-

President Obama congratulated the NY Giants on their XLVI Super Bowl win in a ceremony on the South Lawn this afternoon. The President praised the team for its triumphant end to a difficult season, and their come from behind win of the championship game. He also made a point to note that the team, the coaches, and the owners have all been unwavering in their support of our men and women in uniform:

These guys have made it clear that no matter who you root for on Sundays, if you’re a veteran, the New York Giants are on your team. Whether it’s setting up tickets to games, or inviting folks to practices, the Giants never forget the men and women who risk everything to protect our freedom. And I especially want to thank and congratulate Coach Coughlin on receiving the Army’s Outstanding Civilian Service Award. That's a great honor.

You can read the President's full remarks here

-

President Obama today took to the podium in the White House Briefing Room to discuss the state of the economy and answer a few questions from reporters.

He began by addressing the ongoing crisis in Europe -- America's largest trading partner -- and why it's an area of focus for his administration.

"If there’s less demand for our products in places like Paris or Madrid," he said, "It could mean less businesses...for manufacturers in places like Pittsburgh or Milwaukee."

The President told reporters that, while there are reasons for concern, European leaders have the capacity to solve their problems -- and they'll have the support of the United States in that effort.

-

Today we got more good news showing the difference the health care law is making in people’s lives. A new report from the Commonwealth Fund found that 6.6 million young adults are getting health coverage on their parents’ plans. And according to new data from Gallup, the percentage of young adults who are uninsured continues to decline, indicating that the law is helping families across the country get better access to health care and more peace of mind.

These and other issues came up when I had the privilege to be part of a town hall meeting to discuss the very important topic of women’s health and how the health care law is making the system fair for women and their families across the country.

Joining me were: senior members of the Administration including Valerie Jarrett, Tina Tchen, and Cecilia Muñoz, fellow health experts from HHS including Mayra Alvarez and Caya Lewis, Judy Waxman from the National Women’s Law Center, and a few members of the media including Margarita Bertsos from REDBOOK and Kelly Wallace at iVillage.

-

June 08, 2012

09:30 AM EDTThis past Thursday, officials from the White House and the Department of Health and Human Services held a town hall meeting to discuss how the health care law is helping women and families acros the country. On Monday June 11, we will turn our attention to America’s seniors when we host a a Seniors’ Health Town Hall. The event will be streamed live from the White House from 10 am to 11:30 am ET.

Similar to our Women’s Health Town Hall, this event will be an interactive, open dialogue about how the health care law, the Affordable Care Act, is improving the health and quality of life for the nation’s senior citizens by strengthening the Medicare program:

- It makes preventive services available for free. This includes mammograms, colonoscopies, and an annual wellness visit where seniors can spend more time with their doctor.

- It makes prescription drugs cheaper. Seniors who hit the donut hole get a 50 percent discount on their prescription drugs and the donut hole will be closed completely in the years ahead. It cracks down on waste, fraud and abuse.

Submit questions using the Twitter hashtag #SeniorsHealth or on the HealthCareGov Facebook page.

-

This week, the President traveled to Honeywell International in Minnesota to highlight efforts to help veterans find good paying jobs and urged Congress to support the Paycheck Fairness Act and to not let interest rates double on student loans on July 1.

-

Speaking today at the University of Nevada, Las Vegas, President Obama talked about student loans -- a subject he's personally had quite a bit of experience navigating.

Through the course of their educations -- including a graduate degree for each -- both the President and the First Lady took on debt to pay for school.

"When we got married, we got poorer together," he said. "We sort of added our liabilities together."

In fact, it was 2004 before the Obamas paid off the last of their student loans.

That's not the future he wants for today's college students. And in Las Vegas, he talked about one big step he's taking to help make it easier for everyone to afford a great education:

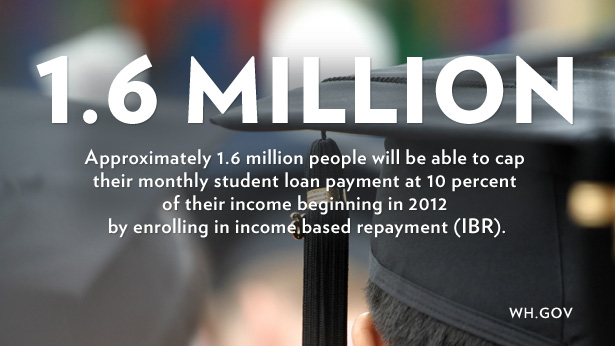

This is a program that more people need to know about. And we’re going to start doing more advertising about this because this is really important. For those of you who are still in school, you're about to graduate, as long as you make your monthly payments on time -- all right, so pay your bills on time -- we will cap the payments you have to make on your student loans at 10 percent of your discretionary income once you graduate. 10 percent.

