-

For weeks, President Obama has pressed Congress to come to an agreement to extend the payroll tax cut into 2012. This afternoon, that's exactly what happened.

In a statement, the President praised the good news:

For the past several weeks, I’ve stated consistently that it was critical that Congress not go home without preventing a tax increase on 160 million working Americans. Today, I congratulate members of Congress for ending the partisan stalemate by reaching an agreement that meets that test.

Because of this agreement, every working American will keep his or her tax cut – about $1,000 for the average family. That’s about $40 in every paycheck. Vital unemployment insurance will continue for millions of Americans who are looking for work. And when Congress returns, I urge them to keep working to reach an agreement that will extend this tax cut and unemployment insurance for all of 2012 without drama or delay.

This is good news, just in time for the holidays. This is the right thing to do to strengthen our families, grow our economy, and create new jobs. This is real money that will make a real difference in people’s lives. And I want to thank every American who raised your voice to remind folks in this town what this debate was all about. It was about you. And today, your voices made all the difference.

-

This holiday season, we’re thanking servicemembers and their families for all the sacrifices they make for our country. Go inside the White House and the Naval Observatory, the official residence of the Vice President, for a look at how the troops are being honored for their service.

-

Today, President Obama gave an update about the status of the payroll tax cut.

When the spoke, the people standing behind him were all Americans who would see their taxes increase if the House of Representatives doesn't take action.

Each of them was at the White House because they wrote in to tell us what they would have to give up if they lost $40 with every paycheck.

The President said:

[On] Tuesday, we asked folks to tell us what would it be like to lose $40 out of your paycheck every week. And I have to tell you that the response has been overwhelming. We haven't seen anything like this before. Over 30,000 people have written in so far -- as many as 2,000 every hour. We’re still hearing from folks -- and I want to encourage everybody who's been paying attention to this to keep sending your stories to WhiteHouse.gov and share them on Twitter and share them on Facebook.

The responses we’ve gotten so far have come from Americans of all ages and Americans of all backgrounds, from every corner of the country. Some of the folks who responded are on stage with me here today, and they should remind every single member of Congress what’s at stake in this debate. Let me just give you a few samples.

Read the full statement here.

Learn more:

- Read stories from Americans saying what $40 means to them.

- So far, more than 30,000 have written in. Check out the infographic.

-

Ed. Note: This article is cross-posted from the SBA Blog

Yesterday, I spoke with Zalmi Duchman, the founder and owner of The Fresh Diet in Florida. His business cooks and delivers freshly prepared, healthy meals directly to customer doors each day.

He talked about how, if Congress doesn’t act, a tax increase will hurt both his hardworking employees and small businesses, like his, that rely on consumers to have money to buy their goods and services. He said that when his employees open their paycheck and see that it got lower, they’ll turn to him and ask why.

That really struck me. I’ve traveled around the country talking with small business owners, and I know he’s not alone. Small business owners think of their employees as part of their own family. They know that an extra $1,000 a year means a lot to working families.

Over the past two days, over 30,000 Americans have told the White House what $40 less per paycheck would mean to them, including many of the more than half of Americans who own or work for a small business.

