The Department of the Interior (Interior, the Department) received over $2.9 billion in Recovery Act funding for eight Bureaus and Offices, and is using this funding to complete approximately 4,300 high-priority projects.

Most organizations that receive Recovery Act-funded awards from the Department and its Bureaus and Offices are subject to the recipient reporting requirements outlined in Section 1512 of the Recovery Act. The Department is committed to working with recipients to maximize compliance with these requirements and support transparency in reporting on the progress of Recovery Act awards via Recovery.gov.

The FAQs on this page will help awardees understand the recipient reporting requirements associated with their Recovery Act-funded awards.

Frequently Asked Questions

- Which contract recipients are required to report?

- Which grant recipients are required to report?

- When do I report?

- How do I report?

- What data must I report?

- How do I calculate the number of jobs created and retained as a result of my award?

- Where can I find more information about recipient reporting?

- Do financial assistance recipients need to register with the Central Contractor Registry (CCR)?

- Do financial assistance recipients need DUNS numbers to register with CCR?

- Who do I contact for more information about my award?

- I reported last quarter; is there a way to copy my report from last quarter into the current quarter?

Frequently Asked Questions

1. Which contract recipients are required to report?

Any prime recipient that received a Recovery Act-funded award of $25,000 or greater from Interior in the form of a contract, contract modification, task order, delivery order, or purchase order is required to report.

The prime recipient is responsible for reporting data on payments made to both sub-recipients and vendors.

2. Which grant recipients are required to report?

Any prime recipient that received a Recovery Act-funded award of $25,000 or greater from Interior in the form of a competitive grant award, tribal agreement, tribal contract, or cooperative agreement is required to report.

Individuals and recipients of Financial Assistance awards below $25,000 are not required to report. The prime recipient of a grant may delegate the responsibility to report sub-recipient information to sub-recipients.

Definition of a sub-recipient: A sub-recipient is a non-federal entity that is awarded Recovery Act funding by a prime recipient to support the performance of any portion of the project/program for which the prime recipient received the funding. The terms and conditions of Recovery Act awards apply to sub-recipients. It is possible that a sub-recipient of one award may also be a prime recipient of another award provided directly by the Federal Government.

The prime recipient may not delegate reporting to vendors.

Definition of a Vendor: A vendor is a dealer, distributor, merchant, or other seller providing goods or services that are required for a federal project/program. Prime recipients and sub-recipients purchase goods and services needed to carry out Recovery Act-funded projects and programs from vendors. Vendors are not awarded funds by the same means as sub-recipients, and are not subject to the recipient reporting terms and conditions of Recovery Act awards.

The following characteristics distinguish vendors from sub-recipients. A vendor:

- Provides goods and services within normal business operations;

- Provides similar goods or services to many different purchasers;

- Operates in a competitive environment;

- Provides goods or services that are ancillary to the operation of the federal program; and

- Is not subject to recipient reporting requirements.

3. When do I report?

The responsibility to report begins upon award, not upon project kickoff. If you received a Recovery Act-funded award (contract or grant) of $25,000 or more, you must report for the quarter that the award was made, regardless of whether you have submitted an invoice or drawn down the funding as of the close of the quarter.

The reporting period quarters are defined as follows:

Quarter 1: January 1 – March 31

Quarter 2: April 1 – June 30

Quarter 3: July 1 – September 30

Quarter 4: October 1 – December 31

In general, FederalReporting.gov is available for recipient reporting for ten days following each calendar quarter. In some quarters, an extended submission period or late submission period may follow the initial reporting period. For example, a contractor receiving an award on or before June 30, 2010 must submit a report to FederalReporting.gov during the report submission period that runs from July 1, 2011 through July 14, 2011. The contractor must continue to submit a report each quarter until the organization has completed all of the work covered by the Recovery Act-funded award.

Reporting periods occur at the beginning of January, April, July, and October. However, the recipient reporting timeline may vary from quarter to quarter depending on schedule changes made by the Recovery Act Transparency Board. Recipients should review the current reporting timeline and any updated guidance available at www.FederalReporting.gov.

4. How do I report?

You must file your report using the centralized reporting system available online at www.FederalReporting.gov. You are encouraged to register well in advance of the reporting period, as the registration process can take several days to complete. In addition, we advise reporting early in the report submission phase to allow yourself time to track down required information, work through any registration-related issues, and avoid the slow system performance that occasionally occurs near the end of the reporting period.

