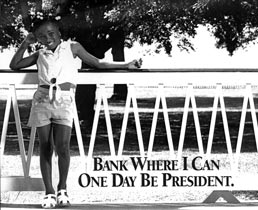

Minority-Owned Banks — Making a Difference in Their Communities

by John C. Dugan, Comptroller of the Currency

Although there are fewer than 200 minority-owned banks in the United States — accounting for about 2 percent of the banking industry’s total assets — their importance can’t be measured solely by such statistics.

Take City National Bank (CNB) of New Jersey, for example. Founded in 1973 and headquartered in Newark, CNB is the only commercial bank in the state owned by African-Americans. With a mission to serve the underserved, CNB is well aware of the urgent need for inner-city neighborhoods to offer good child-care facilities, freeing parents to find and keep full-time jobs.

When Memorial Day Nursery of Paterson — the nation’s oldest child-care center, founded in 1887 — sought funding to expand by buying and renovating a 16,000-square-foot building, it had trouble finding conventional financing. In response, CNB created a loan package that included tax-exempt bond financing through the New Jersey Economic Development Authority, which reduced Memorial’s annual debt obligation. As a result, Memorial opened its new facility in 2003, accommodating 285 children — and helping their parents. “City National was highly professional,” according to Deborah Hoffman, the Treasurer of Memorial’s Board, “and sympathetic to our mission to provide exemplary educational services to Paterson families.”

Full story... |

_r1_c1.gif)

_r1_c2.gif)

_r1_c3.gif)

_r1_c4.gif)

_r1_c1.gif)

_r1_c2.gif)

_r1_c3.gif)

_r1_c4.gif)