By:

Timothy G. Massad

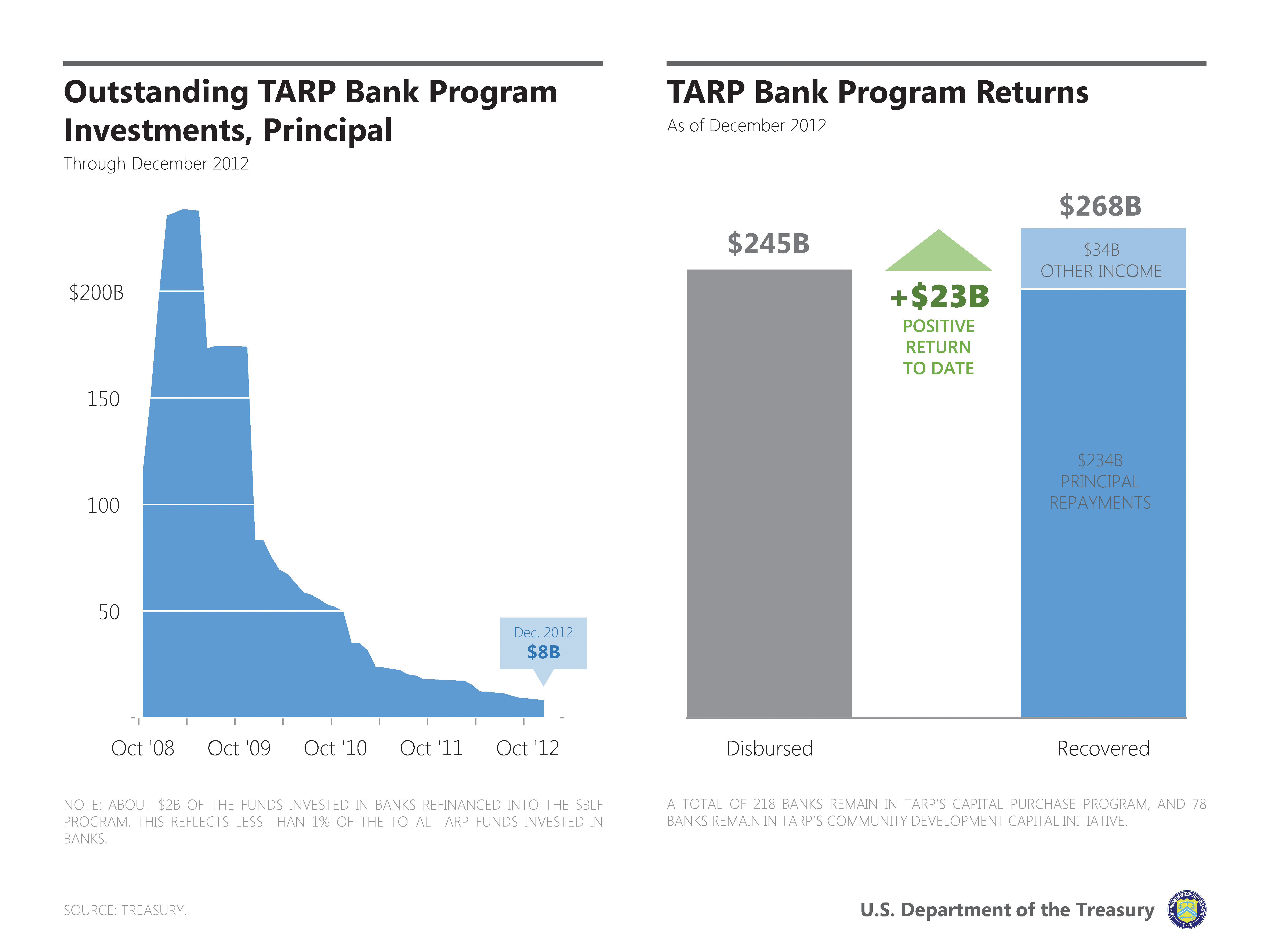

TARP’s bank investment programs played a critical role in

stabilizing the economy during the 2008-09 financial crisis.