There are user guides available in the “downloads” section of www.FederalReporting.gov that cover a variety of reporting-related topics. FederalReporting.gov also has a service desk available to you 8am – 6pm ET, Monday – Friday, to help you with any system issues you may experience. See Section 7 below for links to these resources.

5. What data must I report?

Section 1512 of the Recovery Act requires that recipients report the following information on a quarterly basis, in order to help the public track the progress of their awards:

- Total amount of funds received

- Amount of funding spent to date on projects and activities;

- Description of projects and activities funded by the award and progress made on these;

- Estimate of jobs created / retained during the quarter as a result of the award; and

- Information related to sub-awards and other payments.

Detailed information about the data you are required to provide in your report can be found in the Recipient Reporting Data Model, located in

the “downloads” section of FederalReporting.gov.

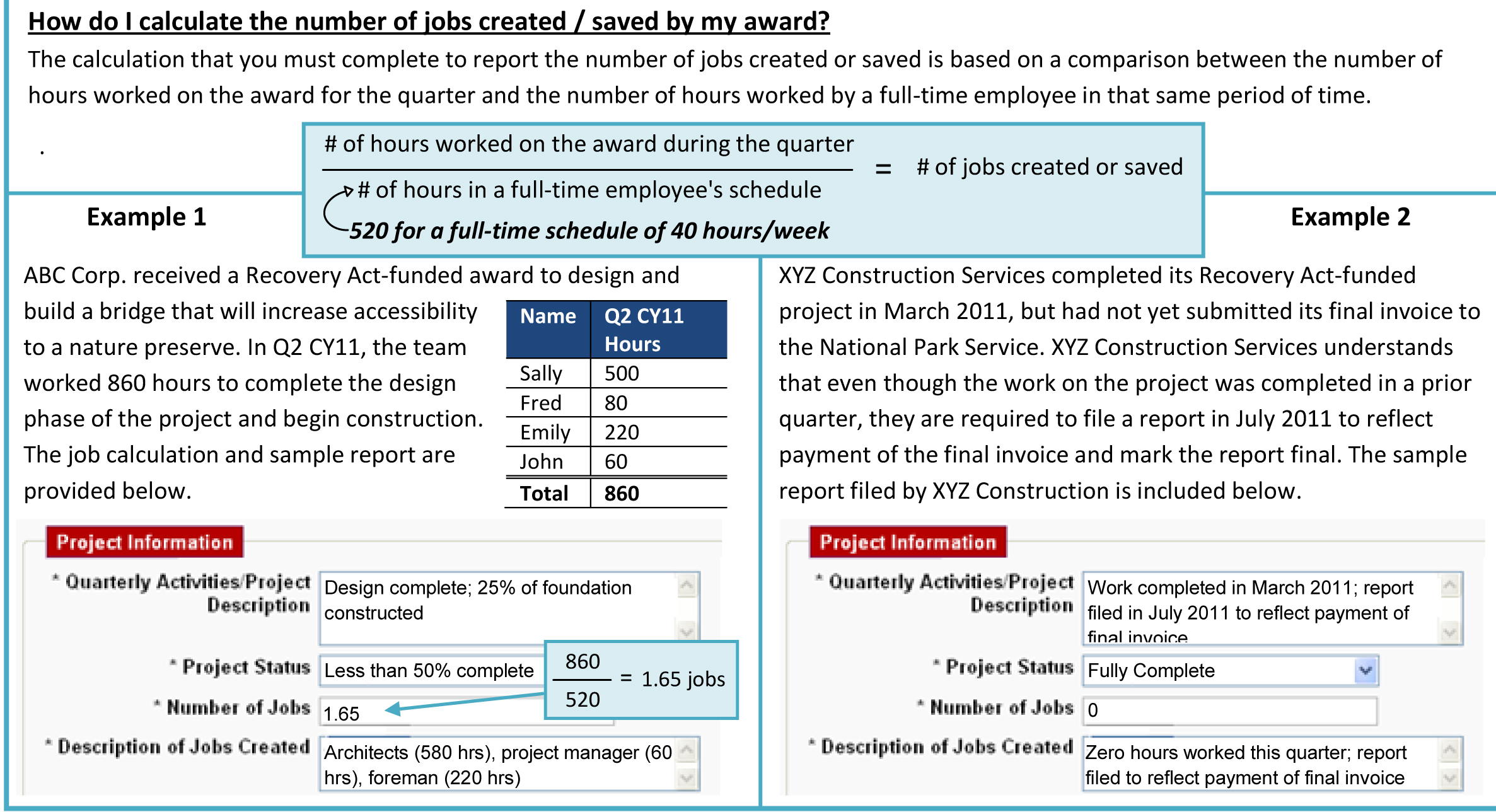

6. How do I calculate the number of jobs created and retained as a result of my award?

Recipients must report the number of jobs created and retained using the Office of Management and Budget (OMB) full-time-equivalent (FTE) methodology. This methodology is described in Section 5.3 of OMB Memo 10-08, Updated Guidance on the American Recovery and Reinvestment Act — Data Quality, Non-Reporting Recipients, and Reporting of Job Estimates.

The calculation that you must complete to report the number of jobs created and retained is based on a comparison between the number of hours worked on the award for the quarter and the number of hours worked by a full-time employee in that same period of time (520 hours for a full-time schedule of 40 hours/week). You should not report on the cumulative hours worked to date, just the hours in the given quarter. You must consider all hours worked on the award in the quarter, regardless of whether they were worked by personnel in a new job (a created position) or an existing job (a retained position).

The examples below show how to calculate and log jobs created/retained for Quarter 2 of 2011.

|

7. Where can I find more information about recipient reporting?

FederalReporting.gov

There are multiple resources available at www.FederalReporting.gov to assist you with the reporting process, including the following:

- Messages regarding this quarter’s recipient reporting process, including deadlines

- Templates to use when creating Excel and XML reports

- Recipient reporting data model

- FederalReporting.gov User Guide

- Registration and reporting quick reference cards

- Congressional district and agency code search tools

- Frequently Asked Questions

