Corker Warns of Looming Debt Crisis

Says First Step in Tackling Should Be a Cap on Spending

In early August 2010, Senator Corker began crisscrossing the state, visiting 26 counties to talk with Tennesseans about Washington’s unsustainable spending habits that are driving the country into dangerous levels of debt. Corker is working on legislation to cap spending at a sustainable level, force Congress to make tough choices and incentivize economic growth.

"There is absolutely no construct for fiscal discipline at the federal level. If we do not change the path we are on and dramatically reduce our level of spending in relation to our country's gross domestic product, I believe we are in danger of becoming the first generation of Americans to leave our country in worse shape than we found it," Corker said. "We need to change the conversation, and I think that means focusing on the big picture first. Page one is agreeing on the amount of spending we can sustain as a country."

| What do you think about the nation's debt crisis? Send your comments via e-mail, Facebook, and YouTube: |

In a sobering slide presentation, Corker uses *charts and graphs to illustrate Washington’s spending trends and mounting debt. Using information from a number of sources, including the Congressional Budget Office, U.S. Department of the Treasury, and the Office of Management and Budget, Corker makes the following points:

The U.S. is Facing a Crushing Wave of Debt

Click image to enlarge

One measure of a country’s economic health can be determined by looking at its debt in relation to its gross domestic product (GDP). America’s debt is currently 62 percent of GDP, well above historical levels. If we continue on our current course, by 2030, America’s debt will be 146 percent of GDP, far exceeding what economists view as sustainable. For reference, Greece’s debt level was at 120 percent when the European Union stepped in.

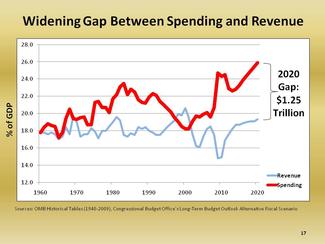

There is a Widening Gap Between Spending and Revenue

Click image to enlarge

In 2010, the federal government will spend $1.29 trillion more than it takes in. To put that in perspective, in 2008, the average Tennessee household earned $43,000 a year. If that family applied Washington logic to their budgeting, they would have spent $70,300, borrowing about 40 cents of every dollar and spending $27,300 more than they earned.

Click image to enlarge

Mandatory Spending is Growing

Click image to enlarge

Non-discretionary or mandatory spending (spending required by law and not subject to the annual congressional appropriations process) is growing. In 1970, discretionary spending (defense, highways, education) was at 62 percent. Mandatory expenditures (Medicare, Medicaid, Social Security) totaled 31 percent. Interest payments equaled seven percent.

Click image to enlarge

In 2010 discretionary spending has fallen to 38 percent. Mandatory spending has increased to 56 percent. Interest payments are at six percent.

Click image to enlarge

Projections for 2035 show discretionary spending at 26 percent, mandatory spending at 49 percent and interest payments at a whopping 25 percent.

Debt Isn’t Free

Click image to enlarge

In 2009, the federal government spent $187 billion in interest on debt. That figure dwarfs annual federal spending on the departments of transportation ($69 billion), homeland security ($49 billion) and education ($45 billion) and is enough to run the state of Tennessee ($30 billion) for six years.

Click image to enlarge

Under the administration’s budget projections, U.S. debt service will be $916 billion by 2020.

Foreign Holders Own a Large Percentage of Our Debt

Click image to enlarge

Fifty years ago, only five percent of our debt was held overseas. Today, that figure is 47 percent. China alone owns about 10 percent (9.7 percent or $868 billion).

Click image to enlarge

The First Step: Determine the Right Amount of Spending

Click image to enlarge

The first step in tackling our debt is determining the right level of spending. Over the past 50 years, U.S. federal spending has averaged 20.3 percent of GDP, and revenue has averaged 18 percent.

Click image to enlarge

Erskine Bowles, who served as chief of staff under President Bill Clinton and now co-chairs President Obama’s debt and deficit commission, has said spending should be at about 21 percent of GDP. Corker would like to see a balanced budget, which would put spending at about 18 percent of GDP.

Click image to enlarge

Getting to 18 percent (and a balanced budget) would mean a $6.7 trillion reduction in spending over the next 10 years. Getting to 21 percent, as proposed by Bowles, would mean reducing spending by $3.4 trillion over the next 10 years. Both would be draconian measures that would require vast changes in the way Washington does business.

"There are some economists on both sides of the aisle who believe a country can sustain a small, two percent gap between spending and revenue. However, the gap between spending and revenue that exists today and the gaps projected in the future are absolutely not sustainable and will bring crisis to our country.

"There is plenty of blame to go around, but pointing fingers isn’t going to solve the problem," said Corker. "Somewhere between 18 and 21 percent, I believe an agreement can be reached between Republicans and Democrats. To me, this is page one in the debate. If we focus on this first, instead of on those things that divide us, maybe we can get the conversation off the ground and begin to actually solve the problem.

