You are hereHome > Blog September 2012

Blog September 2012

MBDA Working with CBC to Inspire Leaders and Build Generational Wealth

|

Created on September 25, 2012 |

Beginning on September 19 through the 22nd, the Congressional Black Caucus Foundation (CBCF) hosted the 42nd Annual Legislative Conference (ALC) in Washington, D.C. The conference, with the theme of Inspiring Leaders/Building Generations, brought together leaders of industry, policy, education, and the population at-large to discuss issues of importance to the African American community.

The Minority Business Development Agency (MBDA) was proud to participate in two discussions during ALC focused on empowering African American communities through economic opportunities both at home and abroad. On Day two of the conference, Kimberly Marcus, Associate Director for the Office of Legislative, Education, and Intergovernmental Affairs, participated in a panel hosted by Mid-Tier Advocacy examining challenges faced by small and emerging businesses in federal contracting. Marcus spoke to the resources provided by MBDA specifically the recently launched Federal Procurement Center as well as online tools such as the Phoenix-Opportunity Database. She was joined on the panel by Bridget Bean of the Small Business Administration, Ben Gaither of IBM, and Congressman Hank Johnson (GA-04).

The Minority Business Development Agency (MBDA) was proud to participate in two discussions during ALC focused on empowering African American communities through economic opportunities both at home and abroad. On Day two of the conference, Kimberly Marcus, Associate Director for the Office of Legislative, Education, and Intergovernmental Affairs, participated in a panel hosted by Mid-Tier Advocacy examining challenges faced by small and emerging businesses in federal contracting. Marcus spoke to the resources provided by MBDA specifically the recently launched Federal Procurement Center as well as online tools such as the Phoenix-Opportunity Database. She was joined on the panel by Bridget Bean of the Small Business Administration, Ben Gaither of IBM, and Congressman Hank Johnson (GA-04).

Picking Up the Pieces After a Disaster

|

Created on September 25, 2012 |

Planning what to do in case of a disaster is an important part of being prepared. The IRS encourages taxpayers to safeguard their records. Some simple steps can help taxpayers and businesses protect financial and tax records.

Security in Electronic Recordkeeping

Many people receive bank statements and documents electronically. This method allows for easy backup to ensure secure record keeping. Files can be copied to a portable electronic storage device, such as a flash drive, or onto a CD or DVD.

In addition, you may scan your paper documents (W-2s, tax returns and other records) to create electronic files for safekeeping.

Be sure to store these backup files in a safe location, apart from your business, in case your normal backup systems are destroyed. Convenience to your home should not be your primary concern. Remember, a disaster that strikes your home may also affect other facilities nearby, making quick retrieval of your records difficult and even impossible.

Document Valuables and Equipment

Publications 584, Casualty, Disaster, and Theft Loss Workbook, and 584-B, Business Casualty, Disaster, and Theft Loss Workbook, can help you compile a room-by-room list of your belongings or business equipment. This will help you recall and document the market value of items for insurance and casualty loss claims. You can also photograph or video the contents of your home and/or business, especially items of great value.

Keep Track of Expenses—on the Road and in Your Home

|

Created on September 24, 2012 |

Car Expenses

Car Expenses

To take a business deduction for the use of your car, you must determine what percentage of the vehicle was used for business. No deduction is allowed for strictly personal use, such as commuting.

Deductible car expenses can include the cost of: 1) traveling from one workplace to another, 2) making business trips to visit customers or attending business meetings away from your regular workplace, and 3) traveling to temporary workplaces.

It is important to keep complete records to substantiate items reported on a tax return. In the case of car and truck expenses, the types of records required depend on whether you claim the standard mileage rate or actual expenses.

Standard mileage rate: To claim the standard mileage rate, appropriate records would include documentation identifying the vehicle and proving ownership or a lease and documentation showing miles traveled, destination and business purpose. The 2012 standard mileage rates for the use of a car (including vans, pickups or panel trucks) are on www.irs.gov, search: standard mileage rate. If you want to use the standard mileage rate for a car you own, you must choose to use it in the first year the car is available for use in your business. Then in later years, you can choose to use either the standard deduction or actual expenses.

Making America More Competitive – Growing Minority-Owned Businesses

|

Created on September 20, 2012 |

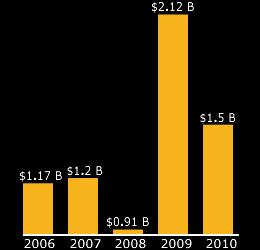

Over the past two decades, the world has been shifting into an innovation economy. Fortunately, as President Obama has said, “Nobody does innovation better than America.” It’s not just our first-rate colleges and universities, though they certainly are a big part of it. It’s the American workforce. According to the President,“Nobody has a greater diversity of talent and ingenuity. No one’s workers or entrepreneurs are more driven or more daring.”

Talent, ingenuity, tenacity and a willingness to take risks. These are the same strengths I see as I travel around the country meeting with minority business owners; strengths that match up with the demands of today’s global economy.

Why is innovation so important? We know it’s the key driver of competitiveness, wage and job growth, and long- term economic growth. We also know that it was Federal government investments in research, education, and infrastructure that made our economy competitive in the past. It was government’s support that paved the way for private sector growth and laid the foundation for American global leadership.

The Entrepreneurial Spirit of Hispanic-Americans and Its Impact on the Economy

|

Created on September 20, 2012 |

Each year, from September 15 to October 15, the United States observes Hispanic Heritage Month. During this time we celebrate the rich histories, contributions, and cultures of those Americans with ancestry traced back to Latin America and Spain. From the trailblazers of politics and justice such as Romualdo Pacheco and Sonia Sotomayor to advances in science and medicine made by Luis Walter Alvarez and Antonia Novello, we take this time to reflect on the history and future. A major economic contribution of the Hispanic American population is their entrepreneurial spirit and the success of Hispanic-owned businesses.

Minority-owned firms have historically been a significant part of our nation’s economy. They have been a model for growth and development throughout the decades, even in the most financially difficult times. Hispanic-owned firms in particular have served as a cornerstone for economic development and U.S. prosperity. According to 2007 figures from the U.S. Census Bureau (the most recent data available), these firms generated $351 billion in economic output towards the U.S. economy, along with creating 1.9 million jobs. Their prospects for job growth are ever-increasing, with trend analysis showing that Hispanic-owned firms outpace the growth of non-minority-owned firms, in gross receipts, employment, and number of firms between 2002 and 2007.