November’s jobs report was generally positive, but with some notable caveats. Unemployment is down to 7.7 percent, the lowest since the financial crisis hit, and the economy gained 146,000 jobs. Then again past months’ numbers have been revised down, and labor force participation is down as well. Let’s dig in, as we usually do, in charts.

Unemployment and Payroll Numbers

It was a generally solid month for both indicators, but that accomplishment was diminished slightly by lower numbers in previous months. Between the September and October revisions, we lost about 49,000 jobs:

Labor force participation

Last month, labor force participation — that is, the percentage of people in the working age population currently working — ticked up to 63.8 percent, an encouraging development. But this month it fell to 63.6 percent, wiping out last month’s gains:

Public/private

The private sector continues to outperform its public counterpart, with the former gaining 147,000 jobs and the latter losing 1,000:

Alternative unemployment measures

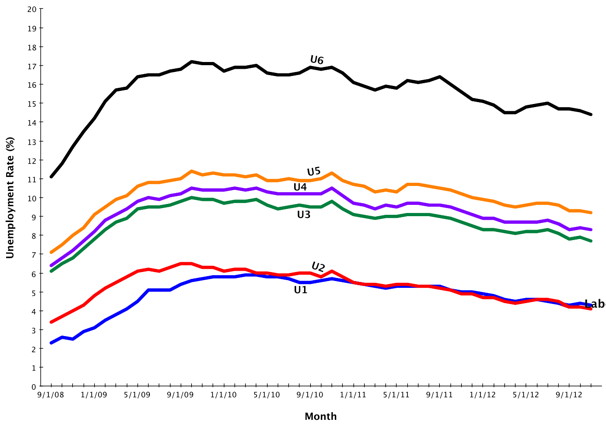

As we explain every month,

the BLS releases six unemployment measures. There’s U3, the number that shows up in all the news article, which counts people who don’t have jobs, but have looked for one in the past four weeks, but U1, U2, U4, U5 and U6 exist as well. U1 and U2 are usually lower than U3, and measure the percentage of people who have been unemployed for 15 weeks or longer and the percentage who have lost jobs or done temporary work in the period in question, respectively.

U4, U5 and U6 are usually higher than U3. Each of these categories includes everyone in all the lower categories: all people in U3 are in U4, all people in U4 are in U5, and all people in U5 are in U6. U4 adds people who have stopped looking for work because they’ve concluded none is available. U5 adds people who would like to work but for whatever reason have not looked for work recently. U6 adds the underemployed, or part-time workers who want to be working full-time but cannot for whatever reason.

For the first time in recent memory, all six measures ticked down:

Sectoral

Different sectors were hit to varying degrees by the downturn. Construction took the heaviest hit, while health and education were barely hurt at all. Same story this past month:

Wages

Private wages continued to grow, but at 1.46 percent last month, probably not enough to outpace inflation: