Top

-

Easy on the easing

-

Cliff at work?

Fiscal cliff blamed for Americans cutting back on holiday shopping online

-

guest work

How Chinese tourists are reinventing Swiss hospitality: Hold the cheese, butter and salt

-

Pandora's Box

When it comes to financial regulation, simplicity is a virtue; complexity is a reality

-

The bigger the data, the larger the deception

-

Inauguration Jan. 10

With Chávez in Cuba, who will be Venezuela’s president next week?

-

FTC clears Google: “Reasonable minds may differ…and reasonable search algorithms may differ”

-

organize the world's $$

How Google resolves antitrust cases without impeding its creeping monopoly

-

How American CEOs’ push for a fiscal deal paid off: It’s not about NASCAR or Hollywood

-

Iraqi Public Offering

First IPO on Iraqi stock market since invasion is a whopper: $1.3 billion for Asiacell

-

Pretty polymer

The ridiculousness of Canada’s “melting” money

-

Gesture-based interface company Leap Motion gets $30 million and a deal with ASUS

-

Why the US needs its own sovereign wealth fund

-

China’s new entrance exam policy looks like a weak beginning of hukou reform

-

Bad Books

Greece living up to most corrupt EU country rating

-

Communication breakdown

We are losing the war against email

-

How China fails to catch the cash illicitly walking out the country’s gates

-

Thanks for avoiding that global recession, America. Now what?

-

Reputational risk

The Arctic holds 25% of the world’s oil and gas, but its rough seas still stymie human efforts

-

What if you had to plan for a pay cut that grew bigger each year? Welcome to the “doctor cliff”

-

Why the fiscal cliff deal offers little to celebrate

-

Rentals galore

Why the 49% premium Avis paid for Zipcar is a bargain

-

Auld Lang Syne

The fiscal cliff in New Year’s resolutions: I resolve to panic less about economic crises

-

Retail Crisis

UK retail bankruptcies jump 6% in 2012, with more to come in 2013

The Fed is starting to get antsy about its ultra-easy monetary policy

The US Federal Reserve has held interest rates incredibly low since late 2008, with the federal funds rate at or below 0.25%. It has taken unprecedented steps (like quantitative easing, or QE) to make money incredibly cheap for businesses, individuals, and banks. Until recently, most members of the Fed’s Open Market Committee (FOMC, which decides these things) have been adamant that, while these policies could do damage under other circumstances, they are necessary now to stimulate the economy.

The most recent minutes from the FOMC suggest the mood is shifting. Although the Fed hasn’t said it will change anything, some members of the committee seemed hesitant about how long it should continue its program of QE, asset purchases meant to push banks out of holding safe securities and into lending. The current round of QE, unlike previous ones, is open-ended. Several committee members now argue that it should be curtailed well before the end of 2013, “citing concerns about financial stability or the size of the balance sheet.” Others suggested it continue at least until the end of the year.

Most interesting is not what the committee said but why. Numerous statements within the minutes suggest that the Fed is truly growing concerned about the unintended consequences of ultra-loose monetary policy on a long-term basis. For four years, Fed Chairman Ben Bernanke and his supporters have argued for more monetary easing, not less. Inflation, the dovish Fed argued, is not the problem right now; we need to do more to get the economy on the move. By all accounts, as my colleague Matt Phillips has reported, this policy has been effective so far.

But three-and-a-half rounds of QE later, Bernanke et. al. see an economy “moderately” on the move, as the housing market improves and unemployment falls. Several committee members now cite concerns about creating unseen bubbles and distortions in the markets, overburdening the Fed’s balance sheet, or even causing problems for the US Treasury in borrowing. Some quotes (our emphasis):

With regard to the possible costs and risks of purchases, a number of participants expressed the concern that additional purchases could complicate the Committee’s efforts to eventually withdraw monetary policy accommodation, for example, by potentially causing inflation expectations to rise or by impairing the future implementation of monetary policy. Participants also discussed the implications of continued asset purchases for the size of the Federal Reserve’s balance sheet. Depending on the path for the balance sheet and interest rates, the Federal Reserve’s net income and its remittances to the Treasury could be significantly affected during the period of policy normalization. Participants noted that the Committee would need to continue to assess whether large purchases were having adverse effects on market functioning and financial stability.