It's called the Income Based Repayment program. Have questions? Here's everything you need to know. As part of today's event, the President issued a memorandum to streamline the IBR process and improve information available to responsible borrowers about student loan repayment options.

-

Yesterday, we told you about President Obama’s proposal to cut through the red tape that is preventing many homeowners from refinancing their mortgages and saving hundreds of dollars each month and then asked you to answer a few questions and tell us what you think about this issue.

Your response was overwhelming. Nearly 20,000 of you responded in a little over 24 hours, telling us about whether you would benefit from this proposal, what you thought was most compelling about the plan, and sharing any additional questions you may have. One thing we learned? Nearly 50% of you hadn’t heard about the plan before, so we need to keep getting the word out.

Haven’t told us what you think yet? Visit Whitehouse.gov/why-refi.

We’re still pouring over the responses, and in the days ahead we look forward to sharing what we’ve read and answering many of the questions you’ve asked. In the meantime, while we at the White House know why we think this is an important proposal, we wanted to hear from you about how this would make a difference. Here’s what you said:

“Listen, people like me aren't looking for a handout. I've got decent credit and if weren't for the value of my home being significantly less than I owe, I would refinance now. If I could refinance at the historically low rates, I could do two things 1) Pay off some other debt and 2) buy things I and my family need. I would hope from a policy level both of these benefits would resonate because reducing personal debt and spurring consumer spending are both very good for this or any other economy.”

“If I had an extra few hundred dollars each month I'd definitely be spending more and putting that money back into the economy. “

“Finally I feel like there is a program that will benefit people like my husband and myself - people who pay our bills on time, try to skimp and save rather than run up credit card debt, and have never missed a single mortgage payment in 19 years, but because of lowered home values have been unable to take advantage of lower interest rates - until now. This program should save us almost $600 per month and will have more of an impact on our monthly budget than any previous tax rebate programs combined.”

“Three houses in my cul-de-sac were foreclosed recently. The owners tried to refinance so they had lower repayments but the banks wouldn't allow it, because of reasons mentioned in this presentation. With this policy in place, our neighbors would still be here and our community would be stronger for it.”

“My husband and I bought our townhouse in August of 2007, right before the bubble burst. We paid top dollar for a house that's now worth more than $100,000 less than what we paid. We pay our mortgage on time every single month, and we feel that we are being penalized for being responsible. We've considered refinancing, but we don't have the extra cash available to pay for all of the costs and fees associated with doing it. If we were able to refinance, we could save a couple hundred dollars every month that we could then use to replenish our savings, and contribute to the economy. We've always tried to do what's right, but it seems that we're on the losing end of this deal.”

“Being able to refinance while underwater will keep people in their homes. This is a huge money saver for entire neighborhoods. When I was selling a house in Santa Fe my neighbors across the street lost their house. The bank put it on the market for $140000 instead of the $230000 it was worth. That dropped my property value by about $10000. The family moved out and someone broke one of their windows. That cost me a few thousand more. Then someone spray painted graffiti on their garage door and there went more value from my home. There were a couple other houses for sale in the same neighborhood. We all lost because of that foreclosure.”

“It is so important for me because we have tried to refinance and 5 yrs ago I bought my house for $340,000 and today I still owe 240,000 but they tell me it's only worth 220,000! The past five years we paid it down $100,000 and now find out it has no equity and the bank wanted us to bring $25,000 to closing and they could do it! Seriously? If I had $25,000 I wouldn't have to refinance! With our property taxes increased we are now paying $2400 per month for a mortgage! It's getting serious for us because we don't have much of anything left over from our paychecks anymore and hadn't gotten a raise in three years! I so hope this plan goes through!” -

June 07, 2012

02:35 PM EDTEd. note: This is a cross-post from the blog of the Library of Congress. It originally appeared in the Library’s staff newsletter, the Gazette.The writing of Natasha Trethewey explores a past that often is unsettling – growing up biracial in 1960s Mississippi, the lives of forgotten African-American soldiers during the Civil War, the murder of her mother, the aftermath of Hurricane Katrina.