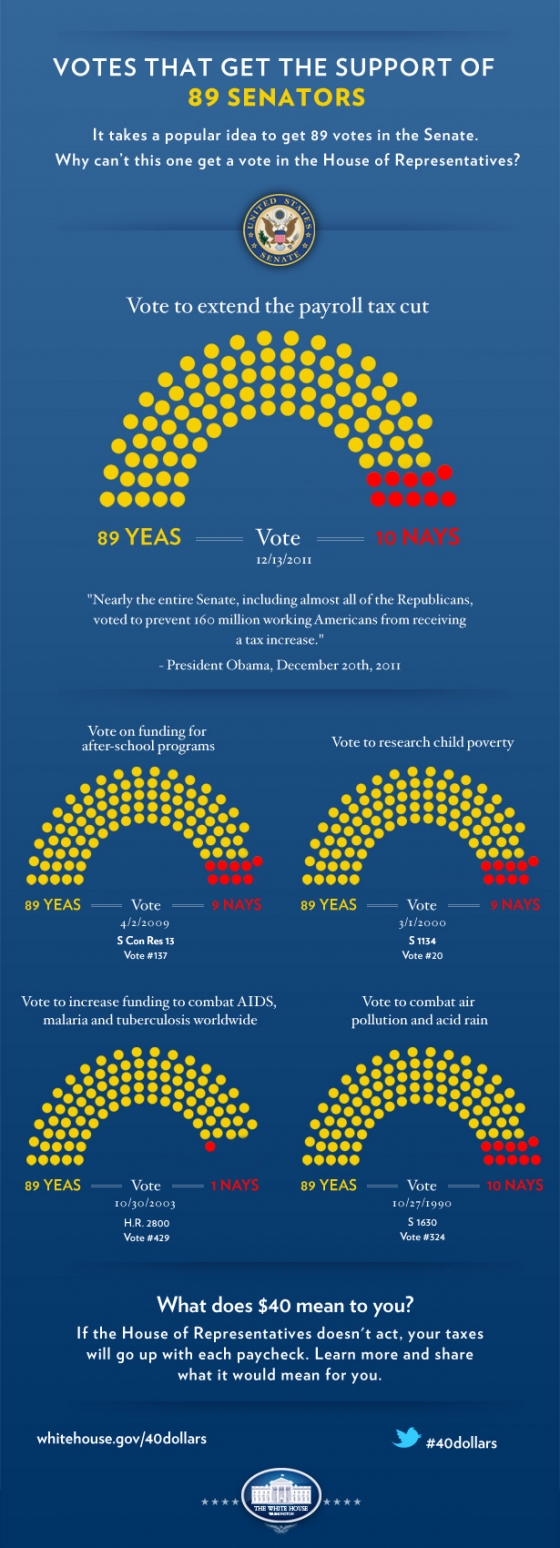

Let’s be clear about what is happening in Washington. The President called for this tax cut extension about four months ago. Senate and House leaders finally came to an agreement last week, and the Senate passed a bipartisan bill – with 89 of 100 Senators in support – to extend the tax cuts. And now, after the Senate has left, House Republicans are backtracking, causing uncertainty among America’s 27 million small businesses as they put the final touches on their business plans for 2012.

Next month, the Administration will continue to work with Congress to extend the tax cut through the rest of 2012. But right now, the House needs to pass the two-month extension and provide a stable environment for small businesses.

I encourage you to tell what $40 means to you or tweet @WhiteHouse with the hashtag #40dollars. That’s money that Americans could otherwise be spending on Main Street, giving a boost to our small businesses which create two of every three new jobs.

As we move into 2012, small business owners need the wind at their back, not in their face. It's unacceptable that Congress hasn’t acted on this to give them the certainty they need right now.

America's small businesses and their employees deserve better.

Karen Mills is the SBA Administrator

-

Just in time for the holiday, President Obama found a little time this week to get some Christmas shopping done. First Dog Bo went along for the ride -- presumably to supervise the President’s stop at a PetSmart just outside Washington, where the two picked up a couple items and mingled with other shoppers, both human and canine.

After leaving the pet store, President Obama continued on (companionless) to Best Buy to pick out some games and gift cards for his daughters before heading to a local restaurant for a few pizzas to take back to the White House.

Need more Bo? Watch this video about his role in this year's White House Holiday decorations

-

In nine days,160 million working Americans will see their taxes go up if House Republicans fail to acton a bipartisan agreement. Additionally, if Congress fails to act, 2.5 million Americans will no longer receive their unemployment insurance benefits. The President refuses to let that happen.

The President believes the only viable option to ensure millions of middle class families aren’t hit with a tax hike is if the House of Representatives takes up the bipartisan compromise that passed in the Senate with nearly 90 percent support, including 39 votes from Senate Republicans. If House Republicans refuse to take up this bill, 160 million Americans will see their taxes increase.

This isn’t about scoring political points, or trying to figure out who’s winning or losing the debate in Washington. This isn’t high-stakes poker. It’s about the livelihood of millions Americans across the nation. It’s about an extra $40 in each paycheck. It’s about being able to afford that extra tank of gas or putting food on the table. If House Republicans refuse to do their job, they’ll put the squeeze on millions of middle class families at a time when they can least afford it.

