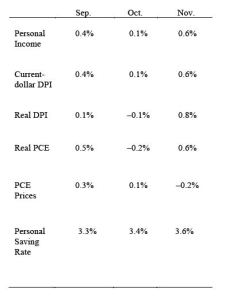

Personal income increased 0.6 percent in November after increasing 0.1 percent in October. Wages and salaries increased 0.6 percent in November after decreasing 0.3 percent in October. The October decrease reflected work interruptions caused by Hurricane Sandy, which reduced wages and salaries by 0.3 percent.

Personal income increased 0.6 percent in November after increasing 0.1 percent in October. Wages and salaries increased 0.6 percent in November after decreasing 0.3 percent in October. The October decrease reflected work interruptions caused by Hurricane Sandy, which reduced wages and salaries by 0.3 percent.

Current-dollar disposable personal income (DPI), after-tax income, increased 0.6 percent in November after increasing 0.1 percent in October.

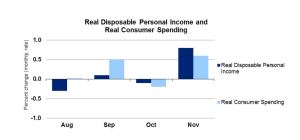

Real DPI, income adjusted for taxes and inflation, grew 0.8 percent in November after decreasing 0.1 percent in October.

Real consumer spending, spending adjusted for price changes, increased 0.6 percent in November after falling 0.2 percent in October. Spending on durable goods increased 2.9 percent in November after falling 0.9 percent in October.

PCE prices decreased 0.2 percent in November after increasing 0.1 percent in October.

PCE prices decreased 0.2 percent in November after increasing 0.1 percent in October.

Personal saving rate

Personal saving as a percent of DPI was 3.6 percent in November, compared with 3.4 percent in October.

To learn more about personal income and outlays, read the full report.