Who has benefits in private industry in 2012?

Health, retirement, and paid leave benefits made up more than three-fifths of private industry employer-provided benefit costs in March 2012.1 Although employers in most states are not required to offer these benefits, they often make some form of each major benefit type available to their employees, especially to full-time and high-wage workers. For example, paid holidays are offered to 77 percent of private industry workers overall and about 90 percent of full-time and high-wage workers. Medical care and retirement benefit availability show similar patterns.

This issue of Beyond the Numbers provides an overview of benefits for private industry workers, focusing on access to and participation in retirement, medical care, and paid leave benefits by various worker and establishment characteristics. The estimates of private industry benefit access, participation, and share of medical care premiums in this issue are from the “National Compensation Survey: Employee Benefits in the United States—March 2012,� available online at http://www.bls.gov/ncs/ebs/sp/ebnr0018.pdf.

A glossary of terms used in this issue is at the end of the article.

Retirement plans

Nearly two-thirds of private industry workers had access to some form of retirement plan, typically either a defined-benefit plan (such as a pension) or defined-contribution plan (such as a 401(k)), and 48 percent chose to participate in a retirement benefit plan. (See table 1.) Access to retirement plans varied significantly by major occupational group, full- or part-time status, bargaining status, and wage category. Management, professional, and related occupations had nearly twice the access rate and more than 3 times the participation rate of service occupations. (Some examples of service occupations are healthcare support, protective service, food preparation, maintenance, and personal care workers.) Similarly, full-time workers had nearly twice the access rate and 3 times the participation rate of part-time workers. Union workers showed very high access (92 percent) and participation (85 percent) rates for retirement plans. Â

Table 1

| Characteristic | Retirement | Medical care | ||||

|---|---|---|---|---|---|---|

| Access | Participation | Take-up rate | Access | Participation | Take-up rate | |

All workers(1) | 65 | 48 | 75 | 70 | 51 | 72 |

| Worker characteristic | Â | Â | Â | Â | Â | Â |

Management, professional, and related | 79 | 68 | 86 | 87 | 67 | 76 |

Service | 40 | 21 | 51 | 41 | 25 | 62 |

Sales and office | 69 | 51 | 74 | 72 | 50 | 70 |

Natural resources, construction, and maintenance | 65 | 51 | 78 | 77 | 57 | 75 |

Production, transportation, and material moving | 66 | 50 | 76 | 75 | 57 | 76 |

Full time | 74 | 59 | 80 | 86 | 64 | 74 |

Part time | 38 | 19 | 50 | 24 | 13 | 54 |

Union | 92 | 85 | 92 | 94 | 78 | 83 |

Nonunion | 62 | 45 | 72 | 67 | 48 | 71 |

Low-wage workers (lowest 25 percent) | 38 | 17 | 45 | 34 | 19 | 57 |

High-wage workers (highest 25 percent) | 85 | 75 | 89 | 92 | 73 | 79 |

| Establishment characteristic | Â | Â | Â | Â | Â | Â |

1 to 99 workers | 50 | 34 | 68 | 57 | 41 | 71 |

100 to 499 workers | 79 | 58 | 74 | 82 | 59 | 72 |

500 workers or more | 86 | 76 | 88 | 89 | 68 | 76 |

Footnotes: | ||||||

SOURCE: U.S. Bureau of Labor Statistics, National Compensation Survey. | ||||||

Â

High-wage workers (those in the top 25 percent of all wage earners, with earnings at or above $24.81 per hour) had significantly higher rates of access and participation in retirement plans than those of low-wage workers (those in the lowest 25 percent of all wage earners, with earnings at or below $10.69 per hour).2 High-wage workers had access rates of 85 percent and participation rates of 75 percent. In other words, 89 percent of the high-wage workers who were eligible for retirement benefits participated in the plan (known as the take-up rate), a significantly higher share than the take-up rate of 45 percent for low-wage workers. Low-wage workers seem to be at a disadvantage because they may have more difficulty providing employee contributions, which are often required to participate in a retirement plan such as a 401(k).

Workers in large establishments (500 workers or more) had a retirement participation rate that was more than twice that of workers in small establishments (less than 100 workers). In addition, the take-up rate for workers in large establishments was 20 percentage points higher than the rate for workers in small establishments.

Medical care plans

Medical care insurance plans were available to 70 percent of private industry workers in March 2012. Of those workers with access to employer-provided medical care benefits, 72 percent participated in such plans. (See table 1.) Some workers may not have participated in medical care coverage because they already had health coverage through a spouse or another family member, or they simply decided they did not want to pay the employee share of premiums for employer-provided medical care coverage.Â

Medical care access rates were more than 80 percent for certain private industry worker characteristics, including for full-time workers (86 percent), management, professional, and related workers (87 percent), workers with wages in the highest 25 percent of all workers (92 percent), and union workers (94 percent). Medical care participation rates for all these groups were above 60 percent. Large establishments also showed significantly higher medical care access and participation rates compared with small establishments.

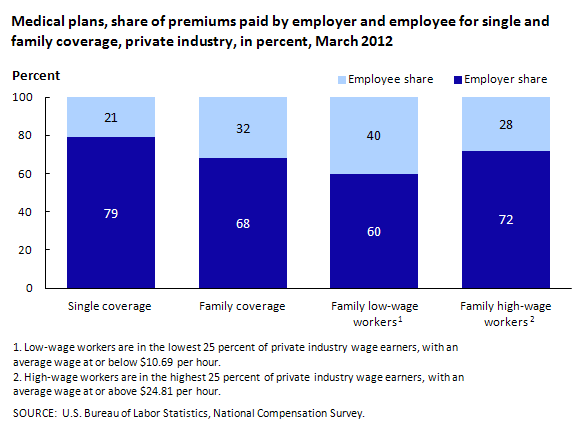

Private industry employers paid, on average, 79 percent of premiums for single coverage and 68 percent of premiums for family coverage. For low-wage employees with family coverage, the employee premium share required for employer-provided medical plans was approximately 40 percent higher than for high-wage workers. (See chart 1.)

