What’s inside? Here are the questions answered in today’s reader mailbag, boiled down to five word summaries. Click on the number to jump straight down to the question.

1. Student loan struggles

2. Highlights of South Dakota

3. Air conditioning debate

4. Is internet stuff “free”?

5. Loan options

6. Starting online businesses

7. Tithing question

8. Multiple credit cards

9. Improving memory

10. Saving options for retirement

Whenever I’m sitting at my desk to write, I usually have a podcast playing. If that’s the case, how can I actually get anything out of the podcasts?

Consciously, I don’t. What I find, though, is that if I listen to a podcast in my “mental background” a few times, I’ve usually picked up most of the useful information in the podcast. Thus, if I listen to informative podcasts, I usually find myself having a deeper understanding of other things that I see and hear in other contexts.

I used to listen to music a lot when writing, with much the same effect. I could find myself singing along to songs that I scarcely remembered listening to at all.

Q1: Student loan struggles

I am currently a sophomore in college and recently filled out my financial aid papers for this coming year and was looking at the amount of money that is borrowed in my name. The amount that I have borrowed (after this next year it is about $13,000), after loan consolidation calculators and looking at repayment plan calculators, does look like an amount that can be paid off in the future. What I am worried about is the fact that, in the profession I have chosen, I will not be making a lot of money, especially not up front. This profession is also one that requires graduate degrees in order to get into. I won’t really have a career until I finish my doctorate and by then there will be interest added from when they were taken out and from deferment periods and more loans taken out to finish my undergrad. So what I’m wondering is how much more money in student loans would it be wise to take out in the 2 years following and what can I do to make sure that when all these loans come due, that I can pay for them?

- Julia

If this is the career path you’re going to stick with, there are a few things you can do.

First, minimize the amount you borrow. This might mean working a part-time job to pay for some of your education and living very lean, but that’s part of college life. These are the years to live very lean.

Second, look for any opportunities for loan repayment. Does your career path offer any programs where your loans will be repaid if you commit to a challenging career path upon graduation? Teachers often have this option, where they’re assigned to challenging districts and have their loans repaid if they stay there for a certain number of years.

Finally, use cost as a major factor in where you go to school. While a prestigious school can help a bit with your career path, it’s not nearly as important as it once was and it’s trumped by a strong academic record and good contacts, something you can achieve at any school.

Q2: Highlights of South Dakota

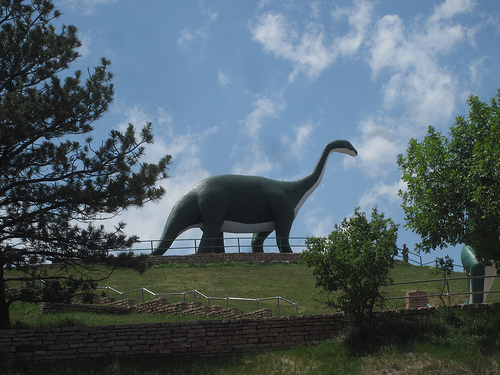

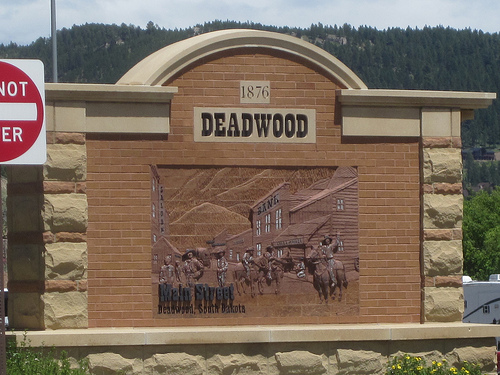

I’ve always wanted to see some of the national parks of the Great Plains area so I’m jealous of your trip to South Dakota and Wyoming. What did you think were the highlights?

- Andie

My personal highlight was driving through the Badlands on the scenic loop starting at Wall, South Dakota. The overlooks were breathtaking and I dearly wished we had an opportunity to camp there for a night. I just kept looking in every direction.

