Employers must complete and sign Section 2 of Form I-9 within three business days of the employee’s first day of work for pay. For example, if the employee started work for pay on Monday, the employer must complete Section 2 by Thursday of that week. If the job lasts less than three days, the employer must complete Section 2 no later than the first day of work for pay.

Employee Responsibilities for Section 2

Employees must present unexpired original documentation that shows the employer their identity and employment authorization. Employees choose which documentation to present.

Employees must make:

-

One selection from List A; or

-

One selection from List B in combination with one selection from List C.

Note that List A contains documents that show both identity and employment authorization, List B documents show identity only, and List C documents show employment authorization only.

In certain circumstances, employees may present an acceptable receipt in lieu of a List A, B, or C document. Receipts only temporarily satisfy the document presentation requirement for Section 2.

Employer Responsibilities for Section 2

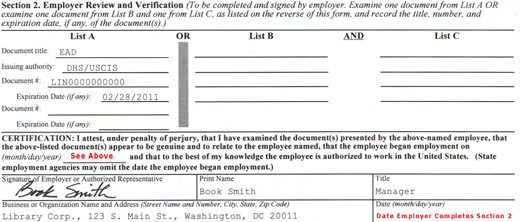

An employer or an authorized representative of the employer completes Section 2. Employers or their authorized representatives must physically examine the documentation presented and sign the form.

The employer or authorized representative must:

-

Ensure that any document the employee presents is on the Lists of Acceptable Documents or is an acceptable receipt.

-

Physically examine each document to determine if it reasonably appears to be genuine and to relate to the employee presenting it. If the employer rejects a document, he or she should allow the employee to present other documentation from the List of Acceptable Documents.

-

Record the document title, issuing authority, number(s) and expiration date (if any) from the original document(s) the employee presented.

-

Enter the date the employee began or will begin work for pay.

-

Provide the name, signature and title of the person completing Section 2, as well as the date he or she completed Section 2.

-

Record the employer’s business name and address. If the company has multiple locations, you can use the local address where the Form I-9 is completed if it is the most appropriate address to use to identify the location of the employer.

-

Return the documentation presented back to the employee.

Entering Dates in Section 2

Section 2 includes two spaces that require dates. These spaces are for:

-

The date the employee began employment (for example, work for pay).

-

The date the employer examined the documentation the employee presented to show identity and employment authorization.

The Date the Employee Began Employment

The date the employee began employment may be a current, past or future date. Employers should enter:

-

A current date if Section 2 is completed the same day the employee begins work for pay.

-

A past date if Section 2 is completed after the employee began work for pay. Enter the actual date the employee began work for pay.

-

Federal contractors completing Form I-9 for existing employees as a result of an award of a federal contract with the FAR E-Verify clause should enter the date employees first began work for pay from Section 2 of their previously completed Form I-9.

-

A future date if Section 2 is completed after the employee accepts the job offer but before he or she will begin work for pay. Enter the date the employee expects to begin work for pay. If the employee begins working for pay on a different date, cross out the expected start date and write in the correct start date. Date and initial the correction.

The Date the Employer Examined the Employee’s Documents

This date is the actual date the employer completes Section 2 by examining the documentation presented by the employee and signing the certification.

If your employee is a minor (under age 18), lists a disability requiring assistance on Form I-9, or presents documents with which you are not familiar, please see the list to the right for further guidance on how to complete Form I-9. If you still need help, please contact USCIS Customer Service.

Back to Top