Understanding your CP259C Notice

We sent you this notice because our records indicate you are presumed to be a private foundation and you didn't file a required Form 990-PF, Return of Private Foundation or Section 4947(a)(1) Nonexempt Charitable Trust Treated as a Private Foundation.

Printable samples of this notice (PDF)

Tax publications you may find useful

- Publication 557, Tax Exempt Status for Your Organization

- Publication 583, Starting a Business and Keeping Records

- Publication 4221-PF, Compliance Guide for 501(c)(3) Private Foundations

- Instructions for Form 990-PF

- Instructions for Forms 1023, SS-4, 1041, and/or 1120

- Find a copy of any necessary tax forms and instructions

How to get help

Calling the 1-800 number listed on the top right corner of your notice is the fastest way to get your questions answered.

You can also authorize someone (such as an accountant) to contact the IRS on your behalf using this Power of Attorney and Declaration of Representative (Form 2848).

What you need to do

- Disregard this notice if you have filed the return within the last four weeks using the same name and EIN listed on the notice.

- Otherwise, file your required Form 990-PF immediately according to the instructions on the notice.

- If you don't think you need to file, complete the Response form enclosed with your notice and mail it to us using the envelope provided.

- If you filed more than four weeks ago or used a different name or EIN, complete the Response form enclosed with your notice and mail it to us in the envelope provided along with a signed and dated copy of the return.

You may want to...

- Review the filing requirements for your organization at Tax Information for Charities & Other Non-Profits.

Answers to Common Questions

Which organizations must file a Form 990-PF?

Form 990-FP must be filed by:

- Exempt private foundations (section 6033(a), (b), and (c))

- Taxable private foundations (section 6033(d))

- Organizations that agree to private foundation status and whose applications for exempt status are pending on the due date for filing

- Organizations that made an election under section 41(e)(6)

- Foundations that are making a section 507 termination

- Section 4947(a)(1) nonexempt charitable trusts treated as private foundations (section 6033(d))

When is Form 990-PF due?

Form 990-PF is due by the 15th day of the 5th month following the close of the foundation's accounting period. Thus, for a calendar year taxpayer, Form 990-PF is due on May 15 of the following year. If any due date falls on a Saturday, Sunday, or legal holiday, the foundation can file the return on the next business day.

More information can be found at Tax Information for Private Foundations.

Can I get help over the phone?

If you have questions and/or need help completing this form, please call 1-877-829-5500. Personal assistance is available Monday through Friday, 7:00 a.m. to 7:00 p.m. CT.

Where can I go for more information about tax-exempt organizations?

For more information on tax-exempt organizations see Tax Information for Charities & Other Non-Profits.

Tips for next year

Review the tax-exempt organization resources at Form 990 Resources and Tools for Exempt Organizations.

Understanding your notice

Reading your notice

Your notice may look different from the sample because the information contained in your notice is tailored to your situation.

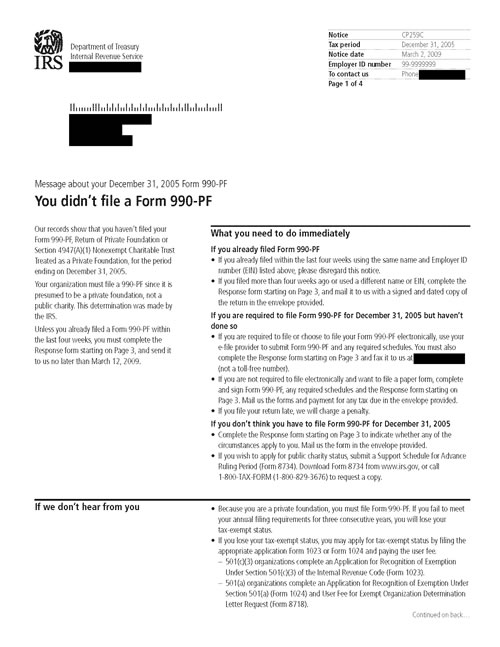

Notice CP259C, Page 1

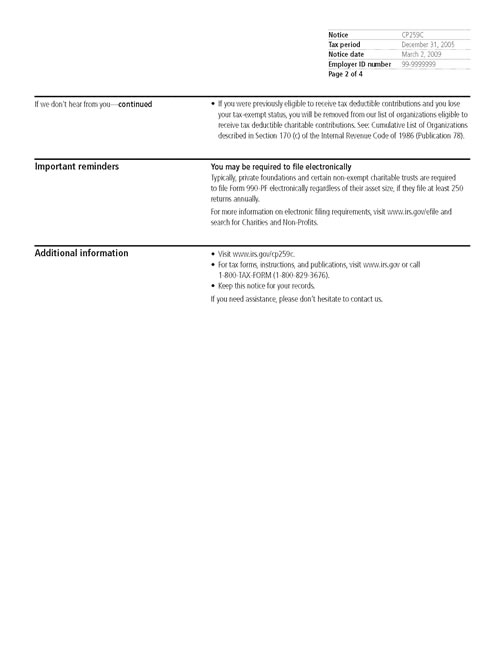

Notice CP259C, Page 2

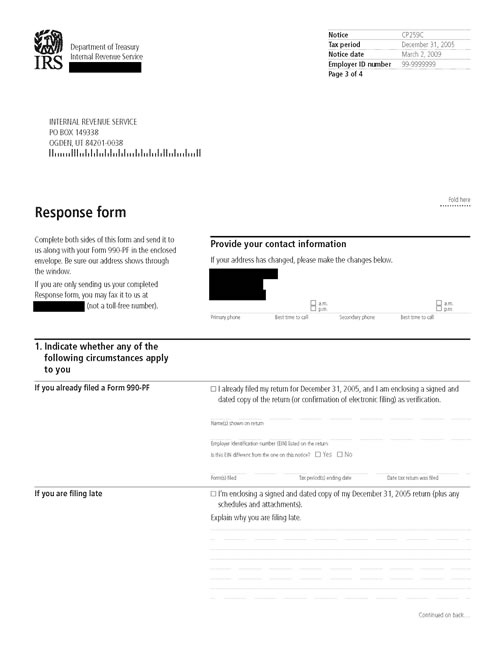

Notice CP259C, Page 3

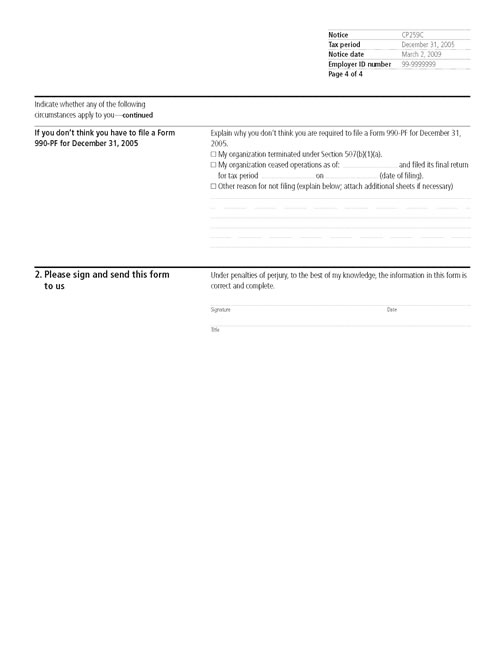

Notice CP259C, Page 4