Yesterday, local newspapers weighed in on the debate. Their message was clear: House Republicans should come to their senses and extend the payroll tax cut. No more games. The American people have had enough. It’s time to get to work and do what’s right for the American people. Today, even more local papers are adding their voices. Let’s take a look:

-

For we are not a nation that says, “don’t ask, don’t tell.” We are a nation that says, “Out of many, we are one.” We are a nation that welcomes the service of every patriot. We are a nation that believes that all men and women are created equal. Those are the ideals that generations have fought for. Those are the ideals that we uphold today. And now, it is my honor to sign this bill into law.

-- President Barack Obama, December 22, 2010.

One year ago, President Obama signed into law the Don’t Ask Don’t Tell Repeal Act, bringing to an end a discriminatory policy that forced patriotic Americans to serve under a cloud of anxiety and isolation and stood in stark contrast to our shared values of unity and equality.

One year later, gay and lesbian service members can serve the country they love without hiding who they love – and both our military and country are stronger for it.

To commemorate the one year anniversary of President Obama signing the Don’t Ask Don’t Tell Repeal Act, we asked a few former service members to reflect on the long journey toward repeal and what it was like to watch President Obama sign the Repeal Act into law:

Zoe Dunning

Until her retirement in 2007, Retired Navy Commander Zoe Dunning was one of the only openly gay service members in the country, having successfully fought an attempted discharge in 1993. For many of those years, she served on the board of Servicemembers Legal Defense Network as an advocate for the repeal of DADT.

-

When the Senate voted to extend the payroll tax cut over the weekend, the bill got support from 89 Senators. That doesn't happen all that often -- most ideas just aren't that popular. So why can't this one get a vote in the House of Representatives?

-

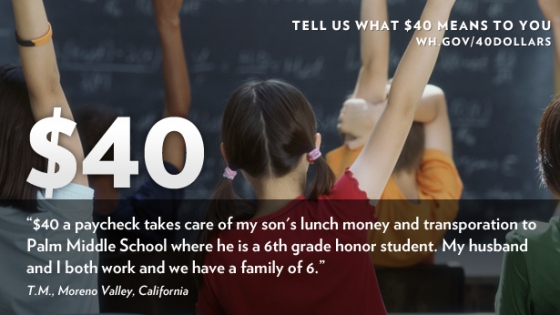

If the House of Representatives fails to extend the payroll tax cut in the next nine days, the typical family making $50,000 a year will have about $40 less to spend or save with each paycheck. Over the year, that adds up to about $1,000.

Opponents of the payroll tax cut dismissed its impact by insisting $40 isn’t a lot of money. We know that's not the case for many families who are already working hard to make ends meet, so on Tuesday, we asked them: What does $40 mean to you?

The response was overwhelming: more than 30,000 people have submitted responses through WhiteHouse.gov since Tuesday afternoon, and thousands more tweeted what $40 meant to them with the hashtag #40dollars. Responses came from all over the country and all 50 states, as represented on the map here. We’ve called out the stories of just a few of the many, many people who told us that losing $40 each paycheck would have serious consequences for them and their families.

You can read more here and here, and also on Storify. And don't forget to share your own story here, or tell us on Twitter with the hashtag #40dollars.

-

On Tuesday, the White House called on Americans to add their voice to the conversation in Washington about why we need to extend the payroll tax cut. If Congress fails to extend the payroll tax cut, the typical family making $50,000 a year will have about $40 less to spend or save with each paycheck. Over the year, that adds up to about $1,000.

Today, Brian Deese, Deputy Director of the National Economic Council, answered your questions about the payroll tax cut extension and why $40 matters during a session of White House Office Hours.

Check out the full questions and answer session below, or over on Storify. Be sure to follow @WhiteHouse on Twitter for updates from the White House and for more chances to engage.

-

On Tuesday, the White House called on Americans to add their voice to the conversation in Washington about why we need to extend the payroll tax cut. If Congress fails to extend the payroll tax cut, the typical family making $50,000 a year will have about $40 less to spend or save with each paycheck. Over the year, that adds up to about $1,000.

Opponents of the payroll tax cut dismissed its impact by insisting $40 isn’t a lot of money. We know that's not the case for many families who are already working hard to make ends meet, so we asked them: What does $40 mean to you?