This hawkish stance extends to long-term interest rates, which could eventually hurt savers and push investors into unnecessarily risky assets.

A few participants, observing that low interest rates had increased the demand for riskier financial products, pointed to the possibility that holding interest rates low for a prolonged period could lead to financial imbalances and imprudent risk-taking. One participant suggested that there were several historical episodes in the United States and other countries that might be used to build a better understanding of the financial strains that could develop from a long period of very low long-term interest rates.

In other, shorter words, committee members are worried that prolonged easy money might get the economy addicted; that it will put a strain on the Fed’s own finances; and that it will encourage moral hazard. (That mystical reference to “historical episodes” might be a warning about Japan’s “lost decade” in the 1990s, or US stagflation in the 1970s.) We’ve talked about this before, and tons of economists have been warning about the unintended consequences of QE or low interest rates for years. That the Fed is now discussing it, however, suggests that these concerns may now be more pressing. It also suggests that this could be the beginning of the end for easy monetary policy in the US.

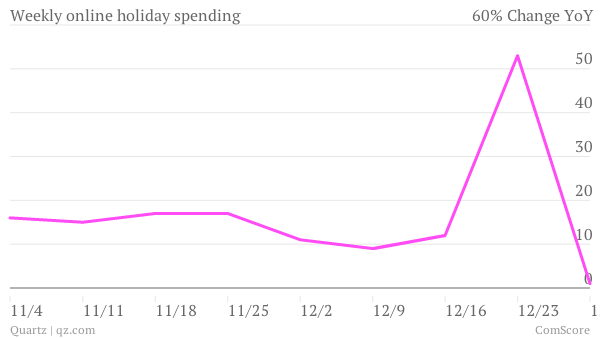

Although holiday shoppers spent $42.3 billion online this holiday season—14% more than they did at the same time in 2011—ComScore says that sales lagged sharply starting in early December. It believes that uncertainty generated by the fiscal cliff—the possibility that taxes would increase, government spending would fall, and Congress would have to debate the debt ceiling all over again—produced a “December swoon,” preventing online spending from reaching the $43.4 billion that was expected.

Although holiday shoppers spent $42.3 billion online this holiday season—14% more than they did at the same time in 2011—ComScore says that sales lagged sharply starting in early December. It believes that uncertainty generated by the fiscal cliff—the possibility that taxes would increase, government spending would fall, and Congress would have to debate the debt ceiling all over again—produced a “December swoon,” preventing online spending from reaching the $43.4 billion that was expected.

Says ComScore Chairman Gian Fulgoni:

While November started out at a very healthy 16% growth rate through the promotional period of Thanksgiving, Black Friday and Cyber Monday, consumers almost immediately pulled back on spending, apparently due to concerns over the looming fiscal cliff and what that might mean for their household budgets in 2013. With Congress deadlocked throughout December, growth rates softened even further and never quite made up enough ground to reach our original expectation.

Admittedly, online retailers did see a late surge on the first ever “Free Shipping Day” on Dec. 19, which accounts for the one-week spike you see in the chart above. Otherwise, strong spending in November slumped significantly in early December, from 17% more money spent year-over-year during the week ending Nov. 25 to just 9% more spent the week ending Dec. 9.

And it does make sense that concerns about fiscal policy would impact consumer spending. Even the deal that was reached on Monday, while avoiding tax rate hikes for most Americans, allowed the payroll tax cut to expire, meaning that anyone earning $50,000 in 2013 will have to pay another $1,000 in taxes.

How Chinese tourists are reinventing Swiss hospitality: Hold the cheese, butter and salt

It starts out well, or well-meaning at least. Chinese outbound tourism is the fastest and biggest growing sector in travel, as outbound tourists rose to 70.3 million in 2011, and are expected to rise to 82 million this year, up 17%. And everyone wants these hordes of Chinese travelers spending money, especially the recession and debt crisis beset European countries.

From hotels, airports, malls, and retailers hiring Manadarin speaking concierge services, to countries easing visa norms and doing joint marketing agreements with China, the efforts run the gamut. And most of the time, in the name of being sensitive to the Chinese cultural needs, some tourism organizations and companies resort to cultural shorthands, or cliches, while dealing with the guests.

For instance, Switzerland, a sophisticated tourism marketer as far as countries go, is in a Chinese marketing overdrive: As its mainstay German travelers are shying away, Chinese are among the fastest-growing groups, populating the Alps and buying its famous and pricey watches.

