Analysis & Projections

-

U.S. households forecast to use more heating fuels this winter compared with last winter ›

Analysis of the Clean Energy Standard Act of 2012 ›

New EIA analysis: What drives crude oil prices? ›

Energy In Brief

What is a cap-and-trade program and how does it work?

A cap-and-trade program is designed to reduce emissions of a pollutant by placing a limit (or cap) on the total amount of emissions. The cap is implemented through a system of allowances that can be traded to minimize costs to affected sources. Cap-and-trade programs for greenhouse gas emissions would increase the costs of using fossil fuels.

What are renewable portfolio standards (RPS) and how do they affect generation of electricity from renewable sources?

Renewable portfolio standards are policies designed to increase electricity generation from renewable resources, including wind, solar, geothermal, and biomass. Many States have their own renewable portfolio standards, although currently there is no program at the National level. States with renewable portfolio programs have seen an increase in the amount of electricity generated from renewable fuels.

Features

Short-Term Energy and Winter Fuels Outlook

Short-Term Energy and Winter Fuels OutlookReleased October 10, 2012 | Next Release: November 6, 2012

EIA's monthly energy projections through 2013. Includes supply, consumption, and price projections for oil and liquid fuels, natural gas, coal, electricity, and renewable energy. The Market Prices and Uncertainty Report is a regular monthly supplement to the Short-Term Energy Outlook.

The Availability and Price of Petroleum and Petroleum Products Produced in Countries Other Than Iran

The Availability and Price of Petroleum and Petroleum Products Produced in Countries Other Than Iran Released August 24, 2012

This is the third in a series of reports to Congress on the availability and price of petroleum and petroleum products produced in countries other than Iran in the 60-day period preceding the submission of the report.

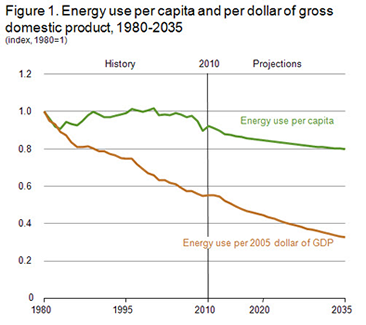

Annual Energy Outlook 2012Released June 25, 2012 | Next Release: June 2013

The Annual Energy Outlook 2012 includes many cases that provide alternative projections of energy markets under a variety of different assumptions. Detailed model results through 2035 are available in an interactive table browser along with extensive analysis of energy issues, regulations, and legislation in the complete report.

Potential Impacts of Reductions in Refining Activity on Northeast Petroleum Product Markets

Potential Impacts of Reductions in Refining Activity on Northeast Petroleum Product MarketsReleased February 27, 2012

Jones Act Addendum: May 11, 2012This report is an update to a previous EIA report, Reductions in Northeast Refining Activity: Potential Implications for Petroleum Product Markets, released in December 2011. This update analyzes possible market responses and impacts in the event Sunoco's Philadelphia refinery closes this summer, in addition to the recently idled refineries on the East Coast and in the U.S. Virgin Islands.

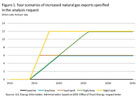

Effect of Increased Natural Gas Exports on Domestic Energy Markets as requested by the Office of Fossil Energy

Effect of Increased Natural Gas Exports on Domestic Energy Markets as requested by the Office of Fossil Energy Released January 19, 2012

This report responds to an August 2011 request from the U.S. Department of Energy's Office of Fossil Energy (DOE/FE) for an analysis of "the impact of increased domestic natural gas demand, as exports."

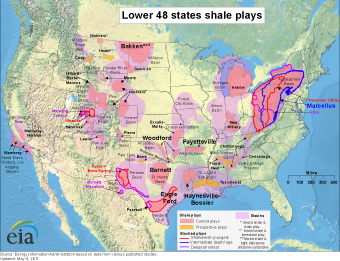

Review of Emerging Resources: U.S. Shale Gas and Shale Oil Plays

Review of Emerging Resources: U.S. Shale Gas and Shale Oil PlaysReleased July 8, 2011

To gain a better understanding of the potential U.S. domestic shale gas and shale oil resources, EIA commissioned INTEK, Inc. to develop an assessment of onshore Lower 48 States technically recoverable shale gas and shale oil resources. This paper briefly describes the scope, methodology, and key results of the report and discusses the key assumptions that underlie the results.

What's New in Analysis & Projections

Short-Term Energy Outlook

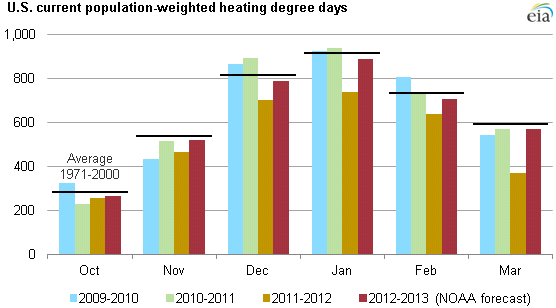

October 10, 2012U.S. households forecast to use more heating fuels this winter compared with last winter

October 10, 2012Projected Alaska North Slope oil production at risk beyond 2025 if oil prices drop sharply

September 14, 2012Requested service reports

from Congress and othersNatural Gas Exports from Iran October 9, 2012

The Availability and Price of Petroleum and Petroleum Products Produced in Countries Other Than Iran August 24, 2012

Analysis of the Clean Energy Standard Act of 2012 May 2, 2012

Sales of Fossil Fuels Produced from Federal and Indian Lands, FY 2003 through FY 2011 March 14, 2012

More service reports ›Presentations

The Future Electricity Fuels Mix: Key Drivers

Howard Gruenspecht, Acting Administrator

May 15, 2012The U.S. Energy Future

Howard Gruenspecht, Acting Administrator

April 26, 2012

More presentations ›What is the outlook for gasoline prices ? ›