Some of the latest responses we received are below. You can read more here and here, and also on Storify. And don't forget to share your own story here, or tweet using the hashtag #40dollars.

I am a pre-school teacher and single parent of 3 girls. That $40 extra dollars means that I can feed my daughters fresh produce instead of buying "value meals" at some fast food joint. That $40 extra dollars means that daddy can actually spend time with his family instead of working side jobs just to put food on the table. $40 dollars may not be alot to Congress but it's everything to me. Please stop the bickering and posturing and do your jobs.

D.M., Washington, DC

#40dollars won't even cover one week's worth of gas in my car, which I use in my job to bring home the paycheck and pay the bills.

@TXBronco7

$40 is the difference between my family finding a way to pay our mortgage payment each month, and losing our home.

B.R., Youngstown, Ohio

#40dollars means I can buy a pair of shoes that don't have holes in the soles so my feet stay dry.@giaimojosephine

That $40 per paycheck is my disposable income. Everything else is budgeted to necessities, such as food, shelter, transportation, medical expenses, and the like. When I lose that $40 per paycheck, I stop buying books. I stop eating out. I stop going to the movies. I stop spending money with local merchants.

M.M.J., Wanaque, New Jersey

#40dollars less would mean having to pull my daughter out of preschool.@Ncklmerry

I have a significant physical disability (born without arms or legs). I have worked all my life, and have always paid out-of-pocket for my personal attendant care. I would have to give up many hours of personal attendant care each month without the $40 per paycheck from the payroll tax cut. These are essential services to me that allow me to work and remain independent. And my attendant would suffer as well.

J.G., California

Giving up $40 per check means that I can't afford to help my college sophomore daughter with her books or incidental school expenses. We fit into the category that doesn't qualify for educational financial aid, but with 2 other children and a home lost in the real estate bubble we can barely afford community college for her. She had to drop out of a 4 year school after 1 year and move in with her aunt to go to community college. She works as much as she can.

J.H., Bishop, CA

-

Today marks yet another historic day in the Obama Administration’s efforts to protect the health of American families and our environment.

The Environmental Protection Agency (EPA) has finalized the first-ever national standards to reduce mercury and other toxic air emissions – like arsenic, acid gas, and cyanide – from power plants, which are the largest sources of this pollution in the United States.

This crucial step forward will bring enormous public health benefits. By substantially reducing emissions of toxic pollutants that lead to neurological damage, cancer, respiratory illnesses, and other serious health issues, these standards will benefit millions of people across the country, but especially children, older Americans, and other vulnerable populations. Cumulatively, the total health and economic benefits to society could reach $90 billion each year.

-

The holidays are a busy time at the White House -- more than 85,000 people are expected to drop by a for a visit.

All the festivities require planning, some creative logistical work, and more than a little aid from volunteers. This year, more than 400 individuals came together to help decorate the White House and assist with celebrations

Get a behind the scenes look at all the action courtesy of the White House Photo Office. For more, check out http://www.whitehouse.gov/holidays.

-

On Tuesday, the White House called on Americans to add their voice to the conversation in Washington about why we need to extend the payroll tax cut. If Congress fails to extend the payroll tax cut, the typical family making $50,000 a year will have about $40 less to spend or save with each paycheck. Over the year, that adds up to about $1,000.

Opponents of the payroll tax cut dismissed its impact by insisting $40 isn’t a lot of money. We know that's not the case for many families who are already working hard to make ends meet, so we asked them: What does $40 mean to you?

The response was overwhelming--more than 20,000 from all 50 states have people submitted their stories through our web site since yesterday afternoon. On Twitter, we asked “What does #40dollars mean to you?” and the hashtag started trending nationwide and worldwide almost immediately. Data is still coming in, but #40dollars has been used in over 1,000 tweets and counting. Based on the latest report from Hashtracking.com, those tweets have generated 7,425,833 impressions, reaching an audience of 7,288,208 followers within the past 24 hours.

Some of the latest responses we received are below, including some mayors from around the country asking their followers what #40dollars means to them. You can read more here and here, and also on Storify. And don't forget to share your own story here, or tweet using the hashtag #40dollars.

