-

Dec 21 2012 9:25 PM

-

Dec 20 2012 3:24 PM

-

Dec 20 2012 2:30 PM

Tax Cuts

The President's Plan

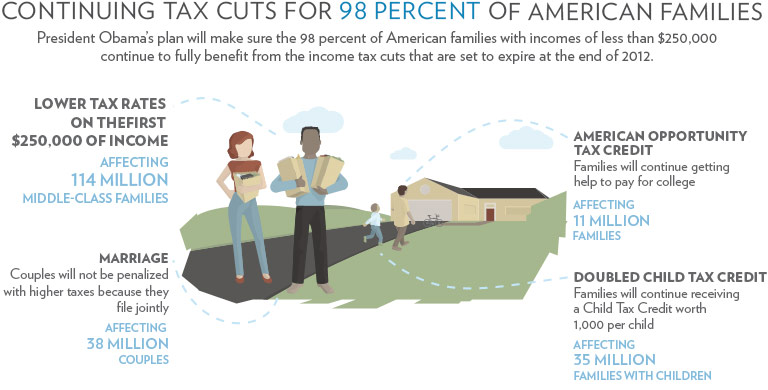

President Obama is calling on Congress to pass a bill that would prevent a tax hike on the first $250,000 of everybody’s income. That means that 98 percent of Americans and 97 percent of small businesses wouldn’t see their income taxes go up at all. And even thewealthiest Americans would get a tax cut on the first $250,000 of their incomes.

If Congress doesn't take action soon, typical middle class family of four will see their income taxes rise by about $2,000 in 2013. We can’t let that happen. Our families can’t afford it, and neither can our economy.

7 Facts About the Tax Debate

Since taking office, President Obama has repeatedly cut taxes for middle-class families. A typical family making $50,000 a year has received tax cuts totaling $3,600 over the past four years – more if it was putting a child through college.

If Congress fails to act before the end of the year, every American family’s taxes will automatically go up in 2013, including 114 million middle-class families. A typical middle-class family of four would see its taxes rise by $2,200.

President Obama is calling on Congress to act on his proposal to extend tax cuts for every family making under $250,000 a year—98 percent of all Americans and 97 percent of small businesses.

See the next 4 factsFeatured News

Increasing Taxes on Middle-Class Families Will Hurt Consumer Spending President Obama: There’s Only One Way to Solve These Challenges - Together President Obama: Let’s Get to Work President Obama Pushes the House of Representatives on Middle Class Tax Cuts Extending Middle Class Tax Cuts for 98% of Americans and 97% of Small BusinessesFeatured Video