The Buffett Rule

The Buffett Rule Explained

What's the deal with our current tax system?

Under the current U.S. tax system, a number of millionaires pay a smaller percentage of their income in taxes than a significant proportion of middle class families. Warren Buffett, for example, pays a lower effective tax rate than his secretary, and that’s not fair.

A full 22,000 households that made more than $1 million in 2009 paid less than 15 percent of their income in income taxes — and 1,470 managed to pay no federal income taxes on their million-plus-dollar incomes, according to the IRS.

And, the very wealthiest American households are paying nearly the lowest tax rate in 50 years— some are paying just half of the federal income tax that top income earners paid in 1960. But the average tax rate for middle class families has barely budged. The middle 20 percent of households paid 14 percent of their incomes in 1960, and 16 percent in 2010.

What is the Buffett Rule?

The Buffett Rule is a simple principle that everyone should pay their fair share in taxes. No household making more than a $1 million should pay a smaller share of their income in taxes than middle-class families pay. For the 98 percent of American families who make less than $250,000, taxes should not go up.

How would it make sure everyone pays their fair share?

The Buffett Rule would limit the degree to which the best-off can take advantage of loopholes and tax rates that allow them to pay less of their income in taxes than middle-class families.

Anyone who does well for themselves should do their fair share in return, so that more people have the opportunity to get ahead—not just a few. And at time when we need to pay down our deficit and invest in the things that help our economy grow and keep our country safe—education, research and technology, a strong military, Medicare and Social Security—giving tax breaks to millionaires simply doesn’t make sense.

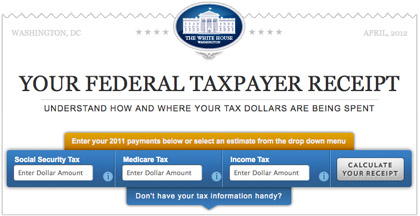

Just enter a few pieces of information about your taxes, and the taxpayer receipt will give you a breakdown of how your tax dollars are spent on priorities like education, veterans benefits, or health care.