News Release

Employment, Sales, and Capital Expenditures for 2010

The following are 2010 advanced and 2009 revised summary estimates of the employment, capital spending, and sales activity of U.S. multinational companies (comprising both their U.S. and foreign operations) and the corresponding activity of foreign multinational companies in the United States. Preliminary 2010 and revised 2009 statistics based on more complete source data and including country and industry detail will be released later this year.1

U.S. multinational companies: U.S. and foreign operations

Worldwide employment by U.S. multinational companies (MNCs) increased 0.5 percent in 2010, to 34.0 million workers, with increases in both the United States and abroad. Employment in the United States by U.S. parent companies increased 0.1 percent, to 23.0 million workers, which contrasted with a 0.6 percent decrease in total private-industry employment in the United States. The employment by U.S. parents accounted for roughly one-fifth of total U.S. employment in private industries. Abroad, employment by the majority-owned foreign affiliates of U.S. MNCs increased 1.5 percent, to 11.0 million workers.

Worldwide capital expenditures by U.S. MNCs increased 3.9 percent in 2010, to $621 billion. Capital expenditures in the United States by U.S. parent companies increased 3.3 percent, to $447 billion. Capital expenditures abroad by their majority- owned foreign affiliates increased 5.5 percent, to $173 billion.

Sales by U.S. parent companies increased 6.8 percent in 2010, to $9,843 billion. Sales by their majority-owned foreign affiliates increased 8.6 percent, to $5,197 billion.2

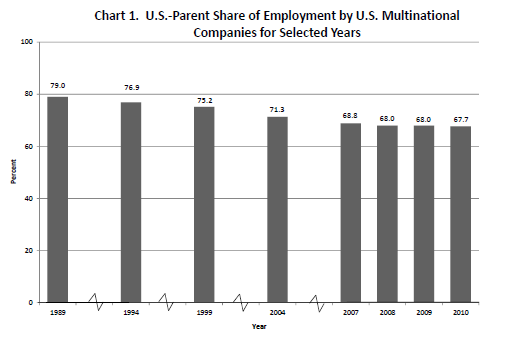

Employment in the United States by U.S. parent companies accounted for 68 percent of the worldwide employment of U.S. MNCs in 2010, a share that was unchanged from 2009. The U.S.-parent share of the worldwide capital expenditures of U.S. MNCs in 2010 was 72 percent, down from 73 percent in 2009.

Changes in the share of MNC activity at the U.S. parent do not necessarily indicate production shifting between U.S. parents and their foreign affiliates. Other factors that may be associated with changes in the share include different rates of economic growth in the Unites States and in specific markets where investment is occurring abroad, or the creation of new market opportunities abroad that cannot be served by exports from the United States. These issues are discussed in annual articles on U.S. MNC operations in the Survey of Current Business.3

Foreign multinational companies: U.S. operations

Employment in the United States by majority-owned U.S. affiliates of foreign MNCs decreased 1.0 percent in 2010, to 5.2 million workers, a rate of decrease slightly faster than the rate of decrease of total U.S. private industry employment in 2010. U.S. affiliates accounted for 4.7 percent of U.S. private industry employment in 2010, the same share as in 2009.

Capital expenditures by U.S. affiliates fell 1.7 percent, to $147 billion. Sales by U.S. affiliates rose 5.0 percent, to $3,063 billion. Changes in the measures of activity of majority-owned U.S. affiliates of foreign companies may reflect a variety of factors, including changes in the operations of continuing affiliates as well as entries to and exits from the universe of majority-owned U.S. affiliates. For example, the decline in employment by U.S. affiliates in 2010 partly reflected changes in ownership that resulted from a number of U.S. affiliates selling off some of their domestic subsidiaries.

1 2009 preliminary statistics with country and industry detail are available on BEA’s Web site.

2 An MNC-wide total for sales is not provided because an MNC-wide total for sales would contain duplication resulting from transactions among and within MNCs.

