How much does the United States own abroad? And how does that stack up against what foreign investors own in this country? Tracking the ownership and value of trillions of dollars’ worth of financial assets like stocks, bonds, loans, and cash in bank accounts to come up with answers to these very questions is the work of skilled financial sleuths at the U.S. Bureau of Economic Analysis (BEA).

We hear a lot about the globalization of commerce and that global interconnectedness is seen vividly on the investment front. BEA’s work helps businesses and government policymakers monitor investors’ appetites for risk and gauge the attractiveness of the United States as a place to invest.

U.S. investors have a strong appetite for the higher returns of foreign stocks versus lower yielding bonds. U.S. investors’ holdings of foreign stocks totaled $4.2 trillion at the end of 2011. In addition, U.S. companies’ and individuals’ ownership stakes in foreign businesses totaled $4.7 trillion. A third large category is money in bank and brokerage accounts valued at $4.3 trillion in bank and brokerage accounts. When other assets are counted, the United States owned a grand total of $21.13 trillion abroad.

Foreign investors, on the other hand, prefer U.S. Treasuries, considered a safe investment. Foreigners’ investments in U.S. Treasuries totaled $5.1 trillion at the end of 2011. (That’s combining the holdings of private investors, foreign central banks, and other government entities.) Foreign companies and individuals, meanwhile, had ownership stakes in U.S. companies valued at $2.9 trillion. Foreigners had $4 trillion worth of assets in U.S. bank and brokerage accounts. Altogether, foreign-owned assets in the United States totaled $25.16 trillion.

Looking across countries, the largest net creditor nations to the United States are China and Japan.

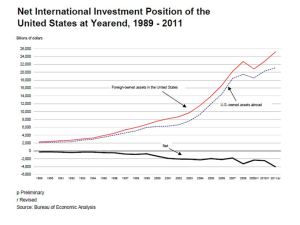

The difference between the total amount of assets Americans own abroad and the total amount of assets foreigners own in the United States is called the net U.S. international investment position.

At the end of 2011, the U.S. net international investment position was $4.03 trillion in the negative. (The United States owned assets in other countries worth $21.13 trillion, while the value of assets foreigners owned in the United States came to $25.16 trillion.) To put that negative $4.03 trillion figure in perspective, it is equal to 5.8 percent of the $69 trillion net worth of U.S. households, businesses, and governments.

In 2010, the net U.S. international investment position was a negative $2.47 trillion, compared with a negative $4.03 trillion in 2011. What happened?

More than half of the negative $1.6 trillion change in the net investment position (from 2010 to 2011) was due to an increase in the prices of foreign holdings of U.S. Treasuries and a decline in the prices of U.S. holdings of foreign stocks. Much of the rest of the increase was in the form of more purchases of U.S. Treasury securities and direct investments by foreign companies. Sometimes, the international investment position is described as the U.S. international debt position, but as the sources of the increase in 2011 suggest, it is in great part reflecting the attractiveness of the United States as a destination for foreign investment.

BEA produces annual reports on the net international investment position, but in just a few months, it will begin providing more timely information on this topic. On March 26, it will begin issuing quarterly reports on the net U.S. international investment position, starting with the fourth quarter of 2012. The new quarterly report (read more here) will offer a more up-to-date picture of the value of U.S. investments abroad compared to the value of foreign investments in the United States.

The investment position accounts complement the international transactions accounts (read more here and here). When used in combination, the two sets of accounts provide a complete statistical picture of the international sector of the U.S. economy.

You can find the latest annual international investment position release here or read more detailed information here.