“When you begin to think about the past, you realize how much of it is lost to us,” says Trethewey, the Pulitzer Prize-winning author of “Native Guard.”

On Thursday, Librarian of Congress James H. Billington announced the selection of Trethewey as the Library’s 19th poet laureate consultant in poetry.

-

June 07, 2012

12:50 PM EDTEd. note: this post originally appeared on Treasury Notes, the official blog of the US Department of the Treasury

Today, President Obama heads to the University of Nevada Las Vegas to discuss student loans. The President believes in creating an economy built to last that gives every hard working student a fair shot at developing the skills they need to find a good job by attending college, university, community college, or job training programs. To help put the cost of higher education within reach for more Americans, the President has taken action to cap monthly payments on student loans for responsible graduates who make their payments on time. Continuing to act, he will issue a Presidential Memorandum to streamline the process and improve information available to responsible borrowers about student loan repayment options. Answering the President’s call, Treasury and IRS will begin working on improving the application process for responsible borrowers.

-

Ed. Note: This live session of Office Hours has concluded. View the full question and answer session below or at Storify.com

This afternoon, President Obama is traveling to UNLV where he’ll push Congress to pass his proposals to create jobs and help middle class families. Specifically, he’ll speak about his proposal to stop student loan interest rates from doubling, which would hit millions of hard-working middle class students and their families with the equivalent of a $1,000 tax if Congress doesn’t do its job and work together on a solution to keep rates low.

Tune-in to the President’s speech at UNLV at 3:50 p.m. EDT on WH.gov/live, then join us for Office Hours at 4:30 p.m. EDT. Roberto Rodriguez, Special Assistant to the President for Education Policy, will be on Twitter to answer your questions about student loan interest rates and Income Based Repayment (IBR).

Here’s how it works:

- Ask your questions now and during the live event on Twitter with the hashtag #WHChat

- Follow the Q&A live through the @WHLive Twitter account

- If you miss the live session, the full session will be posted on WhiteHouse.gov and Storify.com/WhiteHouse

So, stop by for Office Hours at 4:30 p.m. EDT today with Roberto Rodriguez and be sure to follow @WhiteHouse for the latest updates and more opportunities to engage.

-

Earlier this week, I spoke at the WINDPOWER 2012 Conference and Exhibition – the largest wind industry event in the world. Building on President Obama’s remarks in Newton, Iowa, I highlighted a few key items on the President’s To-Do list for Congress -- including extending the Production Tax Credit (PTC) and the 48C Advanced Energy Manufacturing Credit.

These credits have played an important role in fueling job creation and supporting a manufacturing base in clean energy. As I told the crowd in Atlanta:

This is a priority for the President because he sees the American wind industry as an American success story. Over the past few years – thanks in part to these tax credits – this industry has flourished. Today, we have enough wind capacity to power 10 million homes across the country. In 2011, which was a banner year for the industry, nearly one-third of all new power capacity in the United States came from wind. Five states now produce more than 10 percent of their electricity from wind power. And in places like Iowa and South Dakota, that figure is closer to 20 percent.

So this is an industry with momentum. And it’s an industry that’s putting people back to work. It used to be that we had to import most of the 8,000 component parts that go into a modern wind turbine. But today, with nearly 500 wind-related manufacturing facilities in 43 states, we’re producing more and more of those parts in America.

-

Over the past several years, the Obama Administration has worked to improve repayment options available to responsible student loan borrowers. Since 2009, former students have been able to enroll in an “Income Based Repayment” (IBR) plan to cap their student loan payments at 15 percent of their current discretionary income if they make their payments on time.

In 2010, President Obama signed into law an improved income-based repayment plan that would lower this cap to 10 percent of discretionary income for students who take out loans after July 1, 2014. Then, last October, the President announced an executive action to make that lower cap available to more borrowers by the end of 2012, rather than 2014. The latest change will likely reduce monthly student loan payments for more than 1.6 million responsible student borrowers.

