Top

-

-

drilling down

Why reports of huge shale finds don’t mean much until the oil starts flowing

-

The private drone industry is like Apple in 1984

-

Congratulations Britain, your austerity push may mean a triple-dip recession.

-

Don’t get too excited—Lenovo probably can’t buy RIM

-

Apple opens its eyes wider in China, finds terrible labor practices

-

Samsung, the anti-Apple, posts a record operating profit and beats expectations

-

turbulent

The annotated history of Netflix’s recent past

-

Corrupt Chinese officials are racing to withdraw cash and sell property while they can

-

Hyundai is tamping down plans for the messy Indian car market

-

Any last words?

Treasury Secretary Tim Geithner endorses fiscal stimulus on his way out the door

-

bedding

Investors choose sleep over sex in mattress wars

-

China’s mega-rich are worth more than the annual output of South Korea and Taiwan

-

Orlando the cat has a better chance of beating the stock market than a hedge fund manager

-

Probable new SEC head Mary Jo White is hard on Wall Street, soft on puppies

-

Why the Chinese government wants everyone to know Beijing’s first-time home buyers are the youngest in the world

-

Yes, the iPad Mini is cannibalizing sales of the larger iPad

-

If Spain were the size of the US, it would have over 40 million unemployed

-

After Algeria

24 resource-producing places that could be as vulnerable to attack as Algeria

-

Men at Work

This week women are 66% harder to find at Davos than anywhere else

-

Below the surface

Microsoft dips on a mixed earnings report, but keeps mum about Surface and Windows 8

-

Exclusive

The confidential list of everyone attending Davos this year

-

Modest ProPostal

How the Post Office can save America: A Quartz data essay

-

gender bender

Tech companies, stop hiring women to be the Office Mom

Why reports of huge shale finds don’t mean much until the oil starts flowing

In Ukraine, Shell has signed a $10 billion deal to develop shale gas. And in Australia, the share price of a small Brisbane company called Linc Energy has surged since its announcement of a shale oil find of 3.5 billion recoverable barrels. So the days of Ukraine living under Russia’s thumb are numbered. And Australia is on the cusp of becoming the world’s next oil exporting nation. Right?

No.

For the signal of a shift of such magnitude, the news to look for is not such announcements, but the day when supplies begin to flow from a shale gas or shale oil play anywhere in the world apart from North America. In the US, shale gas and shale oil supplies have surged, helping the country’s balance of payments, providing chemical and steel companies with cheap feedstock, and making refiners rich.

But drillers have yet not managed to economically drill for shale deposits anywhere else. The difference is mainly in the shale geology—drillers have vastly more data on US shale than for any other place on the planet, and have not felt confident yet in what they have found in Europe, China or elsewhere.

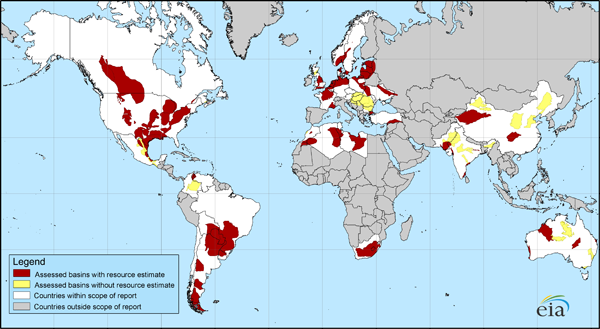

There is potentially much out there. In 2011, the US Energy Information Administration released a study of the shale gas potential of 32 countries. Its initial estimate was that, outside the US, there is a massive resource base of 5,760 trillion cubic feet of technically recoverable shale gas. The largest single nugget is in China—1,275 trillion cubic feet, the EIA says. Here is the EIA map:

The reserves are so vast that, especially in China’s case, successful production would be a paradigmic change. But the headline announcement will be a company announcing investment in actual production infrastructure.