In addition, FederalReporting.gov has a service desk available to you 8am – 6pm ET, Monday – Friday, to help you with any system issues you may experience. Contact information for the service desk is available on the FederalReporting.gov homepage.

Office of Management and Budget (OMB) Recovery Act Webpage

OMB posts all Recovery Act-related memos and Frequently Asked Questions to its website (http://www.whitehouse.gov/omb/recovery_default/). These memos contain detailed guidance for Federal Agencies implementing the Recovery Act.

Department of the Interior/Bureau Guidance

Representatives from your awarding agency are available throughout the reporting cycle to answer any questions you have about the reporting process and what information you should enter into FederalReporting.gov. If you are unsure who to contact at your awarding agency, you may email InteriorRecoveryReporting@ios.doi.gov with any questions, and we will put you in touch with the appropriate contact.

8. Do financial assistance recipients need to register with the Central Contractor Registry (CCR)?

Yes, each prime recipient and reporting sub-recipient must register with CCR in order to file a report in FederalReporting.gov. FederalReporting.gov interfaces with CCR to obtain basic information about recipients and control access to FederalReporting.gov accounts. If you have not yet registered with CCR, please do so as soon as possible so that your registration is complete prior to the reporting deadline.

Visit the CCR website to register.

9. Do financial assistance recipients need DUNS numbers to register with CCR?

Yes, each prime recipient and reporting sub-recipient must have a DUNS number in order to file a report in FederalReporting.gov. A DUNS number is a unique 9-digit number issued by Dun & Bradstreet. Your organization’s DUNS number will be listed on your award document and/or the application your organization submitted for award. If you have not yet registered with Dun & Bradstreet, please do so as soon as possible so that your registration is complete prior to the reporting deadline.

Visit the Dun and Bradstreet website to obtain/locate a DUNS number..

10. Who do I contact for more information about my award?

If you need additional information about your award, or have any questions regarding how the award information should be logged in FederalReporting.gov, please contact your Awarding Official or Contracting Officer.

You may also contact the Interior Recovery Act Office at InteriorRecoveryReporting@ios.doi.gov.

11. I reported last quarter; is there a way to copy my report from last quarter into the current quarter?

Yes, recipients that reported last quarter should use the Copy Forward functionality available in FederalReporting.gov to copy the report from the previous quarter into the current quarter. For step-by-step instructions on how to successfully copy forward a report, please see Chapter 10 of the User Guide available at https://www.federalreporting.gov/federalreporting/downloads.do.

Last Updated June 2011