The others I traveled with had different favorite experiences. My father loved the Crazy Horse monument, owing in some significant part to his American Indian heritage. My wife and children seemed most enamored with Devil’s Tower, which we all hiked around.

My mother’s favorite part was perhaps the simplest. She just enjoyed the scenery everywhere, particularly on the Swordfish Creek loop in the northern Black Hills.

I have a bunch of suggestions for free things to enjoy in the area, which I’ll post about in a few days once I go through all of the trip pictures.

Q3: Air conditioning debate

In the hot summer, we keep our house at 75 degrees when we are home. We both work 8-5 during the week. I think it would be cheaper to keep the A/C off during the day and turn it on when we get home (we don’t have a programmable thermostat to do it on its own). It usually is 81-83 degrees when we get home using this strategy. She thinks it would be cheaper to leave the A/C set on 78 degrees all day so that it doesn’t have to run as hard when we get home to get the temperature down to 75. Who do you think is right?

- Bill

It uses far less energy to turn it off during the day and then turn it on when you get home than to run it at a high temperature during the day.

The reason is pretty straightforward. On a hot day, your house is always gaining heat, but the rate of heat gain slows as your home approaches the temperature of the outdoors. If you leave your air conditioning on during the day, it’s going to kick on several times. Each time, it’s going to push the temperature of your home further away from the outdoor temperature, which means your home is going to take on heat faster than it would if your air conditioning never kicked on in the first place. You’re far better off having your air conditioner lower your home’s temperature from 81 degrees down to 75 once during the day than have it run several times to keep the temperature close to 78, then a final run to get it down to 75.

Note that this is in terms of energy use, not cost. Many areas charge more for energy during peak usage hours (say, between 5 PM and 7 PM). You’ll want to check your last energy bill for rates and, if it’s significantly higher during that time, it may actually be cheaper to follow your wife’s suggestion.

Another idea is to simply close the blinds and window coverings in every room before you leave in the morning. This will keep direct sunlight from getting into your home. Direct sunlight will heat things up quite a lot.

Q4: Is internet stuff “free”?

A lot of times, when you mention stuff on the internet, you talk as though it’s “free.” How do you see it as being “free”? People do pay for internet access you know.

- Jim

Since The Simple Dollar is an internet site, I feel pretty safe assuming that my readers have some access to the internet. According to the Q4 2011 “State of the Internet” report, the average American internet connection is over 5 Mbps, which means it’s reasonable to assume that readers have a reasonably fast connection, too.

If I hold these things as assumptions, it’s reasonable to think that there is no additional cost for users to visit other sites or use other internet services. Thus, in my mind, they’re essentially free.

Yes, users do pay for their internet service, but if they’re willing to pay for the sites they already use, then adding more sites to their list of useful sites is more or less a free bonus, and that’s a good thing.

Q5: Loan options

I have $30k available for a 4% loan from my 401k. Option #2 appears the best to me but would like your thoughts.

1) do nothing and don’t touch the 401k; that amount of compounding can never be re-captured

2) get the 401k loan and apply it to Federal “Parent Plus” loan; current balance is $60k with projected $40k more, all fixed @ 7.9% (side note- $100k for 4 yrs of private college may sound pricey but we’d end up spending much more at a public state college where kids can’t get the classes needed to graduate in 6 years!)

3) get the 401k loan and apply it to “interest only” mortgage; current balance is $425k @ slightly adjustable 2.5% (disclaimer- our old tract house is nothing fancy but the cost of real estate near San Francisco is ridiculous!)

I think we’re ok in the other areas that usually concern you. Here’s some background info:

- Mortgage minimum payment is currently $800. However, we pay $2,500/month and should have it paid off in less than 20 years, which saves a few years and a chunk of money compared to the traditional fixed mortgage.

