How does the GSA SmartPay Program work?

The GSA SmartPay Program manages a set of master contracts through which agencies and organizations can obtain charge cards for employees to accomplish the agency or organization’s mission. Agencies can obtain a number of different types of charge card products and services, including purchase, travel, fleet, and integrated cards.

Agencies and organizations issue a task order under the GSA SmartPay 2 master contracts, and award their program to one of the GSA SmartPay 2 contractor banks (Citibank, JPMorgan Chase, or U.S. Bank). The banks provide charge cards to the agency or organization employees to make purchases on behalf of the agency/organization.

Who qualifies for a Government charge card?

Eligibility for the program is determined by the GSA SmartPay Contracting Officer. Federal agencies, departments, tribal organizations, and approved non-federal entities can apply to obtain charge card services under the GSA SmartPay program.

Why does the Government have a charge card program?

Charge cards enable authorized Government employees to make purchases on behalf of the Government to support their agency or organization’s mission, mostly for small (generally under $3,000) work-related purchases, travel expenses, and fuel. In many cases, traditional paper-based processing techniques cost the Government more to process the transaction than the transaction itself. Charge cards:

- Streamline transaction processing;

- Increase accountability;

- Provide agencies with a more efficient and effective means to monitor large numbers of transactions and identify fraud, waste, and abuse.

Prior to using charge cards, the Government used traditional paper-based payment processes such as purchase orders for small purchases. The inefficiency, costs, and/or risks associated with these processes were a key factor in the dramatic increase in the use of charge cards.

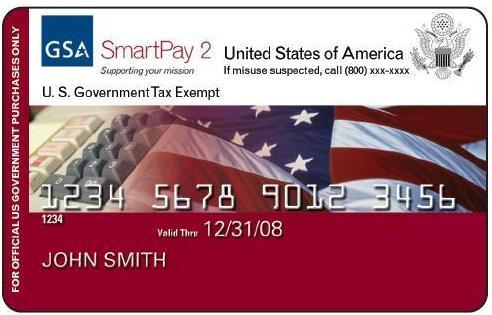

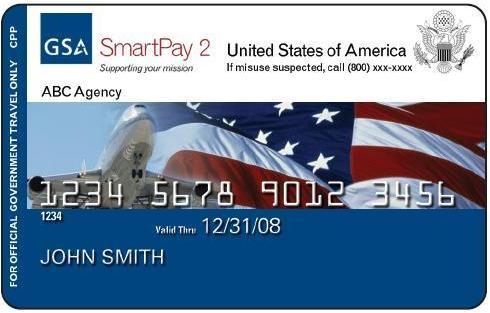

What types of charge cards does the Government use?

There are four primary card types offered through the GSA SmartPay program. Each card type has a specific purpose, and is used by cardholders to make different types of purchases. These card types include purchase, travel, fleet, and integrated cards.

Purchase cards are used to make general purchases for supplies and services. All purchase cards are centrally billed to the Government, and paid for by the Government.

Travel cards are used specifically to pay for travel related expenses for Government employees on official Government travel. Travel cards come in two types, centrally billed accounts (CBA) and individually billed accounts (IBA).

- CBA cards tend to be used to manage the travel plans for a group of people or an office. These are billed to and paid by the Government.

- IBA cards are issued to individual Government travelers, and are billed to and paid by the Government traveler. Generally the Government traveler has to file a travel voucher with their agency to get reimbursed for their travel expenses.

Fleet cards are used to manage vehicles for Government agencies, specifically for fuel and minor repairs. All fleet cards are CBAs.

Integrated cards are cards that are used for more than one type of purchase. For example, a person may have an integrated card that allows them to make office supply purchases and to charge travel expenses.

What are the benefits of charge card use by the Government?

There are a number of benefits associated with the use of charge cards by the Government:

- Administrative cost savings – The estimated administrative savings for the purchase card alone is $1.7 billion per year ($70 per transaction) when used in place of a written purchase order. No studies have been done to estimate the transactional savings of the other programs.

- Identification for discount programs – The GSA SmartPay travel card is required to obtain airfare discounts through the GSA City Pairs program, creating an estimated $3.6 billion in annual savings Governmentwide.

- Agency refunds – Charge cards generate performance-based refunds for agencies.

- Others – Charge cards provide other less tangible benefits, including detailed transaction data, improved ability to monitor transactions, travel insurance, and eliminate the need for imprest funds or petty cash at the agency.

Which banks provide charge cards to the Government?

Three banks provide charge cards under the current GSA SmartPay2 contract: Citibank, JPMorgan Chase, and US Bank. The current contracts provide service from 2007 through 2018.

How much money is spent using Government charge cards each year?

For more detail on the performance of the GSA SmartPay program, please see the Program Statistics page.

What alternatives are available instead of charge cards?

Other options include debit cards, prepaid cards, or alternative payment platforms(e.g., electronic fund transfers linked to a payment tracking system). Agencies have the option to obtain these tools through the GSA SmartPay2 master contract.

Federal Government Shutdown: What does the GSA SmartPay 2 Master Contract say about a shutdown?

