Know Before You Owe

For most Americans, buying a home means taking out a mortgage loan. The Dodd-Frank Act requires us to combine the Truth in Lending and Real Estate Settlement Procedures Act disclosures. You receive these disclosures after you apply for a mortgage and shortly before you close on the mortgage. We decided to involve the people who will actually use the new forms – consumers, lenders, mortgage brokers, settlement agents – in combining and improving them. These are the results so far.

On this page

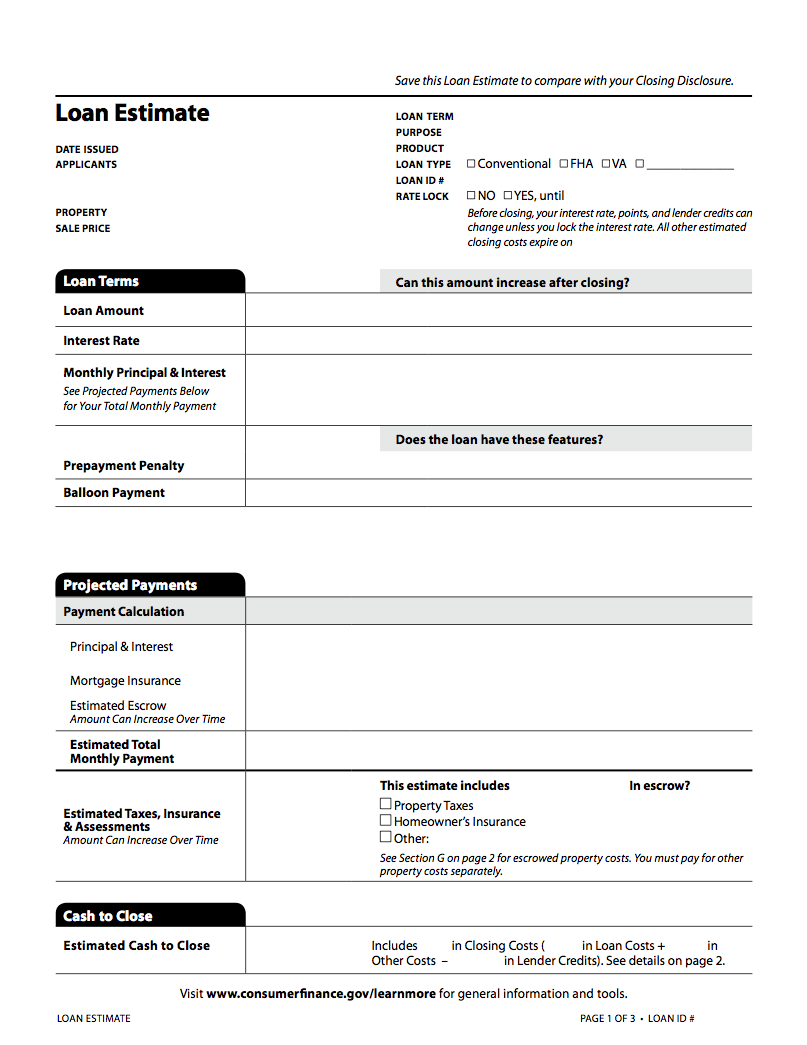

The new disclosure – Compare our proposed disclosures to the existing ones.

How we did it – Review a timeline of the project, from the Dodd-Frank Act to today.

The proposed rule – See the full proposed rule, including a version of the first page of the Loan Estimate annotated with the relevant sections of the rule and commentary.

More resources – What this proposal means for consumers and industry, reports on what we heard in testing and the small business review panel, information about another proposal to strengthen consumer protections on high-cost mortgage loans, and more.

The new disclosure

We’re proposing disclosures that are easier for both consumers and lenders to understand and use. As you review them, think about a few of the things we asked ourselves:

- Would this form help consumers understand the true costs and risks of a mortgage?

- Could lenders and brokers clearly and easily explain the form to their customers?

- Have we made things clearer?

Once you’ve reviewed the proposed disclosures, you can comment on our proposed rule.

Other uses for the proposed disclosures:

- Loan Estimate for a more complicated product

- Closing Disclosure for a refinance with no seller

- Closing Disclosure provided to the seller separately

How we did it

The Know Before You Owe project for mortgage disclosures began in the Dodd-Frank Act, and it continues with the proposal of this rule. Here’s a timeline of how the project developed.

See the full testing timeline or read the full report on the testing process (note: link to large PDF).

The proposed rule

This is the proposal from the Federal Register. It would modify the rules commonly known as Regulations X and Z.

You have until November 6, 2012 to review and provide comments on most of the proposal. However, comments are due for two parts on September 7, 2012: the changes to the calculation of the finance charge and Annual Percentage Rate (APR) and the delay of the effective date for certain disclosures required by the Dodd-Frank Act.

We want it to be easy to understand the disclosures we’re proposing, so we’ve created a new way to explore the rule. Below you’ll see the front page of the new disclosures. Click on any section to see both the regulation that governs that section and the commentary that explains it.

Projected payments

This section of the disclosure corresponds to §1026.37(c) of the proposed rule.

More resources

Here are some other resources that might be helpful:

- The full notice is quite large. If you’d like to review just part of it, download the preamble, regulatory amendments, or official interpretations individually.

- What the proposed mortgage disclosure rule would mean for consumers and a detailed summary of the proposal

- Blog posts about the process that brought us here

- A report on our process for testing disclosure prototypes

- A report on our discussions with small businesses

In addition to simplifying mortgage disclosure, we are also proposing a rule to strengthen consumer protections on high-cost mortgage loans. Read a detailed summary of this rule and what it would mean for consumers.