- Our side-business has a $18k loan for 3 more years; the interest is a tax write-off (we have no debt, other than mortgage, tuition, and business loan)

- Both my husband & I have been working full-time for 25 years, make equal amounts of money, and have life insurance policies that would pay off the house plus have 8 years of that lost income (if it happened today, that would see our youngest child out of highschool).

- We have 3 months emergency fund in short-term CD’s.

- We both have “Long Term Disability” insurance for 60% of our income

- 10% of our income is donated (church, non-profits)

- 10% of our income goes to investments (401k, IRA, 529). Note- until college loans, we had saved 15% of our income.

- We have 2 personal cars (we commute different directions and mass transportation is not feasible) plus 1 business truck which are all paid off, well maintained, and in good working order; they should last a few more years.

- Our lifestyle is not extravagant, simply due to upbringing and personal choice. Many of the “frugal” suggestions in SD seem natural to us, such as central heating set at 65 degrees and only when we’re home, mow our own lawn, clean our own house, rarely eat out, use coupons, etc. There are some of your ideas on my “to do” list, i.e. make my own clothes detergent and shop at thrift stores. I firmly believe that cable is not a utility but cannot get rid of it until I find a way for my husband to watch live professional ball games (football, hockey, basketball, and baseball) at home so he doesn’t have to spend every evening at Applebee’s. ha!

Oh, and we would like to retire in 10-15 years so that we can pursue non-profit jobs, volunteering, some hobbies, and taking care of grandbabies.

- Connie

I would agree with your assessment that the second option is the best one.

There are a couple reasons for this. First, I think it’s going to give you the best overall return on your money. Second, you have enough flexibility to cover that loan if the person from whose 401(k) the money was borrowed were to lose their job (you’d have to repay the 401(k) loan immediately).

If you were in a tighter financial position, I’d probably suggest option one. The thing that always worries me about 401(k) loans is that if you lose your job, you’ve got to repay that loan within ninety days and if you don’t have the resources to do so, you’re going to get hammered by the IRS at a very inopportune time.

Q6: Starting online businesses

I am a teacher of 20+ years and am looking to get into a internet blogging as a business. I need tips and advise. How do you get paid, is my first question, if I may ask? Hope that’s not too personal. What would be helpful for me to get started?

- Rachel

Bloggers typically get paid via the advertisements on their site.

The challenge, of course, is how you get paid. Most advertisements are paid via CPM, which means cost per thousand views. Typical CPM rates are $3 per 1,000 views. So, in order to make $3, you have to have a thousand visitors to a page.

Thus, the trick for most internet sites is simply generating enough traffic. A thousand views a month will only earn you $3. A million views a month will earn you $3,000.

You can, of course, have multiple ads, but if you have too many ads, you’ll drive away readers.

The real key? Have good content that people want to read. The key there is to write from the heart.

Q7: Tithing question

My wife and I moved to a new community recently and joined a new church in this community. At our old church, there was almost no pressure to donate. They passed around a collection plate and that was about it and I felt good about putting money in it. At our new church, though, they talk about tithing all the time and send envelopes to our house seeking donations. Do you think it is necessary to tithe 10% of your income to a church?

- Leon

It depends on the rules and requirements for membership in such a group. If part of the requirement for membership is a 10% tithing, then that’s their call.

Of course, you don’t have to be a member of such an organization. That’s your choice as well.

Should people give away 10% of their money as a religious requirement? Again, I think that’s up to individual belief. Sarah and I give away money to a variety of charities each year, but we don’t force ourselves to match a specific giving amount.

Q8: Multiple credit cards

I’m 22. Trying to build my credit. It’s pretty low right now, but I’ve had a credit card for about 6 months. I’ve paid it off diligently and really just use it for small things to keep it going. I have now started getting tons of offers in the mail for credit cards. My question is will opening more than one credit card at a time build my credit faster? I know if I opened another card I wouldn’t have any problem paying it off or getting out of control with spending.

- Donald

Getting another credit card can provide a small boost to your credit, but it won’t help as much as the first one. Your first card is the one that will really establish the length of your credit history.