To be honest $40 is around what I have to spend each week to feed myself and my 2 yr old. There are times when I can't eat--I have to go to bed without a meal just to make sure my son eats. If the tax credit isn't granted I will have to rely on the local food pantries who are already strained.

S.G., Milledgeville, Georgia

$40 buys a week's worth of the nutrient drink that my 98-year-old mother virtually survives on.

M.H.B, New York

#40dollars a week is the cost of my prescriptions; without these medications I would die from a stroke or heart attack.@JSerrato53

$40 a paycheck is over half our household's grocery expenses. It's not expendable income.

R.L.S., Jersey City, New Jersey

$40 is a pair of inexpensive sneakers for my two daughters. They've been wearing the same pair for a year. I promised I'd have new shoes for them before the end of this year, but $40 out of my next check means they will have to wait longer.

J.M., Cedartown, Georgia

#40dollars is 10 days of interest accumulation on only one of my many federal student loans at a 6.8% interest.@eoxenford

-

The White House Photo Office released the November 2011 photoset on the White House Flickr feed featuring behind the scenes photos from November. Check out photos from the Carrier Classic basketball game onboard the U.S.S. Carl Vinson, the President's trips to Hawaii, Asia, and Australia, and other shots from around the White House that you don't want to miss.

-

December 21, 2011

01:00 PM EDTWith the holiday season in full swing, many of us are thinking about the meals we’ll soon be sharing with family and friends. Whether it’s turkey and egg nog, or latkes, or a New Year’s buffet, food is always a central and cherished part of the festivities. Of course, we all know that a necessary ingredient for any meal is food safety.

When the President came into office, he said that “protecting the safety of our food and drugs is one of the most fundamental responsibilities government has.” He pledged to strengthen our food safety laws and to enhance the government’s food safety performance.

To help accomplish that goal, the Administration worked with Congressional leaders on both sides of the aisle, and a broad coalition of industry and consumer groups, to enact the FDA Food Safety Modernization Act, or FSMA. FSMA is the most sweeping reform of our food laws in more than 70 years. It will apply modern scientific methods to target and prevent the most significant hazards and hold importers accountable for the safety of the food they bring into this country. FDA is working towards a release of proposed rules to implement FSMA and to build a modern new system of food safety oversight that harnesses the best available practices.

To oversee all of the Administration’s food safety efforts, the President created the Federal Food Safety Working Group, led by our two departments. Partner agencies include the FDA and CDC.

We’re pleased to say that the Working Group’s just released report shows that this Administration has delivered substantial results in the area of food safety. These include stricter standards to prevent contamination of food with dangerous bacteria, stronger surveillance to detect contamination problems earlier, and more rapid response to illness outbreaks.

-

If House Republicans fail to act, 160 million working Americans will see their taxes go up – $1,000 a year for the average family. Additionally, 2.5 million Americans will no longer receive their unemployment insurance benefits. We refuse to let that happen.

The President believes the only viable option to ensure millions of middle class families aren’t hit with a tax hike is if the House of Representatives takes up the bipartisan compromise that passed in the Senate with nearly 90 percent support, including 39 votes from Senate Republicans. Unfortunately over the last few days we’ve seen nothing but political theatre from House Republicans. They refuse to even vote on this bipartisan compromise. That’s unacceptable.

Now is not the time for political brinksmanship. Nobody wants to see their taxes go up in just ten days. Not right now. Not when families are trying to pay the bills or make ends meet. Unfortunately, if House Republicans fail to act, this tax cut will expire and millions of families will have $1,000 less next year.

Judging from the local newspaper editorials below, it looks like we’re not the only ones who believe the House Republicans should get to work and get this done before the end of the year. Let’s take a look:

-

Ed. Note: Today at 3:30 pm EDT, Brian Deese, Deputy Director of the National Economic Council will be holding a session of Office Hours on Twitter. He’ll be on the @WHLive account answering questions about the payroll tax cut extension. Ask your question now and during the live event on Twitter using the hashtag #WHChat.

“$40 less a paycheck means I will have to pick between my insulin and the water bill. It means never being able to see my doctor - even though I have insurance.”