Each year, Congress must pass appropriation bills that provide legal authority to spend or obligate U.S. Treasury Funds. The bills must then be signed into law by the President or become law through a Congressional override of a Presidential veto. It is possible that all of the appropriation bills will not be completed in time for the start of any given fiscal year. A continuing resolution is usually passed to allow the Government to continue to function; however, in recent years, the Government has been required to “shutdown” nonessential functions. In the event of a government-wide shutdown, payment to the Contractor would be late for most accounts; however, all centrally billed accounts would be paid with Prompt Payment Act interest upon a budget passing. The Contractor shall not deactivate any account in this situation unless otherwise notified by GSA or the agency/organization.

Federal Government Shutdown: Can I still use my card?

Yes; the GSA SmartPay® 2 banks will continue to function as normal when there is a Government shutdown and purchase, travel, fleet and integrated cards will continue to function normally, absent any agency-specific action to disable the cards. Cardholders are reminded to check with their agency regarding continued use of cards due to appropriation limitations in place during shutdown. You may not be authorized to use your card if your agency has determined you are not an excepted employee during the shutdown.

Please Note: The Anti-Deficiency Act prohibits most agencies from incurring obligations in the absence of appropriations (unless otherwise allowed by law or for emergencies involving the safety of life or limb, the protection of property, or other excepted services). Please coordinate with the appropriate officials in your agency to ensure only appropriate purchases are made and payments are issued in the event of a shutdown, as this issue can become quite complicated given the wide variety of agency missions, funding types, etc.

Federal Government Shutdown: Will the banks’ 1-800 customer service call centers continue to operate?

Yes, if you need to reach the bank during the shutdown, please call the 1-800 number on the back of your GSA SmartPay charge card.

Federal Government Shutdown: Do I still have to pay my individually billed travel card bill?

The answer to this question depends on which contractor bank services your GSA SmartPay charge card account(s).

CITIBANK

In the event of a Government-wide shutdown, many Agencies/Organizations and Cardholders may be unable to make payments. Citibank will ensure that during such periods accounts will not age delinquent or be suspended or cancelled. During this time finance charges will not be assessed; however, Statements of Account will continue to be generated.

JP MORGAN

JP Morgan will work with individual cardholders on a case-by-case basis in the event of government-wide shutdown to address hardships caused by this event. Individual decisions regarding how to assist each cardholder will be made. Standard processes including account aging, late fees and finance charges would remain in force unless it is determined by the bank that an individual cardholder has experienced a hardship related to the shutdown.

US BANK

U.S. Bank will not deactivate any account without authorization from the GSA Contracting Officer. U.S. Bank understands that accounts could become past due until budgetary issues are resolved. Once the budget is approved, we will work with the Government to bring past due accounts up to date. U.S. Bank will also work with the Government to implement risk mitigation measures to monitor fraud and unusual delinquencies in the event of a Government-wide shutdown.

Federal Government Shutdown: If I am late paying due to the shut-down, will my card become delinquent?

Please see the answers to the question above as each bank will treat delinquency differently.

Federal Government Shutdown: What if my card is already delinquent; will I be given more time to pay?

No. Payment is due to the contractor bank per the statement due date. If your account is delinquent prior to the shutdown, it will continue to be considered to be delinquent until full payment is made to the contractor bank. The time elapsed after payment is due does not stop accruing in the event of a government shutdown.

Federal Government Shutdown: My card is about to expire. Will I receive my new card during a shut-down?

Yes. In accordance with the terms of the GSA SmartPay master contract, if your card is due to expire during a government shut-down, your new card will still be mailed out. If your agency elects to have the charge cards sent directly to you (for example, an individually billed travel card) then you will receive the card at the address on file. If on the other hand, your agency has elected to have the cards mailed to the government offices for dissemination by an Agency/Organization Program Coordinator or other government employee, then your card will be mailed by the bank but most likely be held by the distributing government office until the shut-down is over. If you are deemed an excepted employee, your agency will most likely deliver the card to you, but confirm card delivery procedures with the appropriate officials in your management chain prior to the start of the shutdown period.

Federal Government Shutdown: What if I am on travel during a shutdown?

Unless your agency takes action to disable travel cards, your card will continue to work if you are on travel during a government shut-down. However, there are rules related to employees on travel during a shut-down, so please check with your agency regarding what actions are required while traveling during a shut-down.

Federal Government Shutdown: What if I have recurring or automatic payments on my purchase card?

Please coordinate with your agency/organization finance officials and Agency/Organization Program Coordinator to ensure that these payments are properly dispositioned in the event of a shutdown. While it is likely a shutdown will be brief in duration, be advised that purchase cardholders may need to contact merchants to stop any automatic payments which may be scheduled to occur during the shutdown period.

Note: The Anti-deficiency Act prohibits most agencies from incurring obligations in the absence of appropriations (unless otherwise allowed by law or for emergencies involving the safety of life or limb, the protection of property, or other excepted services). Again, please coordinate with the appropriate officials as needed to ensure only appropriate purchases are made and payments are issued in the event of a shutdown, as this issue can become quite complicated.

Tips for cardholders to help detect and avoid fraud.

Tips for cardholders to help detect and avoid fraud.