3 See “Operations of U.S. Multinational Companies in the United States and Abroad: Preliminary Results from the 2009 Benchmark Survey” in the November 2011 issue of the Survey of Current Business. Additional discussion of data and analytical considerations may be found in “A Note on Patterns of Production and Employment by U.S. Multinational Companies,” in the March 2004 issue of the Survey of Current Business.

Revisions

The MNC statistics for 2009 presented in this release supersede preliminary statistics that were released in the second half of 2011. For U.S. parent companies, employment was revised down 0.7 percent, capital expenditures were revised up 5.7 percent, and sales were revised up 0.2 percent. For majority-owned foreign affiliates, employment was revised up 0.1 percent, capital expenditures were revised down 3.3 percent, and sales were revised down 1.5 percent. For majority-owned U.S. affiliates of foreign MNCs, employment was revised up 0.2 percent, capital expenditures were revised down 2.7 percent, and sales were revised up less than 0.1 percent.

* * *

Each year, the Bureau of Economic Analysis releases advance summary statistics of employment, sales, and capital expenditures by U.S. parent companies, by their foreign affiliates, and by U.S. affiliates of foreign MNCs. Statistics based on more complete source data, including country and industry detail, will be released later this year.

The statistics presented in this release were constructed from data collected by BEA in two distinct surveys of MNC operations: (1) a survey of U.S. MNCs that covers the operations of both U.S. parent companies and their foreign affiliates, and (2) a survey of the operations of U.S. affiliates of foreign MNCs.

A U.S. parent company may itself be foreign-owned, so there is some overlap between the data on U.S. parent companies and on U.S. affiliates; thus, to avoid duplication, data on U.S. parents and U.S. affiliates should not be added together to produce U.S. totals.

The statistics presented here pertain to U.S. parent companies and their majority-owned foreign affiliates, and to majority-owned U.S. affiliates of foreign MNCs. Statistics on all U.S. and foreign affiliates, including affiliates that are not majority owned, will be released by BEA later this year. In these series, “affiliates” are defined as businesses in which an investor of another country holds at least 10-percent voting ownership. For 2009, the most recent year for which data are available, foreign affiliates that were not majority-owned employed 2.2 million workers, and U.S. affiliates that were not majority-owned employed 0.7 million workers.

For both U.S. MNCs and U.S. affiliates of foreign MNCs, employment covers the total number of full-time and part-time employees on the payroll at the end of the year. Sales cover gross sales minus returns, allowances and discounts, or gross operating revenues. Capital expenditures cover total expenditures on property, plant, and equipment (that is, expenditures for land and depreciable structures and equipment); they are gross of any sales, retirements, or transfers of previously owned tangible assets. Capital expenditures include spending for equipment that is leased or rented to others, which in some industries—such as automotive equipment rental and leasing—can be very large. The value of sales, retirements, or transfers in these industries can be very large.

Statistics for total U.S private-industry employment are from BEA’s national income and product accounts (NIPA Table 6.4D. Full-Time and Part-Time Employees by Industry).

In addition to presenting data collected directly in its surveys of MNC operations, BEA uses data collected on costs incurred and profits earned in production to estimate the value added of U.S. parent companies, of majority-owned foreign affiliates, and of majority-owned U.S. affiliates of foreign companies. Value added indicates the contribution of parents or affiliates to gross domestic product in the United States or in foreign host countries. The latest statistics for the value added of majority-owned U.S. affiliates of foreign companies, which are for 2009, are presented in "U.S. Affiliates of Foreign Companies: Operations in 2009," in the August 2011 issue of the Survey of Current Business. The latest statistics for the value added of U.S. parent companies and majority-owned foreign affiliates, which are also for the year 2009, are presented in "Operations of U.S. Multinational Companies in the United States and Abroad: Preliminary Results From the 2009 Benchmark Survey" in the November 2011 issue of the Survey of Current Business.

* * *