find out why cbo was ranked one of the best places to work in the federal government

browse the shelves

Peruse all of CBO's publications and cost estimates. Begin with the most recent, focus on a specific topic, jump straight to frequently requested items, or get automatic updates from one of our many RSS feeds.

Peruse all of CBO's publications and cost estimates. Begin with the most recent, focus on a specific topic, jump straight to frequently requested items, or get automatic updates from one of our many RSS feeds. meet the agency

Learn how CBO provides nonpartisan, objective, and timely analysis to aid the Congress in making budgetary and  economic decisions, and discover how you can join one of the best places to work in the federal government.

economic decisions, and discover how you can join one of the best places to work in the federal government.

read the blog

Visit the Director’s Blog for a concise description of CBO's recent work.

Visit the Director’s Blog for a concise description of CBO's recent work.- From our latest blogpost:

Since the terrorist attacks of September 11, 2001, the federal government has spent more than half a trillion dollars...

what's most recent

The Taxation of Capital and Labor Through the Self-Employment Tax

reportSeptember 27, 2012CBO Releases a Report on the Taxation of Capital and Labor Through the Self-Employment Tax

blog postSeptember 27, 2012CBO Releases a Report on the Proposed Homeland Security Budget for 2013

blog postSeptember 27, 2012The Proposed Homeland Security Budget for 2013

reportSeptember 27, 2012S. 1735, a bill to approve the transfer of Yellow Creek Port properties in Iuka, Mississippi

cost estimateSeptember 27, 2012H.R. 5747, Military Family Home Protection Act

cost estimateSeptember 21, 2012Choices for Federal Spending and Taxes

presentationSeptember 21, 2012

what's most read

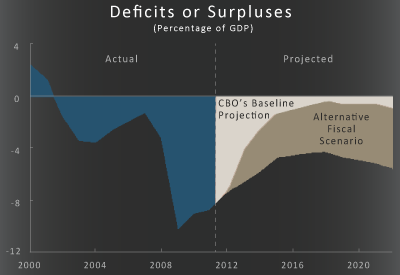

An Update to the Budget and Economic Outlook: Fiscal Years 2012 to 2022

reportAugust 22, 2012Letter to the Honorable John Boehner providing an estimate for H.R. 6079, the Repeal of Obamacare Act

cost estimateJuly 24, 2012Estimates for the Insurance Coverage Provisions of the Affordable Care Act Updated for the Recent Supreme Court Decision

reportJuly 24, 2012The 2012 Long-Term Budget Outlook

reportJune 5, 2012The Long-Term Budgetary Impact of Paths for Federal Revenues and Spending Specified by Chairman Ryan

reportMarch 20, 2012An Analysis of the President's 2013 Budget

reportMarch 16, 2012The Budget and Economic Outlook: Fiscal Years 2012 to 2022

reportJanuary 31, 2012