Pay your Taxes by Debit or Credit Card

Choose your payment processor and pay now

You can pay by debit or credit card whether you e-file, paper file or are responding to a bill or notice. It's safe and secure - the IRS uses standard service providers and commercial card networks.

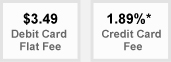

- Your payment will be processed by a payment processor who will charge a processing fee, which may be tax deductible. The fees vary by service provider.

- Your information will only be used to process your payment.

- No part of the service fee goes to the IRS.

- The types of payments (Individual or Business) and limits on how many debit or credit card payments you can make in a year, quarter, or month, vary according to the type of tax you are paying.

How to Make a Payment

You can pay by debit or credit card by internet or over the phone. Please note that debit or credit payments cannot usually be cancelled.

Step 1: On IRS.gov

Step 2: With your Payment Processor

|

You will need:

|

Get Started: Choose a Payment Processor

Paying with a debit card can save you money! Below you will find the website link, name (in parenthesis) and phone number of the service provider, the fee charged for payment by card, and the types of cards accepted. Please note that your payment date will be the date that the charge is authorized.

|

(Official Payments Corporation) 888-872-9829 Payment 800-487-4567 Live Operator 877-754-4413 Service |

|

Payments Accepted:

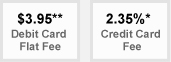

*min. convenience fee $3.95 **MasterCard debit fee 2.35%

|

|

(Official Payments Corporation) Personal Tax Payments Only

|

|

Payments Accepted:

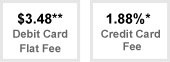

*min. convenience fee $3.48 **MasterCard debit fee 1.88% |

|

(Link2GovCorporation) 888-729-1040 Payment |

|

Payments Accepted:

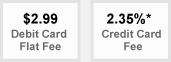

*min. convenience fee $2.99

|

|

(Link2GovCorporation) 888-729-1040 Payment |

|

Payments Accepted:

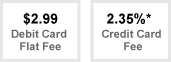

*min. convenience fee $2.99

|

|

(WorldPay US, Inc.) 888-972-9829 Payment |

|

Payments Accepted:

*min. convenience fee $3.89 |

If you are e-filing your return or form and need to make a payment, visit Pay by Debit or Credit Card when you E-file. Different fees apply to debit or credit card payments submitted via IRS e-file.

Additional Considerations

- High balance payments of $100,000 or greater may require special coordination with the service provider you choose.

- You cannot make Federal Tax Deposits with a debit or credit card.

- You cannot get an immediate release of a Federal Tax Lien by making a debit or credit card payment. Please refer to Publication 1468 for the recommended payment option when this is necessary.

- Making an electronic payment eliminates your need to use a voucher.

- On your monthly debit or credit card statement, the payment to the IRS will be listed as "United States Treasury Tax Payment." The convenience fee paid to the service provider will be listed as "Tax Payment Convenience Fee" or something similar.

- If you made an overpayment, IRS will refund it after the return is processed, except in circumstances such as offsets or debt on your account.

For information on other electronic payment options, please visit Electronic Payment Options Home Page.