FOR THE CONSUMER

The FTC's monthly newsletter for the Congressional community

It's the news you - and your constituents - can use.

Volume 9 - Number 7

July

2010

IN THIS ISSUE

NEWS FLASH

AT YOUR SERVICE. Two Countrywide mortgage servicing companies will pay $108 million to settle FTC charges that they collected excessive fees from cash-strapped borrowers who were struggling to keep their homes. This is one of the largest judgments imposed in an FTC case. The money will be used to reimburse overcharged homeowners whose loans were serviced by Countrywide. Read the press release.

INTERNATIONAL IDENTITY THEFT. At the FTC’s request, a federal court has stopped, pending trial, an elaborate international scheme that used stolen identities to place more than $10 million in bogus charges on peoples’ credit and debit cards. More than a million cardholders were hit with one-time charges of $10 or less; their payments were routed through dummy corporations in the United States to bank accounts in Eastern Europe and Central Asia. According to the FTC, the defendants --- API Trade LLC and 15 other sham companies --- opened more than 100 merchant accounts with companies that process charges to cardholders’ credit and debit card accounts. Read the press release.

SOCIAL NETWORKING FIRST. Twitter has agreed to settle FTC charges that it put the privacy of its users at risk by not safeguarding their personal information. The case marks the agency’s first data security case against a social networking service. According to the FTC, serious lapses in the company’s data security protocol allowed hackers to get unauthorized administrative control of Twitter, including access to non-public user information and tweets that users had designated private. Hackers also were able to send out phony tweets from any account. Read the press release.

TEETH-WHITENING COMPETITION. The FTC charged the North Carolina Dental Board with stifling competition for teeth-whitening services when it ordered non-dentist providers operating in malls, salons and other retail locations to stop offering the services. According to the FTC, the Board exceeded its authority and, with six dentists out of eight members, has a financial interest in shutting down lower priced providers of teeth-whitening services. Non-dentists typically charge up to $150 for teeth-whitening; dentists charge from $300 to $700. Read the press release.

MORTGAGE SCAMS. As part of the agency’s continuing crackdown on scams that prey on financially distressed homeowners, the FTC has settled charges against more than a dozen marketers in the mortgage modification or foreclosure relief business. The FTC orders ban the marketers from selling mortgage relief services; a repeat offender must pay $11.4 million for contempt. Read the press release.

KEEP ON TRUCKIN’. U-Haul agreed to settle FTC charges that it improperly asked its closest competitor, Avis Budget Group, Inc., to work together to fix prices for truck rentals. According to the FTC, U-Haul and Budget control more than 70 percent of the “do-it-yourself” one-way truck rental business throughout the U.S., and the two companies could have imposed higher prices on truck-rental consumers if the scheme had been put in place. Read the press release.

STOPPING ROBOCALLS. At the FTC’s request, a federal court has stopped a major telemarketing operation that made millions of illegal phone calls pitching worthless extended auto warranties and credit card interest rate-reduction programs. A federal judge in Chicago has ordered SBN Peripherals, Inc., to stop the calls, temporarily froze its assets and appointed a receiver to take control of the business. According to the FTC, the company allegedly placed more than 370 million calls to people nationwide in the past year, prompting tens of thousands of complaints to the agency. Many of the calls were made to cell phones, sticking people with additional charges. Read the press release.

I SPY WHERE? The FTC has settled its charges that the sellers of “RemoteSpy” keylogger software advertised that it can be disguised and installed on someone else’s computer without the owner’s knowledge. The order requires that the manufacturer tell computer owners that the software has been downloaded --- and get their consent to installation. According to the FTC, CyberSpy Software, LLC, and its owner, Tracer R. Spence, allegedly touted the keylogger software as a “100% undetectable” way to “Spy on Anyone. From Anywhere.” Read the press release.

A BRIGHT IDEA

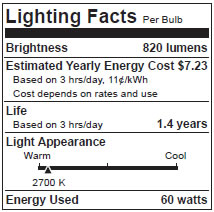

Starting in mid-2011, new labels on light bulb packaging will help people choose the most energy efficient products for their lighting needs. For the first time, the package label will emphasize a bulb's brightness as measured in lumens rather than watts. Watts measure energy use, not brightness, so relying on watt measurements alone makes it tough for shoppers to compare traditional incandescent bulbs to more energy-efficient bulbs like compact fluorescents. Compact fluorescents may produce the same amount of brightness, but they use a lot less energy or watts. Read the press release.

TESTIMONY

Senate Judiciary Committee

Subcommittee on Antitrust, Competition Policy and Consumer Rights

FTC Chairman Jon Leibowitz discussed the Commission’s work to promote competition and benefit consumers, such as ending “pay-for-delay” pharmaceutical agreements, preventing anticompetitive mergers, revising the guidelines that the FTC and the Justice Department use to assess horizontal mergers, and using its authority under Section 5 of the FTC Act to combat unfair methods of competition and protect consumers. Read the testimony.

NEW INFORMATION FOR CONSUMERS

FTC Warns of Oil Spill Scams. Alert urges people to watch out for con artists trying to take advantage of the oil spill in the Gulf and to report their experiences to federal and state authorities.

Mystery Shopping Scams May Target New College Grads. Warns graduates that they may get fraudulent offers to become mystery shoppers, and describes common mystery shopper pitches.

TIP OF THE MONTH — MORTGAGE SERVICING: MAKING SURE YOUR PAYMENTS COUNT

When you get a mortgage, you may think that the lender will hold and service your loan until you pay it off or sell your home. That’s often not the case. In today’s market, loans and the rights to service them often are bought and sold. In many cases, the company you send your payment to is not the company that owns your loan.

A mortgage servicer is responsible for the day-to-day management of your mortgage loan account, including collecting and crediting your monthly loan payments, and handling your escrow account, if you have one. The servicer is who you contact if you have questions about your account.

A home is one of the most expensive purchases you’ll make, so it’s important to know who is handling your payments and that your mortgage account is properly managed. The FTC has important information to share with homeowners so they can better understand their rights and the responsibilities of a mortgage servicer. To learn more, read the FTC’s publication, Mortgage Servicing: Making Sure Your Payments Count.

NUMBERS TO KNOW

FTC'S OFFICE OF CONGRESSIONAL RELATIONS: 202-326-2195.

Check out the CONGRESSIONAL RESOURCES portion of our website. No password needed to access.

ORDERING FTC's FREE CONSUMER INFORMATION

-

For one to 49 copies of FTC publications, call 1-877-FTC-HELP (1-877-382-4357).

-

For 50 or more copies of publications, visit the FTC's bulk order website.

-

If you need a copy of any publication immediately, you can view, download, and print from www.ftc.gov

- For special orders, email Derick Rill at drill@ftc.gov

To file a fraud complaint, visit www.ftc.gov or call 1-877-FTC-HELP (1-877-382-4357).

To subscribe or unsubscribe to this newsletter:

- Email to fortheconsumer@ftc.gov with your name, Member or Committee affiliation, email address, and the word "subscribe" or "unsubscribe" in the body of the message.