| Home |

|

| Our economists engage in scholarly research and policy-oriented analysis on a wide range of important issues. More ›› |

New from Liberty Street Economics |

The Minimum Balance at Risk: A Proposal to Stabilize Money Market Funds

The Minimum Balance at Risk: A Proposal to Stabilize Money Market Funds

Money market funds are vulnerable to runs that can harm investors and the financial system. Cipriani et al. propose a way to reduce, and possibly eliminate, the incentive for investors to run from a troubled fund. By Marco Cipriani, Michael Holscher, Antoine Martin, and Patrick McCabe |

Research Topics in Focus |

Expanded Reporting of U.S. Banking Trends

Expanded Reporting of U.S. Banking Trends

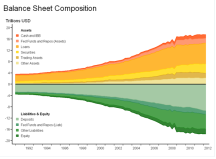

Economists in the Financial Intermediation Function have published the first edition of a new quarterly report tracking the consolidated financial condition of the U.S. commercial banking industry. Quarterly Trends for Consolidated U.S. Banking Organizations analyzes aggregate trends in profitability, assets, capital, and other key measures for commercial banks and bank holding companies (BHCs). The report accounts for nonbank subsidiaries of BHCs, such as broker-dealers and asset management firms, distinguishing it from other industry profiles. |

Report on the Competitiveness of Puerto Rico's Economy

Report on the Competitiveness of Puerto Rico's Economy

Experts from the Bank's research, outreach and education teams were commissioned to analyze the challenges facing Puerto Rico and to put forward recommendations on how to capitalize on the Island’s strengths to promote growth. The results, presented in both English and Spanish, represent their efforts made in consultation with local, national and international experts, as well as stakeholders on the Island itself. |

The Labor Market in Recession and Recovery

The Labor Market in Recession and Recovery

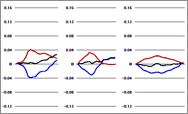

For a recent Liberty Street Economics blog series, a dozen of our economists teamed up to frame the issues affecting the U.S. jobs picture. This interactive graphic, developed for the project, tracks three key measures of labor market health—the unemployment rate, the labor market participation rate, and the employment-to-population ratio—over five recent recessions. The chart also links to blog posts that assess the importance of changing long-term trends in participation and cyclical behaviors. |

| More >> |

Events |

|

Money and Payments Workshop: Financial Market Structure

On October 19, 2012, the Federal Reserve Bank of New York will host a workshop for academics and central bank researchers to discuss current research on the importance of financial market structure. The event will feature presentations on issues related to central counterparty clearing, dealer networks, and the impact of dark pools on price discovery, among other topics. |

Recent Articles |

Assessing the Quality of “Furfine-based” Algorithms

Assessing the Quality of “Furfine-based” Algorithms

Some academic research on the fed funds market relies on individual transactions inferred indirectly from an algorithm, the accuracy of which has not been formally established. This paper tests the algorithm, and obtains results that raise concerns about its appropriateness. By Olivier Armantier and Adam Copeland, Staff Report 575, October 2012 |

The Forward Guidance Puzzle

The Forward Guidance Puzzle

DSGE models tend to overestimate the macroeconomic impact of a key tool for central bankers: forward guidance; this study suggests another way to assess the tool's effectiveness. By Marco Del Negro, Marc Giannoni, and Christina Patterson, Staff Report 574, October 2012 |

Job Polarization and Rising Inequality in the Nation and the New York-Northern New Jersey Region

Job Polarization and Rising Inequality in the Nation and the New York-Northern New Jersey Region

The authors explore the phenomenon of job polarization in the U.S. economy and examine how it has played out in the New York-northern New Jersey region. By Jaison R. Abel and Richard Deitz, Current Issues in Economics and Finance Second District Highlights 18(7), October 2012 |

Key Mechanics of the U.S. Tri-Party Repo Market

Key Mechanics of the U.S. Tri-Party Repo Market

Two important mechanics of the tri-party repo market—the collateral allocation and “unwind” processes—have contributed to systemic weakness and hampered industry reform efforts. By Adam Copeland, Darrell Duffie, Antoine Martin, and Susan McLaughlin, Economic Policy Review, Forthcoming |

Abbott and Bacon Districts: Education Finances during the Great Recession

Abbott and Bacon Districts: Education Finances during the Great Recession

The authors use rich panel data and trend shift analysis to analyze how finances in New Jersey's Abbott and Bacon school districts, as well as the high poverty districts in general, were affected during the Great Recession and the American Recovery and Reinvestment Act (ARRA) federal stimulus period. By Rajashri Chakrabarti and Sarah Sutherland, Staff Reports 573, September 2012 |