Chart 1

Paid leave

Major categories of paid leave benefits, such as sick leave, vacation, and holidays, were all available to the majority of private industry employees. However, benefits varied widely by type and among different worker and establishment characteristics. (See table 2.)

Paid vacation was available to 77 percent of all private industry workers. Access to paid vacation varied by major occupational group, from 87 percent for management, professional, and related workers to 56 percent for service workers. The majority of full-time workers (91 percent) received paid vacation benefits, compared with 35 percent of part-time workers. For high-wage workers, 90 percent had access to paid vacation, compared with approximately one-half of low-wage workers.

Table 2

| Characteristic | Paid sick leave | Paid vacation | Paid holidays |

|---|---|---|---|

All workers(1) | 61 | 77 | 77 |

| Worker characteristic | Â | Â | Â |

Management, professional, and related | 84 | 87 | 89 |

Service | 40 | 56 | 53 |

Sales and office | 65 | - | 81 |

Natural resources, construction, and maintenance | 53 | 82 | 82 |

Production, transportation, and material moving | 52 | 83 | 84 |

Full time | 75 | 91 | 90 |

Part time | 23 | 35 | 40 |

Union | 73 | 91 | 91 |

Nonunion | 60 | 75 | 76 |

Low-wage workers (lowest 25 percent) | 29 | 49 | 50 |

High-wage workers (lowest 25 percent) | 84 | 90 | 91 |

| Establishment characteristic | Â | Â | Â |

1 to 99 workers | 52 | 69 | 69 |

100 to 499 workers | 66 | 83 | 84 |

500 workers or more | 82 | 90 | 91 |

Footnotes: | |||

NOTE: Dash indicates no workers in this category or data did not meet publication criteria. | |||

Â

Private industry employees’ levels of access to paid holidays were similar to their levels of access to paid vacations. For paid holidays, 77 percent of private industry workers received benefits. Full-time workers received paid holidays at more than twice the rate of part-time workers. Significantly higher numbers of high-wage workers received paid holidays (91 percent); just half of low-wage workers received them. More than 90 percent of workers in large establishments received paid holidays, compared with 69 percent of workers in small establishments.

Paid sick leave benefits were not as common among private industry workers. Data indicate that 61 percent of all private industry workers received paid sick leave, while 77 percent of private industry workers received paid holidays and paid vacation. There were great differences in access to paid sick leave, depending on full-time and part-time status, wage category, and establishment size. Full-time workers received paid sick leave benefits at more than 3 times the rate of part-time workers, and high-wage workers received paid sick leave benefits at nearly 3 times the rate of low-wage workers. The rate of paid sick leave benefits was far more common in middle and large establishments than in small establishments.

Detailed incidence and provision data for both private industry and state and local government will be available in early fall. For all benefit publications, see http://www.bls.gov/ebs.

This Beyond the Numbers report was prepared by National Compensation Survey staff, Office of Compensation Levels and Trends, Washington, DC. Email: NCSInfo@bls.gov. For more benefits information, please see http://www.bls.gov/ebs. For additional assistance, contact one of our information offices: National–Washington, DC: (202) 691-6199, TDD (800) 877-8339; Atlanta (404) 893-4222; Boston: (617) 565-2327; Chicago: (312) 353-1880; Dallas: (972) 850-4800; Kansas City: (816) 285-7000; New York: (646) 264-3600; Philadelphia: (215) 597-3282; San Francisco: (415) 625-2270.

Information in this article will be made available to sensory-impaired individuals upon request. Voice phone: (202) 691-5200. Federal Relay Service: 1-800-877-8339. This article is in the public domain and may be reproduced without permission.

Suggested citation:

“Who has benefits in private industry in 2012?,” Beyond the Numbers: Pay & Benefits, vol. 1, no. 13 (U.S. Bureau of Labor Statistics, September 2012), http://www.bls.gov/opub/btn/volume-1/who-has-benefits-in-private-industry-in-2012.htm

Access. An employee has access to a benefit plan if the employee is in an occupation that is offered the plan. By definition, either all employees in an occupation have access to a benefit, or none has access. Access is the only measure of incidence used for leave benefits (e.g. vacation, holidays, and sick leave).

Defined-benefit plan. A defined-benefit retirement plan provides employees with guaranteed retirement benefits that are based on a benefit formula. A participant’s retirement age, length of service, and preretirement earnings may affect the benefit received.

Defined-contribution plan. A defined-contribution retirement plan specifies the level of employer contributions and places those contributions into individual employee accounts. Retirement benefits are based on the level of funds in the account at the time of retirement.

Medical care. Plans that provide payments or services rendered in the hospital or by a qualified medical care provider.

Participation. Participation is the percent of employees who actually enroll in a benefit plan. A plan may be a contributory plan that requires employees to contribute to the plan’s cost in order to participate, or it may be a noncontributory plan in which the employer pays 100 percent of the cost of the benefit.

Take-up rate. The take-up rate is the rate at which workers participate in the plans that are available to them.

1National Compensation Survey produces quarterly data on employer costs per employee hour worked for wages and salaries and benefits in Employer Costs for Employee Compensation, available online at http://www.bls.gov/news.release/archives/ecec_06072012.pdf.

2 The percentile values are based on wages published in the bulletin National Compensation Survey: Occupational Earnings in the United States, 2010 (Bulletin 2753), available online at http://www.bls.gov/ncs/ncswage2010.htm.

Â

Publish Date: Wednesday, September 12, 2012