Understanding Your CP2531 Notice

You need to contact us. We’ve received information not reported on your tax return.

What you need to do

- Read your notice carefully – it explains the information we received. Complete the notice response form to indicate if you agree or disagree with the information reported.

- Compare the information in the two columns - "Shown on return" and "Reported to IRS by others". Did you receive the income? If you received the income, was it reported on your tax return? IRS employees search the tax return to locate all income, but they may be unable to determine the source if some items are combined.

- If it wasn't reported on your tax return, you don't need to file an amended return to report the income. Simply check the box indicating that you agree with the information reported by others, sign and date the CP 2531 response page and return it.

- If you don't agree with the information we sent you, check the box indicating that you don’t agree with some or all of the information on the CP 2531 response page and return it with a signed statement explaining each item of discrepancy. If applicable, attach copies of documents to support the entries on the original return behind this.

You may want to

- Send us the name, address and taxpayer identification number of the other party that received the income if it isn't yours.

- Notify the payers to correct their records to show the name and taxpayer identification number of the person or business who actually received the income, so that future reports to us are accurate.

Answers to Common Questions

Is this notice a bill?

No. It informs you about the information we’ve received.

Why did it take you so long to contact me about this matter?

Tax years generally end on Dec. 31, but we don't receive information from banks, businesses, and other payers until much later. Once we receive all the tax returns and payer information, we compare the information you reported with the information the third party payers provided to us. It can take 8 months or more to complete the review.

Should I call with my response or mail it in?

If you have a simple response, such as directing us to a specific line on your original return where you reported the income, you can call a Customer Service Representative and provide the information. A toll-free number is listed in the top right hand corner of the notice.

A written response may be required if the issue is more involved, especially if you disagree with some of the proposed changes. You may want to mail copies of payer information documents, such as Form(s) 1099 or Schedule(s) K-1. Include any other letters or documents that support your position. You should submit a written statement to fully explain any unusual tax situations.

I need more time to find my records and go through them all. Will you allow me additional time to respond?

Your response is due by the date shown on the notice or we'll use the proposed changes to continue processing the case. If you need more time to research your records, you can call the toll-free number at the top of your notice to request a 30 day extension. We may also provide additional time to respond if you have unusual circumstances.

What should I do to avoid problems like this in the future?

Keep accurate payment information from banks and other payers to verify you've received all payment information for filing your return. Review the documents to be sure they show your most current address.

Take the following actions when filing your tax return to avoid similar issues in the future:

- Report specific income type on the correct line on the Form 1120, U.S. Corporation Income Tax Return. For example, rental income should be claimed on Form 1120, line 6 (Gross Rents). For additional information, please see the reporting instructions for Form 1120.

- If you report income on a line not traditionally reserved for that type of income, please provide us with a statement indicating where the income was reported. For example, your business is related to investment activity and you're reporting all interest income (including amounts reported to the IRS on Form 1099-INT, Interest Income) with your gross receipts on Form 1120, line 1.

- Always attach a statement identifying the source of the amount reported on Form 1120, line 10 (Other Income).

- Provide an attached statement explaining your percentage of gross proceeds (ex; reported to us on Form 1099-MISC) that you would be liable to claim on your tax return.

- Generally, if you receive a Form 1099 for amounts that actually belong to another person, you are considered a nominee recipient. You must file a Form 1099 with the IRS (the same type of Form 1099 you received) for each of the other owners showing the amounts applicable to each.

Tax publications you may find useful

Reading your notice

Your notice may look different from the sample because the information contained in your notice is tailored to your situation.

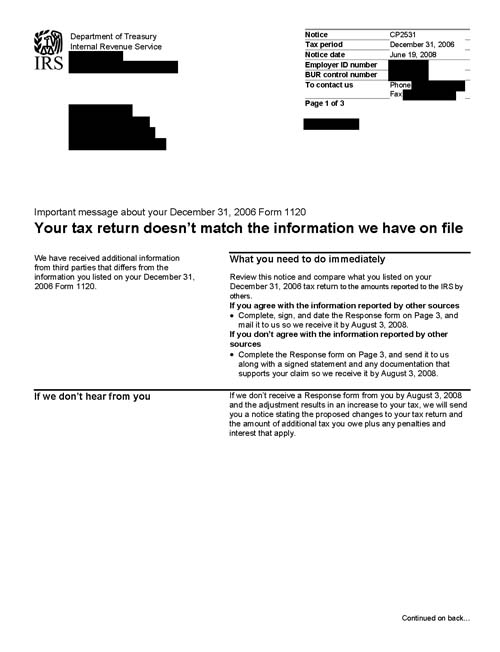

Notice CP2531, Page 1

Notice CP2531, Page 2

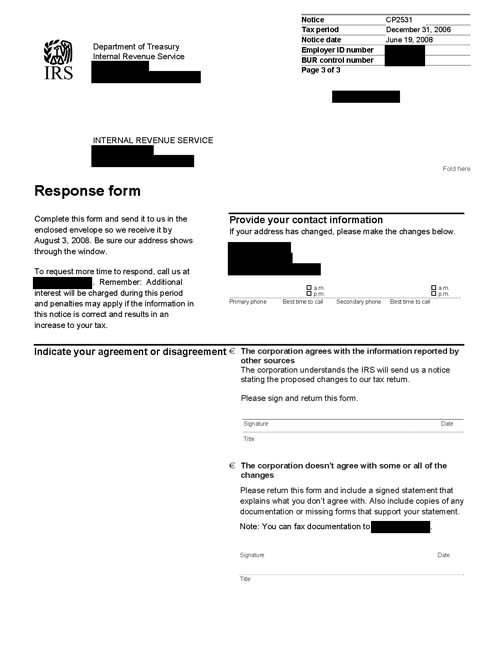

Notice CP2531, Page 3