Despite these opportunities and policy improvements to help graduates make their monthly payments, too few responsible borrowers are aware of their repayment options. Even among borrowers who understand their options, many have difficulties navigating and completing the application process.

Today, President Obama is introducing a Presidential Memorandum that will help educate more students about their loan repayment options and streamline the IBR application process. Read through the questions below to learn more about income based repayment and how these changes might affect you.

1. What is income-based loan repayment?

Income-Based Repayment (IBR) is a repayment plan that caps your required monthly payments on the major types of federal student loans at an amount intended to be affordable based on income and family size. All Stafford, Grad PLUS, and Consolidation Loans made under either the Direct Loan or Federal Family Education Loan programs are eligible to be included in the program. Non-federal loans, loans currently in default, and Parent PLUS Loans are not eligible for the income-based repayment plan.

The program lowers monthly payments for borrowers who have high loan debt and modest incomes, but it may increase the length of the loan repayment period, accruing more interest over the life of the loan.

2. Who qualifies for IBR?

IBR helps people whose federal student loan debt is high relative to income and family size. Currently, your loan servicer (the company you make your loan payments to) determines your eligibility, but starting in September 2012, students won’t have to contact their loan servicer to apply—they will be able to apply directly through the Department of Education’s website, thanks to a new directive from President Obama.

You can use the U.S. Department of Education’s IBR calculator to estimate whether you are likely to qualify for the plan. The calculator looks at your income, family size, and state of residence to calculate your IBR monthly payment amount. If that amount is lower than the monthly payment you are paying on your eligible loans under a 10-year standard repayment plan, then you are eligible to repay your loans under IBR.

-

June 06, 2012

05:46 PM EDTRecently there’s been renewed debate about whether Republicans will stick by their insistence on holding the middle class tax cuts that are scheduled to expire at the end of the year hostage so that they can continue big tax cuts the wealthiest 2 percent of individuals. The President believes we must end the tax rates for the wealthiest Americans and make them permanent for every family bringing in less than $250,000 a year.

There’s a simple choice to make. We can either make investments in education, transportation, and new sources of energy – the types of investments that have always been essential to America’s businesses and to creating good middle class jobs. Or we can cut taxes even more for wealthy Americans who don’t need them and didn’t ask for them. We tried this in 2001 and 2003, and what we got was the slowest job growth in half a century, and the typical American family actually saw its income fall.

Unfortunately, Republicans in Congress this week continued to use tired, false claims about the President’s approach to distract from their insistence on holding the middle class tax cuts hostage so they can give the very wealthiest individuals a tax cut we can’t afford. Just like they continue to push the same failed policies that got us into this mess into the first place, Republicans in Congress continue to push old, proven-false claims that ending these tax cuts for the wealthiest will hurt our nation’s small businesses and hurt the economy. Just today Speaker Boehner said, “We believe it’s time to extend all of the current tax rates because it really will provide certainty for American job creators.” Well, we’ve heard this before, but let’s debunk these claims once again.

Let’s get at the facts:

-

Millions of families who bought homes before the financial crisis are locked in at the high interest rates of the past. Even though they have done everything right, including making their payments on time each month, they can't refinance at today's rates, which are historically low.

That's why President Obama is urging Congress to take up his proposal to cut through the red tape that currently prevents these families from saving hundreds of dollars every month.

Making the process simpler will have an outsized effect. It will give families more money for their everyday needs, which in turn will benefit local communities and the entire economy. It won't just help those who own homes; it will help the country.

It has the potential to be a huge deal, so we want to make sure you have the facts -- and get a chance to tell us what you think.

Take a minute to watch this White House Whiteboard from Brian Deese:

Then answer a few questions that will help guide our work in the weeks ahead:

http://www.whitehouse.gov/why-refi

To be the first to get updates like this and share your input, sign up for the White House email list.

-

Watch President Obama mark the 65th D-Day anniversary:

Today, June 6, marks D-Day, the day in 1944 when Allied forces from America, the United Kingdom, and Canada landed on the beaches at Normandy to liberate mainland Europe from Nazi control. The odds for success that day were bad: for three centuries, no invader had been able to cross the English Channel into Normandy. The 50-mile stretch of French coastline was heavily fortified to fend off a seaborne invasion, and Nazi soldiers lined steep cliffs along the water, armed with machine guns and artillery. Thousands of troops died in the fighting that day, but when it was over, the Allies had gained a foothold into France and, ultimately, Nazi Germany, where they would defeat Hilter.

