Created on September 25, 2012

|

Planning what to do in case of a disaster is an important part of being prepared. The IRS encourages taxpayers to safeguard their records. Some simple steps can help taxpayers and businesses protect financial and tax records.

Security in Electronic Recordkeeping

Many people receive bank statements and documents electronically. This method allows for easy backup to ensure secure record keeping. Files can be copied to a portable electronic storage device, such as a flash drive, or onto a CD or DVD.

In addition, you may scan your paper documents (W-2s, tax returns and other records) to create electronic files for safekeeping.

Be sure to store these backup files in a safe location, apart from your business, in case your normal backup systems are destroyed. Convenience to your home should not be your primary concern. Remember, a disaster that strikes your home may also affect other facilities nearby, making quick retrieval of your records difficult and even impossible.

Document Valuables and Equipment

Publications 584, Casualty, Disaster, and Theft Loss Workbook, and 584-B, Business Casualty, Disaster, and Theft Loss Workbook, can help you compile a room-by-room list of your belongings or business equipment. This will help you recall and document the market value of items for insurance and casualty loss claims. You can also photograph or video the contents of your home and/or business, especially items of great value.

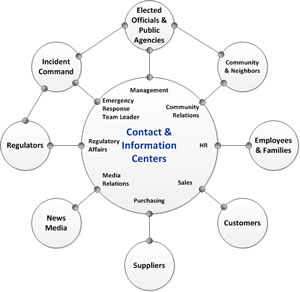

Communications before, during and following an emergency is bi-directional. Stakeholders or audiences will ask questions and request information. The business will answer questions and provide information. This flow of information should be managed through a communications hub.

Communications before, during and following an emergency is bi-directional. Stakeholders or audiences will ask questions and request information. The business will answer questions and provide information. This flow of information should be managed through a communications hub.