And – though cost isn’t our ultimate measure of success –

those programs have also earned a significant profit for taxpayers. Treasury invested

a total of $245 billion and has already recovered $268 billion through

repayments, dividends, and other income – representing a $23 billion

positive return for taxpayers to date.

Of course, TARP was always meant to be a temporary,

emergency program. The government shouldn’t be in the business of owning stakes

in private companies for an indefinite period of time. That’s why, after we

extinguished the immediate financial fire, we began moving to exit our

investments and replace temporary government support with private capital.

Earlier this year, Treasury outlined

its strategy for winding down its remaining TARP bank investments through the

Capital Purchase Program (CPP).

Today, we wanted to provide you with an update on that process and our plans

for the year ahead.

Our Progress to Date

When we first outlined our wind down approach, we said that Treasury

had three basic options: (1) We can wait for banks to repay; (2) We can sell our

investments; or (3) We can restructure our investments in order to facilitate a

repayment or sale.

We also noted that community banks typically face greater

difficulty than larger banks raising private capital to repay taxpayers. And

that banks cannot be compelled to repay under the terms of the program, which

was necessary for our investments to be considered high-quality capital.

Therefore, in order to wind down the program, we said that

we’d employ each one of those three strategies, including conducting auctions

for our investments in banks that we do not expect to repay us in the near term.

And that’s exactly what we’ve done.

- Since March 2012, when we conducted our first preferred stock and subordinated debt auction, Treasury has auctioned its investments in 91 banks for taxpayer proceeds of $1.5 billion. (Those 91 banks have also paid more than $300 million in dividends and interest to taxpayers over the life of the investment.)

- Over that same period (March 2012 through December 2012), 49 banks repaid Treasury at the full par value of the original CPP investment for taxpayer proceeds of $6.9 billion.

- Since March 2012, in a few cases, we’ve restructured our CPP investments – typically tied to a merger or a plan for the bank to raise new private capital. But only when it represented the best deal possible for taxpayers.

When we first outlined our strategy, some expressed the view

that, once Treasury began auctioning its investments in certain banks, the rest

of the banks would refuse to repay. Based on the data, however, that fear

hasn’t come true. Banks have continued to repay at par and we expect that

additional banks will do so moving forward.

Some had also expressed the view that Treasury shouldn’t

sell its investments at a discount to the original par value. But both Treasury

and the non-partisan, independent Congressional Budget Office had already

estimated that the value of those investments is less than par. And we

ultimately receive what the market determines these investments are worth

through open auctions.

In fact, in part because we’ve had such robust demand, we’ve

actually received more than we originally estimated those investments were

worth in our pre-auction financial statements, which are audited by the

independent Government Accountability Office.

Moreover, it’s important to note that since banks cannot be

compelled to repay, and a number of banks are not expected to repay in the near

term, there is no way to wind down the program without Treasury selling its

investments in certain banks.

The Path Forward

Today, there are 218 banks remaining in TARP’s Capital Purchase

Program – down from an original total of 707.

We expect to conduct auctions for Treasury’s CPP preferred

shares or subordinated debt in approximately two-thirds of the remaining banks next

year.

We also expect that the majority of the remaining banks that

are not auctioned will repay Treasury’s CPP preferred shares or subordinated

debt at par. We’ll continue to hold onto those investments.

And when it represents the best deal possible for taxpayers,

we’ll also continue to engage in a limited number of restructurings.

We believe that the approach we’ve outlined is good for

taxpayers and good for our nation’s community banks. Indeed, as we’ve

previously noted, selling these investments can be beneficial for community

banks that don't have easy access to the capital markets because it attracts

new, private capital to replace temporary government support. That means that

the government is able to exit its stake and recover taxpayer dollars, while

the bank is able to keep the capital on its books. The bank can then continue

to use that capital to help it lend to families and businesses in its local

communities.

As with all our investments, Treasury’s wind down plans are

subject to market conditions. We regularly evaluate our investments in all the remaining

banks, so these expectations may be revised as necessary. But we’re confident that we’ll have made

significant additional progress winding down our remaining TARP Capital

Purchase Program bank investments by the end of next year.