essence of America: the idea that everyone who works hard should be able to do well.

America has always been a place where anybody who's willing to work and play by the rules can make it. A place where prosperity doesn’t trickle down from the top, it grows from the bottom; it grows outward from the heart of a vibrant middle class.

Instead of giving more than a trillion dollars in tax breaks to the very wealthiest Americans—those who make more than $250,000 a year—we need to be investing in the things like education and research and health care. These are the same investments we’ve been making for generations because they lead to strong, broad based economic growth that helps everyone, as the President explained:

What drags our entire economy down is when the benefits of economic growth and productivity go only to the few, which is what’s been happening for over a decade now, and gap between those at the very, very top and everybody else keeps growing wider and wider and wider and wider.

The fact is, the share of our national income going to the top 1 percent of earners is as high as it’s been since the 1920s. And those same people are paying taxes at one of the lowest rates in 50 years. To address this imbalance in our tax system, President Obama has proposed the Buffett Rule, based on the simple idea that people who make more than $1 million each year pay at least the same share of their income in taxes as middle-class families do. With the Buffett Rule in place, the President said:

…it makes it affordable for us to be able to say for those people who make under $250,000 a year -- like 98 percent of American families do -- then your taxes don’t go up. And we can still make those investments in things like student loans and college and science and infrastructure and all the things that make this country great.

-

April 10, 2012

06:04 PM EDTThe Energy Department’s first ever Apps for Energy competition challenges the American developer community to build apps that help consumers get the most out of their utility data.

Apps for Energy leverages Green Button -- an open standard for sharing electricity usage information. For the competition, developers will mash-up Green Button data with other public data sources to create innovative, energy-focused apps (visit our developer page for a list of resources). Submissions can be any kind of software application broadly available to the public -- including apps for the web, personal computers, and mobile devices.

Developers who take on the Apps for Energy challenge have an opportunity to significantly impact the way millions of Americans think about and use their electricity usage data. Building apps that provide insight and useful information into everyday electricity consumption will help empower consumers to effectively manage their energy use in ways that save money and energy.

-

Yesterday the President and First Lady hosted more than 30,000 people from all 50 states on the South Lawn of the White House for the 134th annual Easter Egg Roll. There was singing, there was dancing, there was reading, there were crafts, there were cooking demonstrations,and there was basketball drills, hula hoops, and, of course, there were Easter eggs. WhiteHouse.gov captured it all on camera, and livestreamed the day from several locations around the Lawn for those who couldn't join in person. But it came to our attention that some people found the sheer volume of choices overwhelming, so we packaged it into one 1:48 video. Enjoy!

-

Nearly one-quarter of all millionaires (about 55,000 individuals) pay a lower tax rate than millions of middle-class families. Warren Buffett has famously said that he pays a lower tax rate than his secretary, and he agrees that isn’t fair. To reform our tax system, which is currently tilted in favor of very high-income households, President Obama has proposed a basic principle of tax fairness called the Buffett Rule.

And, using the average tax rate to tell the story actually, like in the chart above, masks the fact that some high-income Americans pay extraordinarily low tax rates. A full 22,000 households that made more than $1 million in 2009 paid less than 15 percent of their income in income taxes. And the top 400 richest Americans—all making over $110 million a year—paid an average of 18 percent of their income in income taxes in 2008, but one in three of them paid less than 15 percent.

-

April 10, 2012

01:14 PM EDTEd note: this was originally posted on the Healthcare.gov blog

The Affordable Care Act is bringing real change to a health care system that has cost us too much and could do a better job to keep Americans healthy. As a result the law, the Department of Health and Human Services has been partnering with doctors, nurses, hospitals, and other medical providers to help patients get the best care anywhere.

Accountable Care Organizations, or ACOs, are one of these new ways for doctors, hospitals, and other providers to be rewarded based on the quality of care they provide for patients, not just on how many tests they order or how many procedures they do.

Today, HHS announced 27 new ACOs have joined this partnership – and over 150 more potential ACOs have submitted an application to begin in July. There is enthusiasm and energy behind this program from all parts of the country, from all parts of the health care sector.

Already, 32 “Pioneer ACOs” representing health care groups with experience coordinating care for patients have been participating in a special demonstration program since the beginning of the year to improve Medicare beneficiaries’ health and experience of care, and reduce growth in health care spending.

-

April 10, 2012

12:00 PM EDTWarren Buffett pays a lower tax rate than his secretary. Meanwhile, over the last 30 years, the tax rates for middle class families have barely budged. That doesn’t reflect our values of fairness as a nation -- and that’s why the President has proposed the Buffett Rule.

The President believes we should build an economy where everyone gets a fair shot, everyone does their fair share, and everyone plays by the same set of rules. It’s simple: if you make more than $1 million a year, you should pay at least the same percentage of your income in taxes as middle class families do. On the other hand, if you make under $250,000 a year – like 98 percent of American families do – your taxes shouldn’t go up.

Today the White House released a report, The Buffett Rule: A Basic Principle of Tax Fairness. This report highlights the need for Congress to take action and pass the Buffett Rule. Here are some of the highlights from the report:

- The average tax rate paid by the very highest-income Americans has fallen to nearly the lowest rate in over 50 years. The wealthiest 1-in-1,000 taxpayers pay barely a quarter of their income in Federal income and payroll taxes today—half of what they would have contributed in 1960. And, the top 400 richest Americans—all making over $110 million—paid only 18 percent of their income in income taxes in 2008.

- Average tax rates for the highest income Americans have plummeted even as their incomes have skyrocketed. Since 1979 the average after-tax income of the very wealthiest Americans – the top 1 percent – has risen nearly four-fold. Over the same period, the middle sixty percent of Americans saw their incomes rise just 40 percent. The typical CEO who used to earn about 30 times more than his or her worker now earns 110 times more.

-

April 09, 2012

10:49 PM EDTToday, we are reading about another brand of “new math” in describing how the Affordable Care Act will affect our nation’s Federal budget deficit. In another attempt to refight the battles of the past, one former Bush Administration official is wrongly claiming that some of the savings in the Affordable Care Act are “double-counted” and that the law actually increases the deficit. This claim is false.

According to the official Administration and Congressional scorekeepers, the Affordable Care Act will reduce the deficit: its costs are more than fully paid for. The Office of Management and Budget and Congressional Budget Office project lower Federal budget deficits as a result of the law. The Congressional Budget Office is charged with assessing how legislation would affect the deficit. When the health care bill was passed by Congress, CBO wrote:

“CBO and JCT estimate that enacting both pieces of legislation—H.R. 3590 and the reconciliation proposal—would produce a net reduction in federal deficits of $143 billion over the 2010–2019 period as result of changes in direct spending and revenues.”

When Congressional Republicans sought to repeal the law, CBO found that eliminating the law would increase the deficit. CBO wrote:

“[T]he effect of H.R. 2 on federal deficits as a result of changes in direct spending and revenues is likely to be an increase in the vicinity of $230 billion, plus or minus the effects of technical and economic changes to CBO’s and JCT’s projections for that period.”

- &lsaquo previous

- …

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- …

- next &rsaquo