To commemorate the 65th anniversary of D-Day, President Obama spoke in Normandy, thanking the men who achieved victory there against all odds, and remembering those who died that day:

It was unknowable then, but so much of the progress that would define the 20th century, on both sides of the Atlantic, came down to the battle for a slice of beach only six miles long and two miles wide.

More particularly, it came down to the men who landed here -- those who now rest in this place for eternity, and those who are with us here today. Perhaps more than any other reason, you, the veterans of that landing, are why we still remember what happened on D-Day.

Watch video from the speech above.

-

Ray Bradbury, the legendary novelist whose writing career stretched out over the course of 70 years, died on Tuesday in Los Angeles. The author, whose works included "Fahrenheit 451" and "The Martian Chronicles," was 91.

"His gift for storytelling reshaped our culture and expanded our world," said President Obama. Here's the full statement:

For many Americans, the news of Ray Bradbury's death immediately brought to mind images from his work, imprinted in our minds, often from a young age. His gift for storytelling reshaped our culture and expanded our world. But Ray also understood that our imaginations could be used as a tool for better understanding, a vehicle for change, and an expression of our most cherished values. There is no doubt that Ray will continue to inspire many more generations with his writing, and our thoughts and prayers are with his family and friends.

-

June 05, 2012

06:55 PM EDTToday, Vice President Biden met with the presidents and senior officials of ten colleges, universities, and state systems of higher education from across the country to discuss the importance of providing students and families with transparent information about the cost of attendance and financial aid. Secretary Duncan, Director of the Consumer Financial Protection Bureau Richard Cordray, and Director of the White House Domestic Policy Council Cecilia Muñoz also participated in the discussion.

Post-secondary education is a valuable investment – more than 60 percent of new jobs in the next decade will require a credential beyond a high school diploma. But before settling on a school and signing any loan agreements, students and their families need easy-to-understand information regarding how they will finance their education. Colleges and universities already provide some statistics about the cost of attendance and available financial aid, but that information is often not clearly presented to students and their families in a way that facilitates easy comparison among schools. Further, schools usually do not provide important information including an estimate of students’ future loan payments, or data about the likelihood of graduation or loan default.

-

Equal pay for women is about more than just fairness. Women are breadwinners in more than 50 percent of American households, and if they're making less than men do for the same work, families have to get with less money for childcare and tuition and rent, and small businesses have fewer customers. Everybody suffers.

President Obama supports passage of the Paycheck Fairness Act, a comprehensive and commonsense bill that updates and strengthens the Equal Pay Act of 1963, which made it illegal for employers to pay unequal wages to men and women who perform substantially equal work. Following Congress's failure to act on this bill today, the President released the following statement:

This afternoon, Senate Republicans refused to allow an up-or-down vote on the Paycheck Fairness Act, a commonsense piece of legislation that would strengthen the Equal Pay Act and give women more tools to fight pay discrimination. It is incredibly disappointing that in this make-or-break moment for the middle class, Senate Republicans put partisan politics ahead of American women and their families. Despite the progress that has been made over the years, women continue to earn substantially less than men for performing the same work. My Administration will continue to fight for a woman’s right for equal pay for equal work, as we rebuild our economy so that hard work pays off, responsibility is rewarded, and every American gets a fair shot to succeed.

Learn more about wage inequality and its effects on American families here

-

Today’s college students who take out loans to pay for school graduate with an average of $26,000 in student loan debt. A quality higher education is a sound investment, and it’s never been more important. In fact, two out of every three new jobs requires some postsecondary education.

At the same time, college has never been more expensive. About two-thirds of today’s bachelor’s degree recipients borrow money to pay for their education. President Obama is committed to making college more affordable, and a key piece of his plan to make this goal a reality is by requiring improved information and transparency about college costs and value.

Better information gives students and their families the ability to make informed decisions about choosing a school that is best suited to their financial and educational goals. Too often, students and families face confusion when comparing financial aid packages, some of which do not clearly differentiate loans from grants, nor distinguish private vs. federal loans, making it difficult to compare aid offers side-by-side.

- &lsaquo previous

- …

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- …

- next &rsaquo