You are hereHome > Blog November 2011

Blog November 2011

How to Estimate the Cost of Starting a Business from Scratch

How much does it cost to start your own business?

How much does it cost to start your own business?

Of course, the answer depends on your business model and your chosen industry. However, a useful estimate based on a 2009 study conducted by the Ewing Marion Kauffman Foundation puts the average cost of starting a new business from scratch at just over $30,000.

Many small businesses, particularly freelance, online and home-based businesses come in a lot lower than this, often needing only a few thousand to get started.

But averages aside, what can you do to calculate your specific startup costs? Read on.

Understand the Types of Costs a Startup Will Incur

Before you do any estimating it’s important to understand how startup costs are categorized. All startup costs (meaning the period before you start generating income) include two kinds of spending: expenses and assets.

10 Rules for Holiday Season Hiring

As the economy continues to gain traction, many small retailers are forced to put more of their economic eggs in the holiday season shopping basket. Hoping to take advantage of an uptick in consumer confidence, a three-month end-of-year holiday splash is possible, but may be more difficult this season.

As the economy continues to gain traction, many small retailers are forced to put more of their economic eggs in the holiday season shopping basket. Hoping to take advantage of an uptick in consumer confidence, a three-month end-of-year holiday splash is possible, but may be more difficult this season.

So hiring extra help for the hoped-for push should be thought out more than ever. Here are some ways to help make short-term hires pay off.

10. Have a Staffing Plan

Know what it takes to get specific tasks done, and how long it should take for a competent person to learn what you want them to do. Resist the temptation to be over-optimistic about what you will need to handle holiday season volumes.

9. Know How Much a New Hire Really Costs

Recruiting, hiring, training, employment taxes, wages, etc., all have costs. Compare these costs against the expected benefits in increased revenues or saved expenses. Are you making a wise decision versus paying some overtime to existing staff?

22nd Annual OSDBU Procurement Conference

The OSDBU Procurement Conference is a national conference fostering business partnerships between the Federal Government, its prime contractors, and small, minority, service-disabled veteran-owned, veteran-owned, HUBZone, and women-owned businesses. Now in its 22nd year, the OSDBU Directors Conference has become the premier event for small business throughout the United States.

The OSDBU Procurement Conference is a national conference fostering business partnerships between the Federal Government, its prime contractors, and small, minority, service-disabled veteran-owned, veteran-owned, HUBZone, and women-owned businesses. Now in its 22nd year, the OSDBU Directors Conference has become the premier event for small business throughout the United States.

Apps for Entrepreneurs

Updated on December 20, 2011 - SBA Names Winners in Small Business Mobile Apps Challenge

Updated on December 20, 2011 - SBA Names Winners in Small Business Mobile Apps Challenge

For most entrepreneurs and small businesses, the Federal government has useful programs and services, but it can be hard to identify, engage and navigate Federal websites. Often, small businesses do not know that the Federal government already offers a program that they would find useful. Entrepreneurs and small businesses need better tools to navigate the Federal government’s vast resources – including programs, services, and procurement opportunities. The goal of the Apps for Entrepreneurs is to give small businesses and entrepreneurs those better tools through this challenge format.

How to Enter

To enter, participants should develop an innovative application designed for the Web, a personal computer, a mobile handheld device, console, or any platform broadly accessible on the open internet that utilizes data which is freely available on Federal government websites.

Increase Collaboration among Federal Agencies and with Private & Public Sector

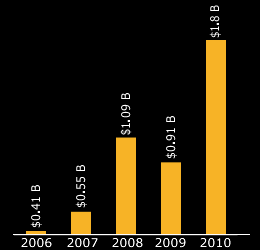

In support of the President’s call to increase collaboration among federal agencies and with private and public sector entities, there has been an abundance of interagency initiatives geared to increase job creation and entrepreneurship. Among these, MBDA has partnered with other federal agencies in support of the Job and Innovation Accelerator, Strong Cities, Strong Communities and Start-Up America.

In support of the President’s call to increase collaboration among federal agencies and with private and public sector entities, there has been an abundance of interagency initiatives geared to increase job creation and entrepreneurship. Among these, MBDA has partnered with other federal agencies in support of the Job and Innovation Accelerator, Strong Cities, Strong Communities and Start-Up America.

As a federal partner, MBDA is providing technical support to grantees of the Job Accelerator to identify and match minority businesses with potential procurement opportunities resulting from the 20 regional innovation clusters. Moreover, we are excited that three MBDA Business Center operators won grants to implement the Job Accelerator projects. MBDA also has boots on the ground in New Orleans and Fresno, California to support economic development, business formation and expansion in those cities as part of the Strong Cities, Strong Communities initiative. In addition, MBDA continues to participate in the Start-Up America initiative to support business formation and innovation.

As many of you may know, last year the President signed into law The Wall Street Reform and Consumer Protection Act, commonly known as the Dodd-Frank Act, to promote the financial stability of America and to protect consumers from abusive financial service practices, among other purposes. In particular, the law brought many changes to increase transparency and accountability in the financial industry, strengthen consumer protection against unfair lending practices, and to promote greater inclusion of minorities and women in the employment and procurement of federal financial regulatory agencies. The law established the new Consumer Financial Protection Bureau and the Offices of Minority and Women Inclusion at the Department of the Treasury, the Federal Deposit Insurance Corporation, the Board of Governors of the Federal Reserve System, and the newly created Consumer Financial Protection Bureau, among other federal financial regulatory agencies.