learn more about working at cbo and check out the agency’s career opportunities

browse the shelves

Peruse all of CBO's publications and cost estimates. Begin with the most recent, focus on a specific topic, jump straight to frequently requested items, or get automatic updates from one of our many RSS feeds.

Peruse all of CBO's publications and cost estimates. Begin with the most recent, focus on a specific topic, jump straight to frequently requested items, or get automatic updates from one of our many RSS feeds. get the data

Find our latest deficit projections, projections of the unemployment rate and other economic variables, and  projections of revenues and spending for health care, income assistance, education, retirement, and agriculture.

projections of revenues and spending for health care, income assistance, education, retirement, and agriculture.

read the blog

Visit the CBO Blog for a concise description of CBO’s recent work. From

Visit the CBO Blog for a concise description of CBO’s recent work. From- our latest post:

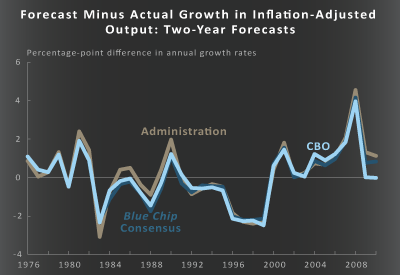

On Tuesday CBO published a new economic forecast in The Budget and Economic Outlook: Fiscal Years 2013-2023. The...

what's most recent

Testimony on the Budget and Economic Outlook: Fiscal Years 2013 to 2023

reportFebruary 13, 2013Trust Fund Projections Under the Baseline

data or technical informationFebruary 12, 2013Testimony on the Budget and Economic Outlook: Fiscal Years 2013 to 2023

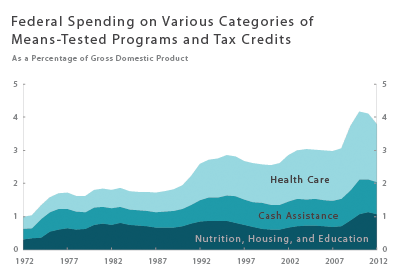

reportFebruary 12, 2013Federal Means-Tested Programs and Tax Credits - Infographic

imageFebruary 11, 2013Growth in Means-Tested Programs and Tax Credits for Low-Income Households

reportFebruary 11, 2013Monthly Budget Review

reportFebruary 7, 2013Economic Growth Is Likely to Be Slow in 2013 and Pick Up in Later Years

blog postFebruary 7, 2013

what's most read

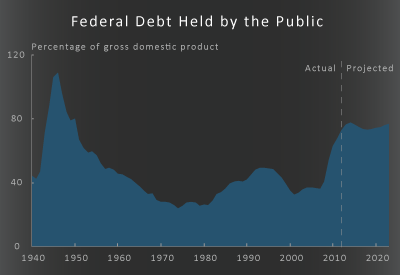

The Budget and Economic Outlook: Fiscal Years 2013 to 2023

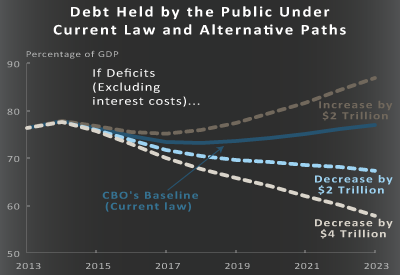

reportFebruary 5, 2013Macroeconomic Effects of Alternative Budgetary Paths

reportFebruary 5, 2013Choices for Deficit Reduction

reportNovember 8, 2012Economic Effects of Policies Contributing to Fiscal Tightening in 2013

reportNovember 8, 2012The Distribution of Household Income and Federal Taxes, 2008 and 2009

reportJuly 10, 2012The 2012 Long-Term Budget Outlook

reportJune 5, 2012