learn more about working at cbo and check out the agency’s career opportunities

browse the shelves

Peruse all of CBO's publications and cost estimates. Begin with the most recent, focus on a specific topic, jump straight to frequently requested items, or get automatic updates from one of our many RSS feeds.

Peruse all of CBO's publications and cost estimates. Begin with the most recent, focus on a specific topic, jump straight to frequently requested items, or get automatic updates from one of our many RSS feeds. get the data

Find our latest deficit projections, projections of the unemployment rate and other economic variables, and  projections of revenues and spending for health care, income assistance, education, retirement, and agriculture.

projections of revenues and spending for health care, income assistance, education, retirement, and agriculture.

read the blog

Visit the Director’s Blog for a concise description of CBO’s recent work. From

Visit the Director’s Blog for a concise description of CBO’s recent work. From- our latest post:

As required by law, CBO prepares regular reports on its estimate of the number of jobs created by the American Recovery...

what's most recent

Estimated Impact of the American Recovery and Reinvestment Act on Employment and Economic Output from July 2012 Through September 2012

reportNovember 20, 2012CBO Releases Latest Quarterly Report on ARRA’s Effect on Output and Employment

blog postNovember 20, 2012Offsetting Costs of a Carbon Tax on Low-Income Households

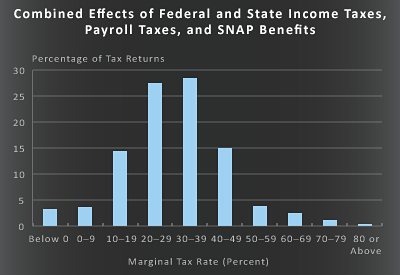

presentationNovember 16, 2012Illustrative Examples of Effective Marginal Tax Rates Faced by Married and Single Taxpayers: Supplemental Material for Effective Marginal Tax Rates for Low- and Moderate-Income Workers

data or technical informationNovember 15, 2012CBO Releases a Report on Effective Marginal Tax Rates for Low- and Moderate-Income Workers

blog postNovember 15, 2012Effective Marginal Tax Rates for Low- and Moderate-Income Workers

reportNovember 15, 2012S. 1345, the Spokane Tribe of Indians of the Spokane Reservation Grand Coulee Dam Equitable Compensation Settlement Act

cost estimateNovember 13, 2012

what's most read

Choices for Deficit Reduction

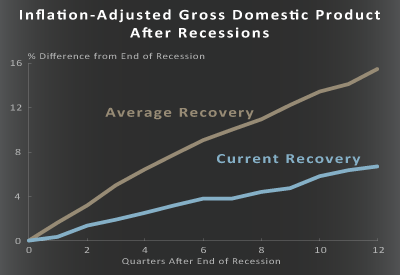

reportNovember 8, 2012Economic Effects of Policies Contributing to Fiscal Tightening in 2013

reportNovember 8, 2012An Update to the Budget and Economic Outlook: Fiscal Years 2012 to 2022

reportAugust 22, 2012Letter to the Honorable John Boehner providing an estimate for H.R. 6079, the Repeal of Obamacare Act

cost estimateJuly 24, 2012Estimates for the Insurance Coverage Provisions of the Affordable Care Act Updated for the Recent Supreme Court Decision

reportJuly 24, 2012The Distribution of Household Income and Federal Taxes, 2008 and 2009

reportJuly 10, 2012The 2012 Long-Term Budget Outlook

reportJune 5, 2012