Spotlight on Foreign Corrupt Practices Act

The Foreign Corrupt Practices Act (FCPA), enacted in 1977, generally prohibits the payment of bribes to foreign officials to assist in obtaining or retaining business. The FCPA can apply to prohibited conduct anywhere in the world and extends to publicly traded companies and their officers, directors, employees, stockholders, and agents. Agents can include third party agents, consultants, distributors, joint-venture partners, and others.

The FCPA also requires issuers to maintain accurate books and records and have a system of internal controls sufficient to, among other things, provide reasonable assurances that transactions are executed and assets are accessed and accounted for in accordance with management's authorization.

The sanctions for FCPA violations can be significant. The SEC may bring civil enforcement actions against issuers and their officers, directors, employees, stockholders, and agents for violations of the anti-bribery or accounting provisions of the FCPA. Companies and individuals that have committed violations of the FCPA may have to disgorge their ill-gotten gains plus pay prejudgment interest and substantial civil penalties. Companies may also be subject to oversight by an independent consultant.

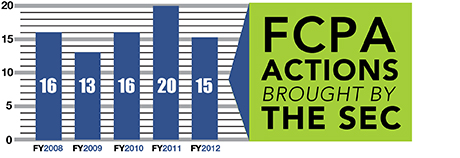

The SEC and the Department of Justice are jointly responsible for enforcing the FCPA. The SEC's Enforcement Division has created a specialized unit to further enhance its enforcement of the FCPA.

Summaries of FCPA Cases

FCPA enforcement continues to be a high priority area for the SEC's enforcement program.

View the complete history of SEC enforcement actions against FCPA violators…

Investor Bulletins

The SEC issued an investor bulletin detailing the FCPA's prohibitions.

The SEC also issued an investor bulletin about American Depositary Receipts ("ADRs").