B.T. Roswell, New Mexico

“Right now, I am unable to pay all my bills every month; $40 less would mean my son and I would be going without groceries or another bill would have to wait and be late.”

P.B., Liberal, Kansas

$40.00 means the world to me. It's the equivalent of 5 hours work or feeding my family for 3 nights.

T.K. Gaylord, Michigan

These are just a few of the 18,000 stories Americans from all over the country submitted through our website since yesterday afternoon, when we asked people to tell us how losing $40 each paycheck—what the typical family would pay in additional taxes if the payroll tax cut expires—would affect them.

And when we asked “What does #40dollars mean to you?” on Twitter, the hashtag #40dollars started trending almost immediately, not just nationwide, but worldwide, as a result of people sharing their stories there.

As Republicans in the House dig in and refuse to even vote on extending the payroll tax cut, we want to make sure your voice is heard.

Share your own story here, or tweet @WhiteHouse with the hashtag #40dollars, and tell us what you would have to cut or go without if you had $40 less to spend with each paycheck.

Below, read more of the stories we’ve already collected, and check back throughout the day for updates. Or read more of the responses we've gotten on Twitter with Storify.

$40 is the difference between our second grade son being able to sign up for an extracurricular activity (soccer, chess, swimming, etc.) or not.

J.E., Ann Arbor, Michigan

$40 means that one of my children can get a much needed dental check up.

A.A., Albuquerque, New Mexico

$40.00 a paycheck means $1040.00 a year for me. With 3 children in Catholic schools, that represents 2 months, 1.5 months, or 1 month tuition for one of my children. I'm also trying to save for their college plans and while $1000.00 doesn't go too far with college tuition, it certainly helps.

W.J., Westminster, MD

What $40 a paycheck means to me is buying books for my daughter so she can learn the importance of reading and learning. My husband and I believe in the power of reading and that is something we have agreed to focus on with our children.

A.G., Murfreesboro, Tennessee

-

Ed. Note: Today at 3:30 pm EDT, Brian Deese, Deputy Director of the National Economic Council will be holding a session of Office Hours on Twitter. He’ll be on the @WHLive account answering questions about the payroll tax cut extension. Ask your question now and during the live event on Twitter using the hashtag #WHChat.

Yesterday, the White House called on Americans to add their voice to the conversation happening in Washington, DC about why we need to extend the payroll tax cut. If Congress fails to extend this tax cut, the typical family making $50,000 a year will have about $40 less to spend or save with each paycheck. Over the year, that adds up to about $1,000 -- and has a real impact on American families.

Opponents of the payroll tax cut dismissed the impact by insisting $40 isn’t a lot of money. Well, we know that's not the case for many families who are already working hard to make ends meet, so we asked you tell us what $40 means for you and your family. We asked in an email from David Plouffe, and on Facebook and Twitter.

The response was overwhelming.

We received over 18,000 submissions through a form on Whitehouse.gov, averaging over 1,000 an hour and coming in from every state in the nation. On Twitter, we asked “What does #40dollars mean to you?” In a short period of time, the hashtag #40dollars was trending on Twitter, not just nationwide, but worldwide. The hashtag #40dollars has been used in over 1,000 tweets and counting, and that based on the latest report from Hashtracking.com generated nearly 16 million impressions and reached an audience of over 3 million people.

So, what does $40 mean to you? Share your story and have a look at what people around the country are saying below or on Storify:

-

If the payroll tax cut expires, the typical American family that makes $50,000 a year will pay $1,000 more in taxes in 2012. That works out to about $40 less per paycheck that families won’t have to spend on groceries, gas, or medicine.

Nearly everyone in Washington—President Obama, Congressional Democrats, and both parties in the Senate—agrees that we must extend the payroll tax cut to avoid increasing taxes on 160 million Americans on January 1. Republicans in the House, however, are refusing to even vote on a bill to keep the payroll tax cut from expiring.

We asked people all over the country to tell us what a difference that $40 every two weeks makes for them and their families, and the answer is clear: American families struggling to make ends meet can’t afford to see their taxes go up.

Read the responses we’ve received so far here, or add your own story. Tell us what $40 means to you—what will you have to cut or go without if the payroll tax cut expires?

- &lsaquo previous

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- …

- next &rsaquo