It recently came out with detailed norms and guidelines for its hotel industry on working with Chinese travelers, titled “Swiss Hospitality for Chinese Guests.” And the document, while very detailed and useful, resorts to plenty of cliches about Chinese culture in general, some surely useful, and some borderline offensive. We’ve extracted the best below:

- Treat your Chinese guests respectfully. They are proud to be citizens of the People’s Republic of China as well as of the economic and political success of their home country. Discussions on politically sensitive matters like human rights, regional independence movements, Taiwan, etc. should be conducted with great care and diplomacy – your Chinese counterpart often does not feel at ease discussing controversial matters.

- Many Chinese understand only little English, German or French: Chinese signalling at the most popular tourist spots of the destination as well as for generally important information (airports, train stations, cable cars, museums, entrance, exit, bathrooms, etc.) is a must.

- Chinese are “last-minute travellers,” they don’t really plan their trip, and they don’t like to wait: Show flexibility with regard to the suggestions of your Chinese guests and provide fast response and service.

- Chinese visitors have high expectations: Show as much flexibility as possible and take into account their requests.

- If possible do not assign rooms on the 4th floor or containing a “4” (4, 14, 24, 34, etc.) in the room number to Chinese travellers as this number is associated with death. In particular room numbers containing “6”, “8” or “9” or being located on the 6th, 8th, and the 9th floor are considered to be lucky rooms.

- Provide clear operational instruction in Chinese about Pay-TV and indicate that the fee is not included in the room rate or the package.

- Assign your Chinese guests rooms with twin beds: The members of the group travelling together will, in general, not have known each other before starting the trip.

- Ensure fast check-in and check-out service: Chinese get rather impatient if they have to wait.

- Chinese love to drink hot tea or hot water at almost any time of the day (or night): Provide an electrical water cooker or a thermos containing hot water as well as free tea and coffee in the rooms. Hot water or hot tea is usually served at lunch and dinner as well.

- Chinese travel with little luggage: Provide a basic selection of accessories for daily use, such as shampoo, tooth brush and tooth paste, in their room.

- Chinese prefer to spend their free time in a group: Take this fact into account, when proposing leisure activities during their trip.

- Chinese dine early (at about 7 p.m.) and go to sleep rather late: Let them know what kind of evening entertainment the destination offers (shows, movies, bars, etc.)

- Chinese are evening and weekend shoppers: Make sure your shop is open when they come and adapt the opening hours.

- Shopping is also a social event: Be prepared to deal with a whole group of customers at once and entertain them with some small talk.

- The Chinese love variety: therefore, offer to your Chinese guests several small dishes rather than just one big dish. Put emphasis upon using different kinds of food stuffs (meat, vegetables, eggs, etc.).

- Chinese eat quickly: try and serve the food all at the same time and please don’t take it as a mark of disrespect when the Chinese leave the table immediately – as soon as they have put down their cutlery or chopsticks.

- Avoid using too many milk products (cream, cheese, butter) and be moderate in the use of salt.

- The Chinese like foods which are liquid and soft. However, baked goods are not very common in China.

- Soft-boiled eggs are not so much appreciated. So please boil them longer.

- Hot drinks (and often simply hot water) are preferred to cold drinks.

- A basic selection of Chinese food, such as rice, stewed or fried vegetables and sliced meat (chicken, beef, veal, pork) or fish should be available at all meals.

- Reserve a big, if possible round, table for your Chinese guests: The group travelling together will, in principle, prefer to eat together.

- Chinese like to combine different dishes and tastes: It is appreciated if all courses are served together. The soup will, in principle, be served at the end of the meal.

- Together with the classical European cutlery, chop sticks – placed on the right side of the bowl or dish – should be provided for each person. Chop sticks should never be stuck into the food – this will be associated with bad luck or even death. Otherwise the usual European tableware and decoration will be appreciated by your Chinese guests.

- Chinese eat early: Breakfast at 7 a.m., lunch at noon and dinner at 7 p.m. are quite standard eating hours for Chinese tourists.

This post originally appeared on Skift.com. More from our partner site:

13 global trends that will define travel in 2013

Americans moving out of New York City and into DC

Expedia and Concur team up for $30 million funding round for Room 77