"I believe in American exceptionalism, and I believe we can solve this problem. Previous generations of Americans made sacrifices for the good of our country, so their children and grandchildren would have an even greater standard of living. It's time for us to do the same. That means living within our means. It means politicians no longer promising things to their constituents without paying for them, and it means constituents telling their elected officials they would rather sacrifice a little now than leave future generations with crippling debt."

A copy of Corker’s presentation is attached below.

*Data is based on information available on October 15, 2010.

-

Debt Presentation

Update_October_25th_No_Notes-Debt_Presentation_Charts.pdf (379.0 KBs)

Corker Delivers Debt Message

-

08-11-10: Corker speaks to NFIB in Mt. Juliet

U.S. Senator Bob Corker, R-Tenn., speaks to the NFIB (National Federation of Independent Business) at the Wilson Bank & Trust in Mt. Juliet. -

08-11-10: Corker speaks at Rhea County town hall

U.S. Senator Bob Corker, R-Tenn., speaks at a Rhea County town hall meeting hosted by the Rhea County Economic and Tourism Council in Dayton. -

08-12-10: Corker speaks to Kiwanis Club of Madison County

U.S. Senator Bob Corker, R-Tenn., speaks to the Kiwanis Club of Madison County in Jackson. -

08-12-10: Corker at the Woodbridge General Store in Somerville

U.S. Senator Bob Corker, R-Tenn., speaks with Terry and Wendy Renoux at the Woodbridge General Store in Somerville. -

08-12-10: Corker speaks to Dickson County Chamber

U.S. Senator Bob Corker, R-Tenn., speaks to the Dickson County Chamber of Commerce meeting at Ace’s Diner in Dickson. -

08-13-10 Collierville Chamber

-

08-16-10: Corker speaks to NWPC

U.S. Senator Bob Corker, R-Tenn. speaks to the Nashville Women’s Political Caucus at their August Luncheon. -

08-16-10: Corker speaks to Clarksville Area Chamber of Commerce

U.S. Senator Bob Corker, R-Tenn., speaks to the Clarksville Area Chamber of Commerce. -

08-17-10 Corker speaks to Cool Springs Chamber

August 17, 2010: U.S. Senator Bob Corker, R-Tenn., speaks at the Cool Springs Chamber of Commerce breakfast in Brentwood. -

08-18-10: Corker speaks to Chattanooga Chamber

U.S. Senator Bob Corker, R-Tenn., speaks to the Chattanooga Chamber of Commerce at the Trade Center. -

08-24-10: Corker addresses Johnson City Rotary

U.S. Senator Bob Corker, R-Tenn., addresses a meeting of the Johnson City Rotary. -

08-26-10: Corker speaks to business leaders at a meeting hosted by the PBPA

U.S. Senator Bob Corker speaks to business leaders at a meeting hosted by the Powell Business and Professional Association (PBPA) in partnership with the Halls, Karns and Fountain City Business and Professional Associations. -

08-27-10 NFIB/Cleveland-Bradley County Chamber Event

August 27, 2010 - Senator Corker addresses a meeting co-hosted by the NFIB (National Federation of Independent Business) and the Cleveland-Bradley County Chamber of Commerce at Cleveland State Community College. During the Senate’s August recess, Corker is visiting 26 counties across the state to listen to Tennesseans’ concerns, answer questions, and talk about the major issues facing our country, namely the nation’s debt crisis.

Corker's Debt Message in the News

- Chattanooga Free Press Editorial: Corker vs. bigger U.S. debt

- Knoxville News Sentinel: Corker urges U.S. to rein in spending

- TriCities.com: Corker talks debt at town hall

- Jackson Sun: Corker warns of debt: Senator holds town hall at Union University

- Union City Daily Messenger: Corker says borrowing is out of control

- CNBC.com: Shock and Awe: The U.S. Deficit Problem

- Interview with InstaPundit’s Glenn Reynolds on Pajamas TV

- Chattanooga Times Free Press (Free Press Editorial): Corker on debt and solution

- Radio Interview on the Mark Bernier Show

- The Dickson Herald (Letter to the Editor): Federal debt is threat to national security

- The Dickson Herald (Op-ed): Corker spending cap necessary to avoid meltdown

- Chattanooga Free Press Editorial: Sen. Corker vs. debt

- Chattanooga Free Press Editorial: Corker seeks deficit remedy

- Tennessean: Sen. Bob Corker proposes cap on spending to control U.S. debt

- Commercial Appeal: Corker sounds alarm about national debt in Memphis speech

- Jackson Sun: Corker: Cut federal spending

- Tennessean: Corker takes aim at national debt

- Johnson City Press: Corker in town to sell plan on controlling national debt