Top

-

-

drilling down

Why reports of huge shale finds don’t mean much until the oil starts flowing

-

The private drone industry is like Apple in 1984

-

Congratulations Britain, your austerity push may mean a triple-dip recession.

-

Don’t get too excited—Lenovo probably can’t buy RIM

-

Apple opens its eyes wider in China, finds terrible labor practices

-

Samsung, the anti-Apple, posts a record operating profit and beats expectations

-

turbulent

The annotated history of Netflix’s recent past

-

Corrupt Chinese officials are racing to withdraw cash and sell property while they can

-

Hyundai is tamping down plans for the messy Indian car market

-

Any last words?

Treasury Secretary Tim Geithner endorses fiscal stimulus on his way out the door

-

bedding

Investors choose sleep over sex in mattress wars

-

China’s mega-rich are worth more than the annual output of South Korea and Taiwan

-

Orlando the cat has a better chance of beating the stock market than a hedge fund manager

-

Probable new SEC head Mary Jo White is hard on Wall Street, soft on puppies

-

Why the Chinese government wants everyone to know Beijing’s first-time home buyers are the youngest in the world

-

Yes, the iPad Mini is cannibalizing sales of the larger iPad

-

If Spain were the size of the US, it would have over 40 million unemployed

-

After Algeria

24 resource-producing places that could be as vulnerable to attack as Algeria

-

Men at Work

This week women are 66% harder to find at Davos than anywhere else

-

Below the surface

Microsoft dips on a mixed earnings report, but keeps mum about Surface and Windows 8

-

Exclusive

The confidential list of everyone attending Davos this year

-

Modest ProPostal

How the Post Office can save America: A Quartz data essay

-

gender bender

Tech companies, stop hiring women to be the Office Mom

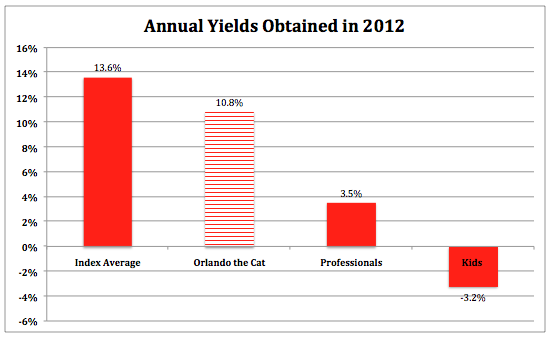

Orlando the cat has a better chance of beating the stock market than a hedge fund manager

Orlando, a cat, got a higher yield from its investments than a team of financial experts in a 2012 financial acumen’s contest organized by The Observer, a British Sunday newspaper. In the process, Orlando also defeated a third contestant, a team of schoolboys.

The competition was fair and realistic. At the start of 2012, each of the contestants was given a notional 5,000 pounds, which they would invest in five companies from the FTSE All-Share Index. (The Index is the average of a number of companies representing at least 98% of the full capital value of all UK companies listed in the London Stock Exchange that also meet other requirements. In June 2012 the Index included 627 companies out of 2000 listed in the stock exchange.) Every three months, the contestants could replace any stocks with others belonging to the Index. The winner would be the contestant earning the highest yield through the year. The experts and the kids wrote down their choices. Orlando, the cat of Jill Insley, who is The Observer’s head of the consumer team, threw a toy mouse against a list of numbers representing each of the Index’s companies.

Source: The Observer and FT for the average of the Index.

As shown in the accompanying graph, Orlando generated a yield that was three times as high as that generated by the financial experts. The kids lost money. The graph also shows that Orlando was defeated by the average yield of all the companies included in the Index. Somebody investing in a fund with holdings reproducing the structure of the FTSE All-Shares Index would have earned 13.6% against 10.8% earned by Orlando. This, however, was irrelevant for the competition because the Index was not a contestant. Orlando was pronounced the winner.

Bizarre as they might seem, the results of The Observer’s contest are consistent with those obtained during the last several decades by the statistical analysis of portfolio choices in the stock exchange. In fact, Burton G. Malkiel, who wrote the seminal book in this field (A Random Walk Down Wall Street, 1973) expressed the results of his research saying that a blinded chimpanzee throwing darts at the stock listings could select a portfolio that performs as well as those managed by experts.

Forty years in the future, he found that he had been too kind to the experts. In this way, an investor with $10,000 at the start of 1969 who purchased shares in the average actively managed fund would have seen his investments grow to $205,000 by 2010, assuming that all dividends were reinvested. A second investor who invested in a Standard & Poor’s 500-stock Index Fund (the average of the Standard & Poor’s Index) would have a portfolio worth $463,000 by 2010. The second investor would have results close to those of the chimpanzee. By throwing its darts at random, the chimpanzee would eventually hit all companies in the Fund, accumulating a portfolio that would yield the average of the Fund Index. It would have been holding $463,000 in 2010, while the experts would be holding only $205,000. Thus, the fictional chimpanzee would have outperformed the experts in the same way as the real cat had.

Other studies have confirmed these results. They have reached this conclusion based on two facts: (a) only a few fund managers could earn more than the average yielded by all shares, (at least two thirds of the managed funds underperform the average of the market in any given year) and, (b) the managers that outperformed the average in one year tended to be different from those that outperformed it in the previous year.

As expressed by Daniel Kahneman, Nobel Prize of Economics, finding a fund manager outperforming the average in some years and underperforming it in others is the footprint of randomness—or, said in another way, of sheer luck. And this is what the studies find. Kahneman himself tested 28 wealth advisors in one firm over 8 years. The correlation between those fund managers who were successful in one year and those who were successful in the next year was close to zero (0.01) over the eight years. That is, they were successful or unsuccessful by sheer luck, not by skill.

Leonard Modlinow, a professor of randomness at Caltech, took a sample of 800 mutual fund managers and ordered them in terms of their yield performance in 1991-1995 and in 1996-2000. There was no correlation whatsoever between the winners of the first period and those of the second, or between the losers in the two periods. That is the trademark of a random process.

Moreover, it is possible to consistently win for several periods based on luck exclusively. Think of a process suggested by Nassim Taleb in Fooled by Randomness. It starts with 10,000 fund managers, who would win or lose depending on the throwing of a coin—heads, you win, and stay in the game for the next period; tails, you lose and abandon the game. Using a balanced coin, you would expect that 5,000 would abandon the game and 5,000 would stay for the next round. In the second round, you eliminate 2,500 and 2,500 stay. In the next one, 1,250 would abandon and 1,250 would stay. In the fourth round, 625 would stay, and in the next, 625. Thus, by a completely random process, you were able to create 625 highly successful fund managers, who consistently won for five years. In real life, people would begin to see them as great winners, who posses the ability to beat the markets—until the next move, when the same luck that made them winners makes them losers.

That is, the relative performance of fund managers could be explained by sheer luck, and the results of the statistical analyses of the evidence suggest that it is indeed explained by sheer luck. No wonder a cat could compete and win. Actually, it had an advantage. It was following random whims when throwing the toy mouse, in such a way that the probability of it falling in any company was equal for all companies. In these circumstances, over time, the value of the cat’s portfolio would approximate that of the average of the Index—in the same way as the chimpanzee’s investments.

Thus, if you want to maximize your yields, your best strategy would be to buy a wide index fund. The second best would be to give your portfolio to Orlando or a similar cat. You should look for an active investment advisor only if your alternative is to have your portfolio managed by a bunch of high school kids.

We welcome your comments at ideas@qz.com.