This new card would only help your credit in terms of bolstering your debt-to-credit ratio, which basically means the amount of debt you have on all of your cards as compared to the total credit line on all of your cards. It can have a very minor impact in other areas, too.

Your best bet, if you were to get a second card, is to either get one and sit it in your closet untouched or get one that you use for a very specific purpose, like a card associated with your gas station of choice.

Q9: Improving memory

I have a terrible time with short term memory. I always forget things I’m trying to remember, like the three items I need to get when I stop at a grocery store or the four errands I need to run. Any good memory tips?

- Colleen

Over the last year, I’ve come to really rely on the “memory palace” tactic for such things. It’s a simple tactic, but it really works.

All you do is visualize a familiar place in your head, such as your home or the house you grew up in. Imagine yourself walking through that home. As you’re imagining it, imagine giant versions of the items you need or of the errands you need to run throughout the home. Absurdly giant versions, preferably with another absurd attribute related to it. Imagine a giant piece of cheese dominating your kitchen. Imagine a giant carton of milk in your living room that your cat is bathing in.

Walk your mind through this absurd version of your house a few times and you’ll find it much easier to recollect the items you want to remember in an hour or so.

Q10: Saving options for retirement

I will make about $125-$130k this year, so I believe that I dont qualify to contribute to a Roth IRA anymore. My employer of 2 years now offers a 401k but doesnt offer a match (we are still in start-up mode). I’ve been contributing to the 401 anyways, just to make sure I am putting something towards retirement. In the past I did Roth’s as well.

My question is, what other options do I have to save for retirement considering my situation? I am not really well versed in investing so any help would be appreciated.

For what its worth my grandmother has been retired for about 40 years now and swears by CD’s and EE bonds and tells me its better to just save then to worry about the best return.

- James

The big advantage that a 401(k) has for retirement is that it shifts the income tax burden from today until your retirement (when you’re in a lower tax bracket). It also allows you to change your investments without tax implications (within the 401(k)) and you can sometimes get an employer match. However, you’re usually restricted to a pretty small set of investment choices, many of which are going to be relatively substandard. A 401(k) is also inflexible when it comes to making career shifts. If you want to quit and use some of that money for starting a business, you can’t get a loan from it and you can’t withdraw from it without a huge penalty. I think a 401(k) works great for most people who intend to minimize their job hopping in the decades before retirement and don’t really desire to become self-employed or start their own business, but it’s not the only option.

It sounds like your grandmother saved for retirement outside of a 401(k), which certainly works. In fact, her plan for retirement savings would have worked really well at various points in history. There were times when savings bonds and CDs returned well over 10% and it wasn’t too long ago when they were still returning over 5%. Given the flexibility that they offer, that’s a pretty good deal.

The problem is that savings bonds, CDs, and treasuries are now returning below 3% – and most of them are approaching a 1% annual return. That’s just not a great return no matter how you slice it.

Assuming that you’re relatively young, if I were in your shoes, I would probably invest in a very large and very secure dividend-paying company, like Verizon. Buy stocks in that company and reinvest the dividends.

You’ll have to pay taxes on those dividends and you’ll also have to pay taxes on the capital gains you earn when you sell, but you’ll still get a better return over the long haul than you would with CDs and savings bonds right now.

Then, if the rates on CDs and treasury notes climbs in the future (above 5%, at least), I’d lock my investment down with those.

Again, this is what I would do in your shoes. I encourage you to do your own research and reading.

Got any questions? Email them to me or leave them in the comments and I’ll attempt to answer them in a future mailbag (which, by way of full disclosure, may also get re-posted on other websites that pick up my blog). However, I do receive hundreds of questions per week, so I may not necessarily be able to answer yours.

My new book, The Simple Dollar: How One Man Wiped Out His Debts and Achieved the Life of His Dreams, is available in bookstores now! Check out some of the

My new book, The Simple Dollar: How One Man Wiped Out His Debts and Achieved the Life of His Dreams, is available in bookstores now! Check out some of the